Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

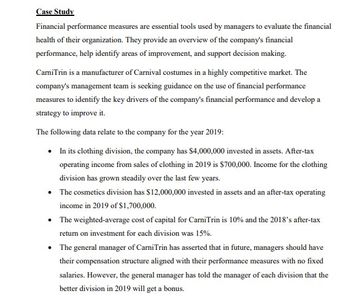

Transcribed Image Text:Case Study

Financial performance measures are essential tools used by managers to evaluate the financial

health of their organization. They provide an overview of the company's financial

performance, help identify areas of improvement, and support decision making.

CarniTrin is a manufacturer of Carnival costumes in a highly competitive market. The

company's management team is seeking guidance on the use of financial performance

measures to identify the key drivers of the company's financial performance and develop a

strategy to improve it.

The following data relate to the company for the year 2019:

In its clothing division, the company has $4,000,000 invested in assets. After-tax

operating income from sales of clothing in 2019 is $700,000. Income for the clothing

division has grown steadily over the last few years.

• The cosmetics division has $12,000,000 invested in assets and an after-tax operating

income in 2019 of $1,700,000.

• The weighted-average cost of capital for CarniTrin is 10% and the 2018's after-tax

return on investment for each division was 15%.

• The general manager of CarniTrin has asserted that in future, managers should have

their compensation structure aligned with their performance measures with no fixed

salaries. However, the general manager has told the manager of each division that the

better division in 2019 will get a bonus.

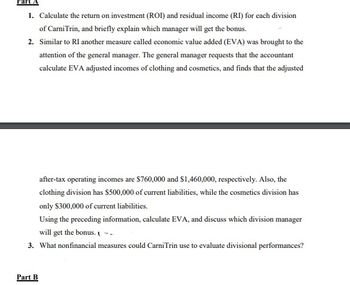

Transcribed Image Text:Part

1. Calculate the return on investment (ROI) and residual income (RI) for each division

of Carni Trin, and briefly explain which manager will get the bonus.

2. Similar to RI another measure called economic value added (EVA) was brought to the

attention of the general manager. The general manager requests that the accountant

calculate EVA adjusted incomes of clothing and cosmetics, and finds that the adjusted

after-tax operating incomes are $760,000 and $1,460,000, respectively. Also, the

clothing division has $500,000 of current liabilities, while the cosmetics division has

only $300,000 of current liabilities.

Using the preceding information, calculate EVA, and discuss which division manager

will get the bonus. -

3. What nonfinancial measures could CarniTrin use to evaluate divisional performances?

Part B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

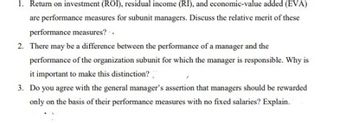

Transcribed Image Text:1. Return on investment (ROI), residual income (RI), and economic-value added (EVA)

are performance measures for subunit managers. Discuss the relative merit of these

performance measures? -.

2. There may be a difference between the performance of a manager and the

performance of the organization subunit for which the manager is responsible. Why is

it important to make this distinction?

3. Do you agree with the general manager's assertion that managers should be rewarded

only on the basis of their performance measures with no fixed salaries? Explain.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

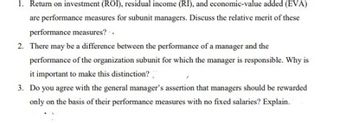

Transcribed Image Text:1. Return on investment (ROI), residual income (RI), and economic-value added (EVA)

are performance measures for subunit managers. Discuss the relative merit of these

performance measures? -.

2. There may be a difference between the performance of a manager and the

performance of the organization subunit for which the manager is responsible. Why is

it important to make this distinction?

3. Do you agree with the general manager's assertion that managers should be rewarded

only on the basis of their performance measures with no fixed salaries? Explain.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company uses charging rates to allocate service department costs to the using departments. The accountant compiled the following information on one of the service departments: If Department K plans to use 1,350 hours of the service departments service in the coming year, how much of the service departments cost is allocated to Department K? a. 3,375 b. 27,300 c. 26,325 d. 23,950arrow_forwardClassify each of the following actions as either being associated with the financial accounting information system (FS) or the cost management information system (CMS): a. Determining the total compensation of the CEO of a public company b. Issuing a quarterly earnings report c. Determining the unit product cost using TDABC d. Calculating the number of units that must be sold to break even e. Preparing a required report for the SEC f. Preparing a sales budget g. Using cost and revenue information to decide whether to keep, or drop, a product line h. Preparing an annual statement of financial position that conforms to generally accepted accounting principles (GAAP) i. Using cost and revenue information to decide whether to invest in a new production system or not j. Reducing costs by improving the overall quality of a product k. Using a debt-equity ratio and liquidity ratios from a balance sheet to assess the likelihood of bankruptcy l. Using a public companys financial statements to decide whether or not to buy its stockarrow_forwardMason, Durant, and Westbrook (MDW) is a tax services firm. The firm is located in Oklahoma City and employs 15 professionals and eight staff. The firm does tax work for small businesses and well-to-do individuals. The following data are provided for the last fiscal year. (The Mason, Durant, and Westbrook fiscal year runs from July 1 through June 30.) Required: 1. Prepare a statement of cost of services sold. 2. Refer to the statement prepared in Requirement 1. What is the dominant cost? Will this always be true of service organizations? If not, provide an example of an exception. 3. Assuming that the average fee for processing a return is 850, prepare an income statement for Mason, Durant, and Westbrook. 4. Discuss three differences between services and tangible products. Calculate the average cost of preparing a tax return for last year. How do the differences between services and tangible products affect the ability of MDW to use the last years average cost of preparing a tax return in budgeting the cost of tax return services to be offered next year?arrow_forward

- Financial information for Lighthizer Trading Company for the fiscal year-ended September 30, 20xx, was collected. As part of a management training session, you have been asked to prepare an income statement format that will be used to distribute to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using this information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $42,000 and 8% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement.arrow_forwardEach of the following scenarios requires the use of accounting information to carry out one or more of the following managerial activities: (1) planning, (2) control and evaluation, (3) continu-ous improvement, or (4) decision making. a. MANAGER: At the last board meeting, we established an objective of earning an after-tax profit equal to 20 percent of sales. I need to know the revenue that we need to earn in orderto meet this objective, given that we have $250,000 to spend on the promotional campaign. Once I have estimated sales in units, we then need to outline a promotional campaign thatconforms to our budget and that will take us where we want to be. However, to compute the targeted sales revenue, I need to know the unit sales price, the unit variable cost, and theassociated fixed production and support costs. I also need to know the tax rate. b. MANAGER: We have problems with our procurement process. Our accounts payable department is spending 80 percent of its time resolving…arrow_forwardPrepare an Incremental analysis to assist Management in making a decision. Should the company follow the accountant’s recommendation.arrow_forward

- Refer to the information for Jasper Company on the previous page.Required:1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for eachline item on the income statement. (Note: Round percentages to the nearest tenth of a percent.)2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the incomestatement created for Requirement 1 to better control costs.arrow_forwardExercise 10-32 (Algo) Activity-Based Costing of Customers (LO 10-3, 4) Northwestern Bank (NB) offers only checking accounts. Customers can write checks and use a network of automated teller machines. NB earns revenue by investing the money deposited; currently, it averages 4.1 percent annually on its investments of those deposits. To compete with larger banks, NB pays depositors 0.3 percent on all deposits. A recent study classified the bank's annual operating costs into four activities. Activity Using ATM Visiting branch Processing transactions Managing functions Total overhead Cost Driver Number of uses Number of visits Number of transactions Total deposits Cost $ 1,936,800 1,900,800 8,521,920 7,321,600 $ 19,681,120 Driver Volume 3,228,000 uses 396,000 visits 129,120,000 transactions $ 615,035,000 in deposits Data on two representative customers follow: Emily Jacob ATM uses 40 130 Branch visits 5 Number of transactions Average deposit 200 45 520 $ 10,000 $ 10,000arrow_forwardEach of the following scenarios requires the use of accountinginformation to carry out one or more of the following managerialactivities: (1) planning, (2) control and evaluation, (3) continuousimprovement, or (4) decision making.a. MANAGER: At the last board meeting, we established anobjective of earning an after-tax profit equal to 20 percent of sales.I need to know the revenue that we need to earn in order to meetthis objective, given that we have $250,000 to spend on thepromotional campaign. Once I have estimated sales in units, wethen need to outline a promotional campaign that conforms to ourbudget and that will take us where we want to be. However, tocompute the targeted sales revenue, I need to know the unit salesprice, the unit variable cost, and the associated fixed productionand support costs. I also need to know the tax rate. b. MANAGER: We have problems with our procurement process.Our accounts payable department is spending 80 percent of itstime resolving discrepancies…arrow_forward

- Investment Center Sales. Net income Average invested assets Profit margin Investment turnover Return on investment Profit Margin: Investment Center A B Investment Turnover: Investment Center A B Choose Numerator: Investment Center Use the information in the table above to compute each department's contribution to overhead (both in dollars and as a percent). (Round your final answers to 2 decimal places.) Return on investment: A B Choose Numerator: Choose Numerator: 1 A 1 $ $ 584,600 $1,580,000 ? 1 10% ? ?% B $12,200,000 $ $ 1 Choose Denominator: Choose Denominator: 1 Choose Denominator: ? ? ?% 1.3 13% = Profit Margin Profit margin 10.00 % % = Investment Turnover = Investment turnover 1.30 Return on investment = Return on investment % 13.00 %arrow_forwardCan you help me with this question? Thank you for your help and time :)arrow_forwardRequirements 1. Prepare a single-step income statement. 2. Prepare a multi-step income statement. 3. M. Fisher, owner of the company, strives to carn a gross profit percentage of at least 50%. Did Farm Quality achieve this goal? Show your calculations. mourarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage