ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no

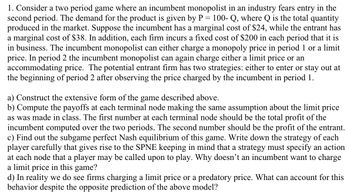

Transcribed Image Text:1. Consider a two period game where an incumbent monopolist in an industry fears entry in the

second period. The demand for the product is given by P = 100- Q, where Q is the total quantity

produced in the market. Suppose the incumbent has a marginal cost of $24, while the entrant has

a marginal cost of $38. In addition, each firm incurs a fixed cost of $200 in each period that it is

in business. The incumbent monopolist can either charge a monopoly price in period 1 or a limit

price. In period 2 the incumbent monopolist can again charge either a limit price or an

accommodating price. The potential entrant firm has two strategies: either to enter or stay out at

the beginning of period 2 after observing the price charged by the incumbent in period 1.

a) Construct the extensive form of the game described above.

b) Compute the payoffs at each terminal node making the same assumption about the limit price

as was made in class. The first number at each terminal node should be the total profit of the

incumbent computed over the two periods. The second number should be the profit of the entrant.

c) Find out the subgame perfect Nash equilibrium of this game. Write down the strategy of each

player carefully that gives rise to the SPNE keeping in mind that a strategy must specify an action

at each node that a player may be called upon to play. Why doesn't an incumbent want to charge

a limit price in this game?

d) In reality we do see firms charging a limit price or a predatory price. What can account for this

behavior despite the opposite prediction of the above model?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What benefits are their in operating a business to consumer online business model for consumers and the owner?arrow_forwardPrepare a flow chart for a typical family of 4 (3 drivers), taking a two-week (Monday is 1st-14th is a Sunday) vacation driving from New York to Orlando in August. Your return to workday is 15th of the month which is a Monday. Discuss areas of concerned revealed by the flow chart.arrow_forwardWhat is the unit contribution margin?arrow_forward

- What are the ethical issues that could be encountered when running an e-commerce platform?arrow_forwardPlease help Why is basic understanding of global geography important? Just q&a DO NOT COPY FROM OTHER WEBSITES Upvote guarenteed for a correct and detailed answer. Thank you!!!arrow_forwardcan you do part b, c, d and e i can hse 4 questions for itarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education