ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

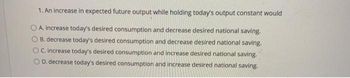

Transcribed Image Text:1. An increase in expected future output while holding today's output constant would

A. increase today's desired consumption and decrease desired national saving.

B. decrease today's desired consumption and decrease desired national saving.

C. increase today's desired consumption and increase desired national saving.

D. decrease today's desired consumption and increase desired national saving.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 6. In the Solow model, a decrease in the capital depreciation rate: O Increases the saving rate. O Increases consumption per capita and decreases investment per capita. O Increases savings per capita but decreases investment per capita. O Note of the above.arrow_forwardSaved The accompanying table shows real GDP from 2010 to 2015 for China, measured in billions of 2009 dollars: Bil1ions of 2009 Year Dollars Growth Rate 2010 5,609 2011 6,140 2012 6,613 2013 7,122 2014 7, 642 2015 8, 169 J Instructions: Enter your response rounded to one decimal place. a) Complete the growth rate column above. % b) By what percentage did the Chinese economy grow between 2010 and 2015? c) Chinese economic growth was the highest in (Click to select)arrow_forwardThe United States exports14%ofGDP while Germany exports about 50% of it sGDP.Explain wha ttha tmeans.arrow_forward

- a. If national saving of a closed economy equals$100,000, net taxes equal$125,000,GDPdeflator is 175 and government expenditure equals$45,000, what is private saving?arrow_forwardIn a closed economy, if Y and T remained the same, but G rose, and C fell but by less than the rise in G, what would happen to public and national saving? a. public and national saving would rise b. public saving would fall and national saving would rise c. public saving would rise and national saving would fall d. public and national saving would fallarrow_forwardWhat do loanable funds finance? What is the source of loanable funds? Loanable funds finance _______. A. business investment, the government budget surplus, and international borrowing B. business investment, the government budget deficit, and international investment or lending C. private saving, the government budget surplus, and international borrowing D. private saving, the government budget deficit, and international investment or lendingarrow_forward

- 4. Relative to a closed economy, it is easier in an open economy toa. pass the burden of government debt on to future generations.b. control interest rates.c. discourage private investment through government borrowing.d. confer monopoly power on key domestic industries.arrow_forwardAnswer These Three Sub Parts i) In an open economy, Y = C + I + G + NX. Using symbols from this identity, write anexpression that defines national saving, S, in an open economy.S = _________________________ . ii) True or False? In an open economy, the following is always true: S = I + NCO, where I isinvestment spending and NCO is net capital outflow. iii) In an open economy, a country’s net capital outflow is:a.) the value of domestic assets purchased by foreigners minus the value of foreign assetspurchased by domestic residentsb.) the value of foreign assets purchased by domestic residents minus the value of domesticassets purchased by foreigners.arrow_forwardA country has domestic investment of $100 billion. Its citizens purchase $500 of foreign assets and foreign citizens purchase $300 of its assets. What is national saving?Answer1. $600 billion2. $300 billion3. $100 billion4. -$100 billionarrow_forward

- 3. How does each of the following changes affect the real gross domestic product and price level of an open economy in the short run? Explain each. a) An increase in the price of crude oil, an important natural resource. b) A technological change that increases the productivity of labour. c) An increase in spending by consumers. d) The depreciation of the country's currency in the foreign exchange market.arrow_forwardCurrently, the US has a total consumption of $12 trillion, saving of $6 trillion, tax revenues of $5 trillion, and government spending of $7 trillion. Relative to a balanced budget, the government’s actions in this economy will cause: a. Higher interest rates today and reduced economic growth for future generations. b. Lower interest rates today and reduced economic growth for future generations. c. Higher interest rates today and enhanced economic growth for future generations. d. Lower interest rates today and enhanced economic growth for future generations.arrow_forwardIf the GDP per capita grows by 5%, it means that O a. The rich people's incomes increased by 5% © b. On the average, the people's income grew by 5% © c Everyone's income grew by 5% d. Employment rates increased by 5%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education