ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

question 1

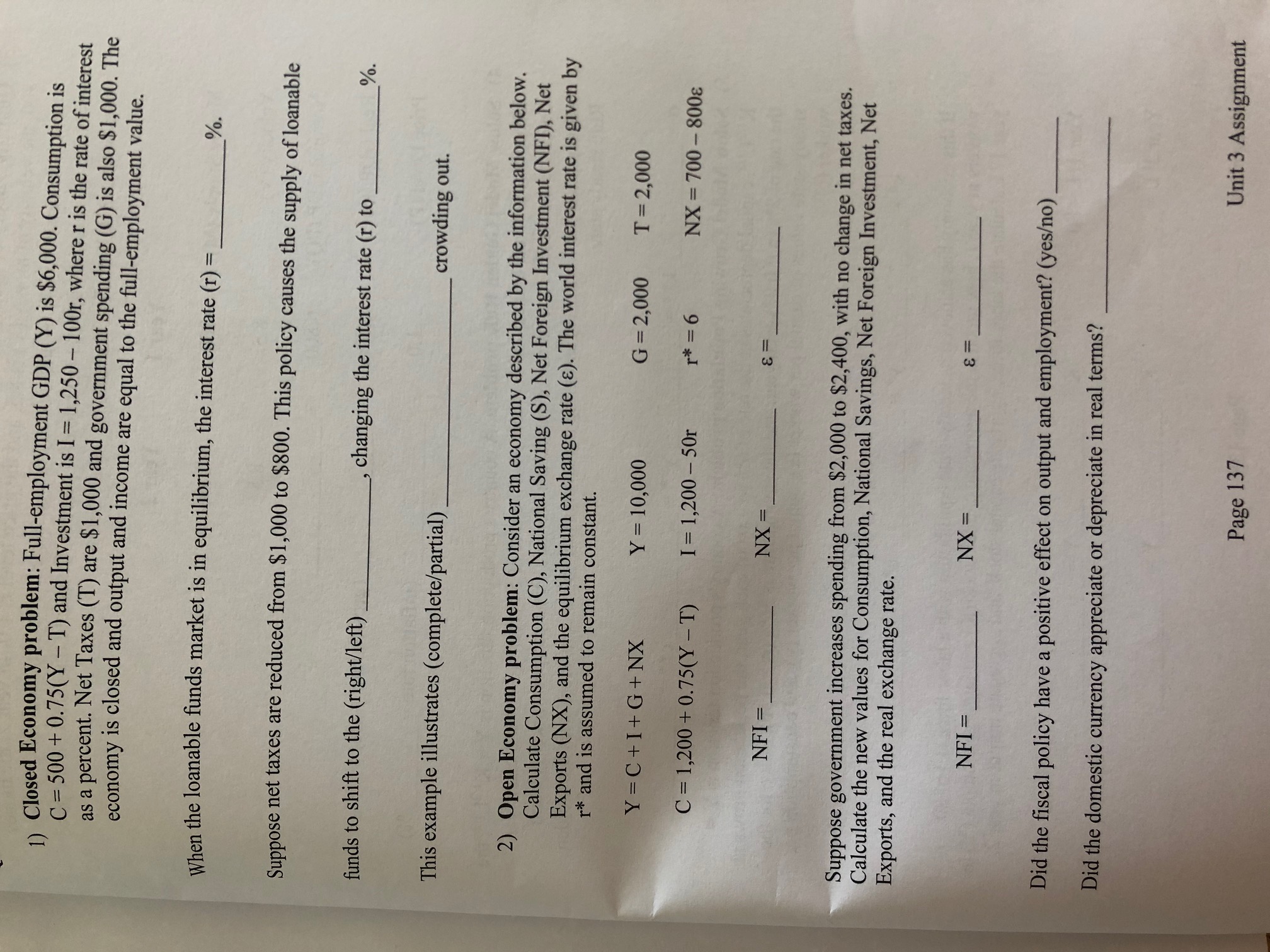

Transcribed Image Text:1. Closed Economy problem: Full-employment GDP (Y) is $6,000. Consumption is

C= 500 + 0.75(Y – T) and Investment is I= 1,250 – 100r, wherer is the rate of interest

as a percent. Net Taxes (T) are $1,000 and government spending (G) is also $1,000. The

economy is closed and output and income are equal to the full-employment value.

When the loanable funds market is in equilibrium, the interest rate (r) =

%.

Suppose net taxes are reduced from $1,000 to $800. This policy causes the supply of loanable

funds to shift to the (right/left)

changing the interest rate (r) to

%.

This example illustrates (complete/partial)

crowding out.

2) Open Economy problem: Consider an economy described by the information below.

Calculate Consumption (C), National Saving (S), Net Foreign Investment (NFI), Net

Exports (NX), and the equilibrium exchange rate (ɛ). The world interest rate is given by

r* and is assumed to remain constant.

Y=C+I+G + NX

Y = 10,000

G=2,000

T= 2,000

C = 1,200 + 0.75(Y – T)

I = 1,200 – 50r

r* = 6

NX = 700 - 800ɛ

NFI =

NX =

%3D

=D3

Suppose government increases spending from $2,000 to $2,400, with no change in net taxes.

Calculate the new values for Consumption, National Savings, Net Foreign Investment, Net

Exports, and the real exchange rate.

NFI =

NX =

= 3

Did the fiscal policy have a positive effect on output and employment? (yes/no)

Did the domestic currency appreciate or depreciate in real terms?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education