ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

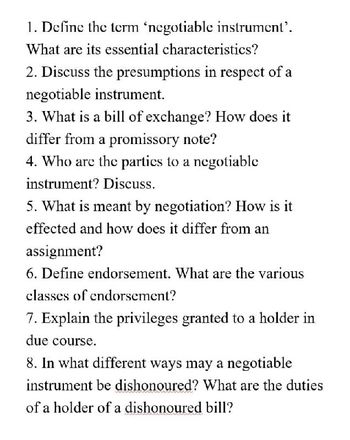

Transcribed Image Text:1. Define the term 'negotiable instrument'.

What are its essential characteristics?

2. Discuss the presumptions in respect of a

negotiable instrument.

3. What is a bill of exchange? How does it

differ from a promissory note?

4. Who are the parties to a negotiable

instrument? Discuss.

5. What is meant by negotiation? How is it

effected and how does it differ from an

assignment?

6. Define endorsement. What are the various

classes of endorsement?

7. Explain the privileges granted to a holder in

due course.

8. In what different ways may a negotiable

instrument be dishonoured? What are the duties

of a holder of a dishonoured bill?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. Financial institutions in the U.S. economy Suppose Clinton decides to use $1,000 currently held as savings to make a financial investment. One method of making a financial investment is the purchase of stock or bonds from a private company. 1. Suppose Warm Breeze, a cloud computing firm, is selling bonds to raise money for a new lab. This practice is called finance. Buying a bond issued by Warm Breeze would give Clinton (an IOU, or promise to pay/ a claim to partial ownership in) the firm. In the event that Warm Breeze runs into financial difficulty, (the stockholders/ Clinton and the other bondholders) will be paid first. 2. Which of the following statements are correct? Check all that apply. - The price of his shares will rise if Warm Breeze issues additional shares of stock. - The Dow Jones Industrial Average is an example of a stock exchange where he can purchase Warm Breeze stock. - Expectations of a recession that will reduce economywide corporate profits will likely…arrow_forward9. How would you incorporate security considerations/costs into the transactions demand model? What would this imply for the demand for currency in a relatively insecure urban environment (a) compared with a relatively safe one, (b) when owner-identified smart cards become available? Do these factors affect the demand for demand deposits? How would the proportion of currency to demand deposits be affected in these cases? 10. Can the transactions demand model be used to explain why financial innovations in recent decades have reduced the transactions demand for M1? 11. Are transactions demand models useless, as Sprenkle (1969) argued? If they are, how would you explain the demand for M1 or just for demand deposits in the economy?arrow_forwardNeed it urgent.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward1. What are the possible consequences for international banks seeking to operate across borders? 2. How can banks effectively navigate across borders regulatory environments to manage risks and ensure compliance?arrow_forward1. They serve as coordinators who link the buyers and sellers of financial securities, and sometimes take positions in the securities. *Financial intermediariesGovernmentInvestorsMarket maker 2. A contract requiring a specified future monetary payment at a specified future point in time in exchange for the delivery of a specific asset is called a: *nonconvertible option.hedge.long contract.swap.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education