FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

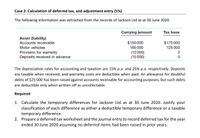

Transcribed Image Text:Case 2: Calculation of deferred tax, and adjustment entry (5%)

The following information was extracted from the records of Jackson Ltd as at 30 June 2020.

Carrying amount

Tax base

Asset (liability)

Accounts receivable

$175 000

125 000

$150 000

Motor vehicles

165 000

Provision for warranty

Deposits received in advance

(12 000)

(15000)

The depreciation rates for accounting and taxation are 15% p.a. and 25% p.a. respectively. Deposits

are taxable when received, and warranty costs are deductible when paid. An allowance for doubtful

debts of $25 000 has been raised against accounts receivable for accounting purposes, but such debts

are deductible only when written off as uncollectable.

Required

1. Calculate the temporary differences for Jackson Ltd as at 30 June 2020. Justify your

classification of each difference as either a deductible temporary difference or a taxable

temporary difference.

2. Prepare a deferred tax worksheet and the journal entry to record deferred tax for the year

ended 30 June 2020 assuming no deferred items had been raised in prior years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Recognition of tax benefits in the loss year due to a NOL carry back involves: O The establishment of an income tax refund receivable. Only a note to the financial statements. The establishment of a deferred tax liability. O The establishment of a deferred tax asset.arrow_forwardNonearrow_forwardIn 2021, a company accrued salaries expense. It will make the payment in 2022. At the end of 2021, as a result of this transaction, the company will __________. (Enter 1, 2, 3, or 4 that represents the correct answer). 1. record a deferred tax asset. 2. record a deferred tax liability. 3. have a permanent difference in pretax financial income and taxable income for 2021. 4. have no differences in pretax financial income and taxable income for 2021.arrow_forward

- At December 31, 2018 PT ABC reported a deferred tax liability of Rp90.000 which was attributable to a taxable temporary difference of Rp300.000. The temporary difference is scheduled to reverse in 2022. During 2019, a new tax law increased the corporate tax rate from 30% to 40%. ABC should record this change by debiting: * Retained Earnings for Rp9.000. Income Tax Expense for Rp9.000. Retained Earnings for Rp30.000. Income Tax Expense for Rp30.000.arrow_forwardEight Independent situations are described below. Each involves future deductible amounts and/or future taxable amounts: 1. 2. 3. 5. 6. 7. 2 The Income Statement Revenue 3 4 5 6 7 8 ($ in millions) Temporary Differences Reported First on: The Tax Return $24 19 19 19 Expense $24 Situations Taxable Income 1 24 24 24 24 Revenue $24 19 9 Expense Required: For each situation, determine taxable income, assuming pretax accounting income is $140 million. (Enter your answers in millions (I.e., 10,000,000 should be entered as 10).) $24 14 14arrow_forwardNovak Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 20 % 2019 20 % 2020 25 % 2021 25 % $123,000 98,000 (105,000) 110,000 The tax rates listed were all enacted by the beginning of 2018.arrow_forward

- Subject: acountingarrow_forwardHi there, Need help with question, thanks!arrow_forwardDuring the preparation of financial statement for Master Ltd for 2023 it was discovered thatan amount of $22,000, incurred in September 2021 and payable to an overseas supplier, wasoverlooked and not paid or provided for in the financial statement ending 30 June 2022. Theamount is considered to be material and will be permitted as a deduction for tax purposes(tax rate 30%).Required:i) Prepare the necessary journal entry to correct this error.arrow_forward

- Which of the following statements concerning the classification of deferred tax assets and liabilities is true? Multiple Choice A deferred tax asset is classified as noncurrent only if the company expects the future tax benefit to be received more than 12 months from the balance sheet date. All deferred tax assets and liabilities are treated as noncurrent. A deferred tax asset related to a bad debt reserve is classified as current if the related accounts receivable is classified as a current asset. A deferred tax asset related to inventory capitalization is classified as noncurrent only if the company uses a FIFO accounting method and the inventory to which the deferred tax asset relates will not be treated as sold within 12 months from the balance sheet date.arrow_forwardTamarisk Construction Company changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2021. For tax purposes, the company employs the completed-contract method and will continue this approach in the future. (Hint: Adjust all tax consequences through the Deferred Tax Liability account.) The appropriate information related to this change is as follows. Pretax Income from: Percentage-of-Completion Completed-Contract Difference 2020 $727,000 $561,000 $166,000 2021 644,000 450,000 194,000 (a) Assuming that the tax rate is 40%, what is the amount of net income that would be reported in 2021? Net income $ (b) What entry is necessary to adjust the accounting records for the change in accounting principle? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and…arrow_forwardFor each of the following subsequent (post-balance-sheet) events, indicate whether a company should (a) adjust the financial statements, (b) disclose in notes to the financial statements, or (c) neither adjust nor disclose. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Subsequent (Post-Balance-Sheet) Events Settlement of federal tax case at a cost considerably in excess of the amount expected at year-end. Introduction of a new product line. Loss of assembly plant due to fire. Sale of a significant portion of the company's assets. Retirement of the company president. Prolonged employee strike. Loss of a significant customer. Issuance of a significant number of shares of common stock. Material loss on a year-end receivable because of a customer's bankruptcy. Hiring of a new president. Settlement of prior year's litigation against the company (no loss was accrued). 12. Merger with another company of comparable size. < < < <arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education