FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ok

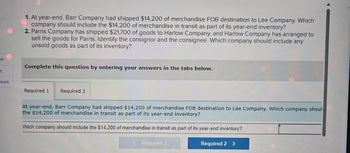

1. At year-end, Barr Company had shipped $14,200 of merchandise FOB destination to Lee Company. Which

company should include the $14,200 of merchandise in transit as part of its year-end inventory?

2. Parris Company has shipped $21,700 of goods to Harlow Company, and Harlow Company has arranged to

sell the goods for Parris. Identify the consignor and the consignee. Which company should include any

unsold goods as part of its inventory?

Complete this question by entering your answers in the tabs below.

t

nces

Required 1

Required 2

At year-end, Barr Company had shipped $14,200 of merchandise FOB destination to Lee Company. Which company shoul

the $14,200 of merchandise in transit as part of its year-end inventory?

Vhich company should include the $14,200 of merchandise in transit as part of its year-end inventory?

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following summarizes Tesla’s merchandising activities for the year. Set up T-accounts for Merchandise Inventory and for Cost of Goods Sold. Enter each line item into one of the two T-accounts and compute the T-account balances. Cost of merchandise sold to customers . $196,000 Merchandise inventory, beginning-year . 25,000 Cost of merchandise purchases, gross amount . 192,500 Shrinkage on merchandise as of year-end . 800 Cost of transportation-in for merchandise purchases . 2,900 Cost of merchandise returned by customers and restored to inventory 2,100 Discounts received from suppliers on merchandise purchases 1,700 Returns to and allowances from suppliers on merchandise purchases . 4,000arrow_forwardThe following selected transactions were completed by Betz Company during July of the current year: July 1 Purchased merchandise from Sabol Imports Co., $13,322, terms FOB destination, n/30. 3 Purchased merchandise from Saxon Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $240 was added to the invoice. 5 Purchased merchandise from Schnee Co., $13,700, terms FOB destination, 2/10, n/30. 6 Issued debit memo to Schnee Co. for merchandise with an invoice amount of $4,850 returned from purchase on July 5. 13 Paid Saxon Co. for invoice of July 3. 14 Paid Schnee Co. for invoice of July 5, less debit memo of July 6. 19 Purchased merchandise from Southmont Co., $29,840, terms FOB shipping point, n/eom. 19 Paid freight of $410 on July 19 purchase from Southmont Co. 20 Purchased merchandise from Stevens Co., $22,200, terms FOB destination, 1/10, n/30. 30 Paid Stevens Co. for invoice of July 20. 31 Paid Sabol Imports Co. for…arrow_forward1. At year-end, Barr Company had shipped $12,500 of merchandise FOB destination to Lee Company. Which company should include the $12,500 of merchandise in transit as part of its year-end inventory? 2. Parris Company has shipped $20,000 of goods to Harlow Company, and Harlow Company has arranged to sell the goods for Parris. Identify the consignor and the consignee. Which company should include any unsold goods as part of its inventory? Complete this questlon by entering your answers in the tabs below. Required 1 Required 2 Parris Company has shipped $20,000 of goods to Harlow Company, and Harlow Company has arranged to sell the goods for Parris. Identify the consignor and the consignee. Which company should include any unsold goods as part of its inventory? Identify the consignor. Identify the consignee. Which company should include any unsold goods as part of its inventory? < Required 1arrow_forward

- Kelly Corporation shipped goods to a customer f.o.b. destination on December 29, 2018. The goods arrived atthe customer’s location in January. In addition, one of Kelly’s major suppliers shipped goods to Kelly f.o.b. shipping point on December 30. The merchandise arrived at Kelly’s location in January. Which shipments should beincluded in Kelly’s December 31 inventory?arrow_forwardPresented below are selected transactions for Blue Spruce Company during September and October of the current year. Blue Spruce uses a perpetual inventory system. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $46,000, FOB destination, terms 1/15, n/30. 2 The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $2,280 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $109,300, terms 2/10, n/30, FOB destination. 16 The correct company paid $2,100 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $5,700 for returned goods. These goods had cost Blue Spruce Company $2,280 and were returned to inventory. 25 Received the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Company the…arrow_forwardCan you please explain how to get the Cost of Goods Solds category using LIFO?arrow_forward

- Questions # 21-23 are based on the information below: Wicker Inc. has the following transactions during March: March 3 March 5 March 6 March 12 March 29 Purchases inventory on account for $3,500, terms 2/10, n/30. Pays freight costs of $200 on inventory purchased on March 3. Returns inventory with a cost of $500. A. $60 B. $70 C. $56 D. $84 Pays the full amount due to supplier. Sells all inventory purchased on March 3 (less those returned on March 6) for $5,000 on account. 21. On March 12, how much is the purchase discount? 22. How much cash does Wicker pay to the supplier on March 12? A. $2,936 B. $2,930 C. $2,940 D. $3,000 23. How much will Wicker record as cost of goods sold on March 30? A. $5,000 B. $3,000 C. $3,200 D. $3,140arrow_forward37. EX.07.91Logan Company has provided the following information:(1) Included in the physical count were inventory items billed to a customer FOB shipping point on December 31,2019. The goods had a cost of $280 and had been billed at $400. The shipment was on Logan's loading dock waitingto be picked up by the trucking company.(2) Goods returned by customers and held pending inspection in the returned goods area on December 31, 2019,were not included in the physical count. On January 5, 2020, the goods costing $260 were inspected and returned toinventory. Credit memos totaling $380 were issued to the customers on the same date.(3) On January 3, 2020, a monthly freight bill in the amount of $170 was received. The bill specifically related tomerchandise purchased in December 2019, 30% of which was still in inventory at December 31, 2020. The freightcharges had not been recorded at December 31, 2019.(4) Goods were shipped out on consignment on December 15, 2019, and were recorded as a sale…arrow_forwardThe following selected transactions were completed by Capers Company during October of the current year: Oct. 1 Purchased merchandise from UK Imports Co., $13,322, terms FOB destination, n/30. 3 Purchased merchandise from Hoagie Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $240 was added to the invoice. 4 Purchased merchandise from Taco Co., $13,700, terms FOB destination, 2/10, n/30. 6 Issued debit memo to Taco Co. for $4,850 of merchandise returned from purchase on October 4. 13 Paid Hoagie Co. for invoice of October 3. 14 Paid Taco Co. for invoice of October 4 less debit memo of October 6. 19 Purchased merchandise from Veggie Co., $29,840, terms FOB shipping point, n/eom. 19 Paid freight of $410 on October 19 purchase from Veggie Co. 20 Purchased merchandise from Caesar Salad Co., $22,200, terms FOB destination, 1/10, n/30. 30 Paid Caesar Salad Co. for invoice of October 20. 31 Paid UK Imports Co. for invoice of…arrow_forward

- On June 10, Wildhorse Company purchased $9,500 of merchandise on account from Novak Company, FOB shipping point, terms 2/10, n/30. Wildhorse pays the freight costs of $590 on June 11. Damaged goods totaling $350 are returned to Novak for credit on June 12. The fair value of these goods is $75. On June 19, Wildhorse pays Novak Company in full, less the purchase discount. Both companies use a perpetual inventory system. how do i prepare a entrie transaction for the items that i have attached?arrow_forwardResgan Corporation is a wholesale distributor of truck replacement parts. Initial amounts taken from Reagan's records are as follows: Inventory at Decenber 31 (based on a physical count of goods in Reagan's warehouse on December 31) $1,480, e0e Accounts payable at December 31: Vendor Terms Атount Baker Corpany Charlic Corpany Dolly Corpany Eagler Company Full Company $ 295, 0e0 248,eee 338,eee 255,0e0 28, 10 days, пet 38 Net 30 Net 30 Net 30 Net 30 Greg Company Net 30 Accounts payable, December 31 $1,120,0ee Sales for the year $9,750,000 Additional Information: 1. Parts held by Reagan on consignment from Charlie, amounting to $230,000, were included in the physical count of goods in Reagan's warehouse and in accounts payable at December 31. 2 Parts totaling $37,000, which were purchased from Full and paid for in December, were sold in the lost week of the year and appropriately recorded es sales of $43,000. The parts were included in the physical count of goods in Reagan's warehouse on…arrow_forwardPlease help with Question Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education