FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Helping tags: Management accounting

.

.

.

.

Will UPVOTE, just pls help me answer the problem and show complete solutions. Thanks.

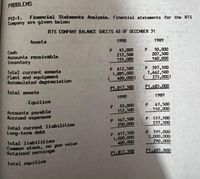

Transcribed Image Text:PROBLEMS

P12-1.

Company are given below:

Financial Statoments Analyais. Financial stataments for the RTS

RTS COMPANY BALANCE SHEETS AS OF DECEMBER 31

Assets

1990

1989

Cash

Accounts receivable

Inventory

45,000

212,508

155,000

50,000

207,500

140,000

Total current assets

Plant and equipment

Accumulated depreciation

P 412,500

1,885,000

480,000)

P 397,500

1,662,500

75,000)

Total assets

P1.817.500

P1.685.000

1990

1989

Equities

Accounts payable

Accrued expenses

55,000

112,500

47,500

110,000

Total current liabilities

Lang-term debt

P 167,500

250,000

P 157,500

237 500

Total liabilities

Coon stock, no par value

Retained eorninge

P 417,500

1,000,000

400,000

P 395,000

1,000,000

290,000

P1.817.500

P1.685.000

Total equities

Transcribed Image Text:RTS COMPANY Incone Statement for 1990 T0 eiob Seoy

634 Part 2/Systems & Techniques for Analysis, Planning & Control

Ch

P12

Han

Sales

Cost of goods sold

P2,162,500

1,206,250

pta.o 32

Gross profit

Depreciation

Other operating expenses

P 956,250

000, era

O88,2

105,000

533,750

00A

003

P.

638,750

Ne

İncome before interest and taxes

v Interest expense

317,500

17,500

youl yd bertred 014 asoio Ided

Income before taxes

Income texes at 35% rate

P 300,000

105 000

Net income

P 195.000

During 1990 the firm declared and paid cash dividends of P85,000, 1.R

were 50,000 shares of common stock outstanding throughout the year. e

nacket price of the stock at year end was P16.25. All sales and purcha

are on credit.

Required:

1. Compute the following ratios as of the end of 1990 or for the vear

ended December 31, 1990, whicheyer is appropriate:

Current ratio

2. Quick ratio

3. Accounts receivable turnover

4. Days' credit sales in accounts receivable

5. Inventory turnover

6. Days' sales in inventory

7. Days' purchases in accounts payable

8. Gross profít ratio

9.

1.

raodsioe7geb badabuo

Return on sales

10.

Return on assets (ROA)

Return on equity (ROE)

12. Earnings per share (EPS)

13. Príce-earnings ratio (PE)

14. Dividend yield

15. Payout ratio

16. Debt ratio

17. Times interest earned

11.

oldoreg oiosod

amegotpe boUSoo

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Educate these stakeholders on the advantages of utilizing a spreadsheet solution and how simple it was to process data in order to generate the information provided in the report in Excelarrow_forwardin your own words, what is accounting information system (AIS)? List and discuss the three sub system of AIS and identify which one you consider the most important of the three and state why?arrow_forwardHow do you find UBS Accounting software? What are the users comment of this accounting software (like/dislike/criticism)?arrow_forward

- Identify two specific IT-related risks in computerized accounting information systems. Propose a strategy that might be implemented to mitigate or eliminate each selected risk. Be sure to effectively support your rationale.arrow_forwardManagement accounting focus on the benefits of users. Select one: True O False PE cam ump toa Retum to: Generalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education