FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

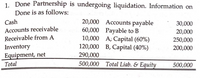

Transcribed Image Text:1. Done Partnership is undergoing liquidation. Information on

Done is as follows:

20,000 Accounts payable

60,000 Payable to B

10,000 A; Capital (60%)

120,000 B, Capital (40%)

290,000

Cash

30,000

Accounts receivable

Receivable from A

20,000

250,000

Inventory

Equipment, net

200,000

Total

500,000 Total Liab. & Equity

500,000

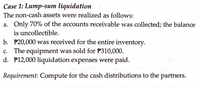

Transcribed Image Text:Case 1: Lump-sum liquidation

The non-cash assets were realized as follows:

a. Only 70% of the accounts receivable was collected; the balance

is uncollectible.

b. P20,000 was received for the entire inventory.

c. The equipment was sold for P310,000.

d. P12,000 liquidation expenses were paid.

Requirement: Compute for the cash distributions to the partners.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partnership of Winn, Xie, Yang, and Zed has the following balance sheet: Cash Other assets $ 40,000 257,000 Liabilities Winn, capital (50% of profits and losses) Xie, capital (30%) Yang, capital (10%) Zed, capital (10%) Beginning capital Assumed loss of Schedule 1 Step one balances Assumed loss of Schedule 2 Step two balances Assumed loss of Schedule 3 Step three balances Zed is personally insolvent, and one of his creditors is considering suing the partnership for the $3,000 that is currently owed. The creditor realizes that this litigation could result in partnership liquidation and does not wish to force such an extreme action unless Zed is reasonably sure of obtaining at least $3,000 from the liquidation. Prepare a predistribution plan to determine the amount for which the partnership must sell the other assets to ensure that Zed receives $3,000 from the liquidation. Liquidation expenses are expected to be $25,000. (Do not round intermediate calculations.) $ $ $ Winn 0 $ 0 $ 0…arrow_forwardThe Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash Noncash assets $ 41,000 229,000 Liabilities Drysdale, loan Drysdale, capital (50%) Koufax, capital (30%) Marichal, capital (20%) $46,500 21,000 77,500 67,500 57,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $20,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $79,000 are sold for $62,500. How is the available cash to be divided?arrow_forwardThe Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash $ 37,000 Liabilities $ 49,000 Noncash assets 209,000 Drysdale, loan 12,500 Drysdale, capital (50%) 71,500 Koufax, capital (30%) 61,500 Marichal, capital (20%) 51,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $16,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $75,000 are sold for $60,500. How is the available cash to be divided?arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education