ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Solve the following question

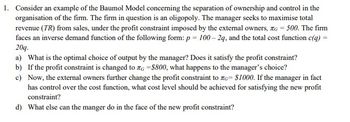

Transcribed Image Text:1. Consider an example of the Baumol Model concerning the separation of ownership and control in the

organisation of the firm. The firm in question is an oligopoly. The manager seeks to maximise total

revenue (TR) from sales, under the profit constraint imposed by the external owners, G = 500. The firm

faces an inverse demand function of the following form: p = 100-2q, and the total cost function c(q) =

20q.

a) What is the optimal choice of output by the manager? Does it satisfy the profit constraint?

b) If the profit constraint is changed to G =$800, what happens to the manager's choice?

c)

Now, the external owners further change the profit constraint to G= $1000. If the manager in fact

has control over the cost function, what cost level should be achieved for satisfying the new profit

constraint?

d) What else can the manger do in the face of the new profit constraint?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Felicity is studying economics and political science. She can read 30 pages of political science per hour but only 5 pages of economics per hour. This week she has a 50 -page assignment in economics and a 150 -page assignment in political science. Because of sorority rush, she cannot devote more than 10 hours to studying these subjects this week. She realizes she cannot complete all of her assignments but is determined to complete at least 30 pages of her economics reading. Draw a graph with pages of economics on the horizontal axis and pages of political science on the vertical axis. On this graph, show the possibilities that are consistent with the constraints that Felicity has imposed on berself, i.e, show her choice set. (She is NOT allowed to read abead in either subject.) Label key points on your graph with their numerical values. Belinda loves chocolate and always thinks that more is better than less. Belinda thinks that a few piano lessons would be worse than none at all, but…arrow_forwardplease help with #4arrow_forwardquestions in images:arrow_forward

- Q4 Solve in 5 minarrow_forwardWhat is an Economistarrow_forwardwhat does this mean in terms of the interrelationship of supply, price, and demand on two items of your choice. Maybe it’s a Christmas that a child really wants but that most stores no longer have in stock. Or it might be a piece of clothing that you bought last year and now want to replace it but which is hard to find or twice as expensive as what it was last year.arrow_forward

- MICROECONOMICS Questions 3 ( ALL OF IT IS ONE QUESTION!!!) For article 3 write the number of the graph that best describes what happened. Fill in only the appropriate boxes in the chart for article 3 and be sure and indicate if it is an increase or a decrease. For the graph use an arrow to indicate an increase or a decrease. Make sure you fill in the graph PLEASE Leave it blank if there is no change Masks (Now). The easing Covid-19 pandemic is expected to reduce demand for medical masks this year, joining a group of companies that have forecast a decline in business from Covid-19 prevention. Masks became a billion-dollar business for the St. Paul, Minn., manufacturer starting in 2020, when the virus’s rapid spread sent consumers and healthcare workers looking to secure facial coverings to try to avoid infection. Now, as the latest U.S. surge caused by the Omicron variant fades, 3M said they are seeing slowing mask sales. WHICH GRAPH BEST FITS THE ARTICLE. Graph # Graph…arrow_forwardType the correct answer in the box. Spell all words correctly. Vivian conducted market research on her company’s products. She found that after the company raised the price of its product by $1.50, the demand in the uptown region remained the same with only minor fluctuations. However, she found that the demand in the downtown region dropped by 20 percent after the price change. How should Vivian take these demands into consideration? In a situation where demand differs in different areas, Vivian should consider the demand.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education