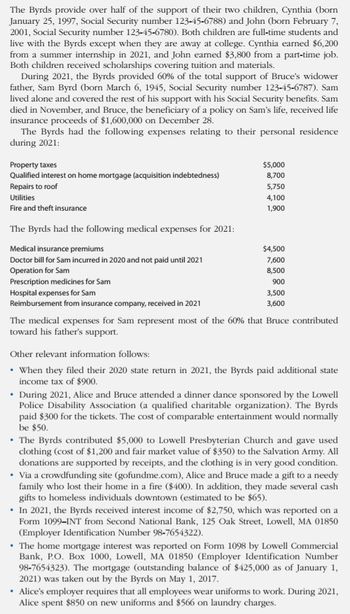

41. Alice J. and Bruce M. Byrd are married taxpayers who file a joint return. Their Social Security numbers are 123-45-6784 and 111-11-1113, respectively. Alice’s birthday is September 21, 1974, and Bruce’s is June 27, 1973. They live at 473 Revere Avenue, Lowell, MA 01850. Alice is the office manager for Lowell Dental Clinic, 433 Broad Street, Lowell, MA 01850 (Employer Identification Number 98-7654321). Bruce is the manager of a Super Burgers fast-food outlet owned and operated by Plymouth Corporation, 1247 Central Avenue, Hauppauge, NY 11788 (Employer Identification Number 11-1111111). The following information is shown on their Wage and Tax Statements (Form W–2) for 2021.

See Image 1

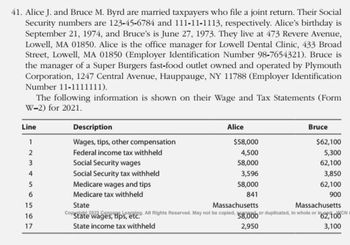

The Byrds provide over half of the support of their two children, Cynthia (born January 25, 1997, Social Security number 123-45-6788) and John (born February 7, 2001, Social Security number 123-45-6780). Both children are full-time students and live with the Byrds except when they are away at college. Cynthia earned $6,200 from a summer internship in 2021, and John earned $3,800 from a part-time job. Both children received scholarships covering tuition and materials. During 2021, the Byrds provided 60% of the total support of Bruce’s widower father, Sam Byrd (born March 6, 1945, Social Security number 123-45-6787). Sam lived alone and covered the rest of his support with his Social Security benefits. Sam died in November, and Bruce, the beneficiary of a policy on Sam’s life, received life insurance proceeds of $1,600,000 on December 28. The Byrds had the following expenses relating to their personal residence during 2021:

See Image 2

Below is a continuation of image 2

• Bruce paid $400 for an annual subscription to the Journal of Franchise Management and $741 for annual membership dues to his professional association.

• Neither Alice’s nor Bruce’s employer reimburses for employee expenses.

• The Byrds do not keep the receipts for the sales taxes they paid and had no major purchases subject to sales tax.

• This year, the Byrds gave each of their children $2,000, which was then deposited into their Roth IRAs.

• Alice and Bruce paid no estimated Federal income tax, and they did not engage in any virtual currency transactions during the year. Neither Alice nor Bruce wants to designate $3 to the Presidential Election Campaign Fund. The Byrds received the appropriate recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored.

Part 1—Tax Computation Compute net tax payable or refund due for Alice and Bruce Byrd for 2021, and complete their 2021 Federal tax return using appropriate forms and schedules. If they have overpaid their taxes, they want the amount to be refunded to them. Suggested software: ProConnect Tax. Use 1040 and Schedule A and B

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Mr. & Mrs Grnager both work full time. They have three children ages 16, 6, and 3. In 2021, the Grangers' paid $13,750 of qualifying expenses for child care for their two youngest children. For purposes of claiming the Child and dependent Car credit, how much of their qualifying expenses can they consider?arrow_forwardAlbert and Avery, ages 66 and 64, respectively, filed a joint return for 2023. They provided all of the support for their 19-year-old son, who is blind and had no gross income. They also provided the total support of Avery's father, who is a citizen and life-long resident of Peru. What is the amount of credit for other dependents that Albert and Avery can claim?arrow_forwardBeth R. jordan lives at 2322 skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manfacturing Company, 1203 Western Avenue, Mesa, AZ85201(employer identification number 11-11111111). She also Writes computer software programs for tax practitioners and has a part-time tax practise. Beth is a single and has no dependents. Beths's birthday is july 4, 1972, and her Social Security number is 123-45-6785. She wants to contribute $3 to the President Election Campaign Fund. The following information is shown on Beth's Wage and Tax Statement (form W-2) for 2018. The following information is shown on Beth's Wage Tax Statement (form W-2) for 2018 Chapter 13, Problem 44CP, Beth R. jordan lives at 2322 Skyview Road, Mesa, AZ85201. She is Tax accountant with Mesa , example 1 During the year, Beth received interest of $1,300 from Arizona Federal Savings and Loan and $400 from Arizona State Bank. Each financial institution reported the interest income on Form 1099-INT. She received…arrow_forward

- Kyle (44) and Elise (39) Terry have four children. Kyle works for Lockheed Martin as a flight engineer and Elise is a freelance writer/editor. Their family is covered by a qualified High Deductible Health Insurance Plan. Kyle's gross pay is $120,000 nd Elise's net earnings from self-employment is $75,000. Their children are Jacob(16), Katie(14), Rachael(12), and Luke(10). For the current tax year, Kyle and Elise prepared for retirement. Kyle's plan is a profit sharing plan and Elise utilizes a SEP IRA. Kyle's employer contributes 14% of his gross pay to the profit sharing plan. Kyle pays the health insurance premiums through his employer's cafeteria plan, his portion of the health insurance premiums are $7,000 per year. Kyle also incurred the following expenses during the year: $1,900 in student loan interest, $4,000 contribution to Utah's 529 plan ($1,000 for each child, kyle lives in Georgia); State income taxes of $12,000; property taxes of $4,000; mortgage interest of $10,000; and…arrow_forward(Federal Taxation, Individual Income Taxes) Janice Morgan, age 24, is single and has no dependents. She is a freelance writer. In January 2019, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at 132 Stone Avenue, Pleasant Hill, NM 88135. Her Social Security number is 123-45-6782. Janice's parents continue to provide health insurance for her under their policy. Janice did not engage in any virtual currency transactions during the year and wants to contribute to the Presidential Election Campaign Fund. During 2019, Janice reported the following income and expense items connected with her business. Income from sale of articles $85,000 Rent 16,500 Utilities…arrow_forwardAshley Panda lives at 1310 Meadow Lane, Wayne, OH 43466, and her Social Security number is 123-45-6777. Ashley is single and has a 20-year-old son, Bill. His Social Security number is 111-11-1112. Bill lives with Ashley, and she fully supports him. Bill spent 2019 traveling in Europe and was not a college student. He had gross income of $4,655 in 2019. Bill paid $4,000 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the $4,000 to Bill using a check from her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2019, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises, LLC (98-7654321), a data processing service that she reports as a sole proprietorship. Her business is located at 456 Hill Street, Wayne, OH 43466. The business activity code is 514210. Her 2019 Form 1040, Schedule C for Panda Enterprises shows revenues of $315,000,…arrow_forward

- Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray's birthdate is February 21, 1992 and Maria's is December 30, 1994. Ray and Maria each received a W-2 from their respective employers (see separate tab). Ray and Maria have interest income from McAllen State Bank which is reported a 1099-INT form (see separate tab). In addition, they own U.S. Savings bonds (Series EE). The bonds had a value of $10,000 on January 1, 2020, and their value is $10,700 on December 31, 2020. They have not made an election with respect to these bonds. Ray has an ex-wife named Judy Gomez. Pursuant to their January 27, 2015 (pre-2019) divorce decree, Ray pays her $450 per month in alimony. All payments were made on time in 2020. Judy's Social Security number is 566-74-8765. During 2020, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his…arrow_forward• Jeff, age 68 and Claire, age 63 elect to file Married Filing Jointly. Neither taxpayer is blind. • Jeff is retired. He received Social Security benefits and a pension. • Jeff and Claire's daughter Shelby, age 19, is a full-time college student in her second year of study. She is pursuing a degree in foreign studies and does not have a felony drug conviction. She received a Form 1098-T for 2022. Box 7 was not checked on her Form 1098-T for the previous tax year. • Shelby spent the summer at home with her parents but lived in an apartment near campus during the school year. • Shelby received a scholarship and the terms require that it be used to pay tuition. Jeff and Claire paid the cost of Shelby’s tuition and course-related books in 2022 not covered by scholarship. They paid $120 for a parking sticker, $5,500 for a meal plan, $750 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. • Jeff and Claire…arrow_forwardMark for follow up Question 30 of 50. Which of the following taxpayers may qualify for the Premium Tax Credit? Each purchased health care coverage through the Healthcare Marketplace, and each received Form 1095-A, Health Insurance Marketplace Statement. None received unemployment income. Alanis. She files single and her tax liability is zero. Caleb. He and his spouse file married filing separately, but live in the same house. Jordan. He files head of household and was eligible for employer-sponsored coverage, but he chose not to enroll in the plan because it would have cost him 5% of his household income. Sydney. She files single and will be claimed as a dependent on her grandmother's return. Mark for follow uparrow_forward

- Reba is a single taxpayer. Lawrence, Reba's 84-year-old dependent grandfather, lived with Reba until this year, when he moved to Lakeside Nursing Home because he needs specialized medical and nursing care. During the year, Reba made the following payments on behalf of Lawrence: Room at Lakeside Meals for Lawrence at Lakeside Doctor and nurse fees at Lakeside Cable TV service for Lawrence's room at Lakeside Total $20,700 4,140 3,105 414 $28,359 Lakeside has medical staff in residence. Disregarding the AGI floor, how much, if any, of these expenses qualifies for a medical expense deduction by Reba?arrow_forwardRahul and Ruby are married taxpayers. They are both under age 65 and in good health. For 2021 they have a total of $42,000 in wages and $300 in interest income. Rahul and Ruby's deductions for adjusted gross income amount to $6,000 and their itemized deductions equal $18,700. They have two children, ages 32 and 28, that are married and provide support for themselves. Table for the standard deduction Filing Status Standard Deduction Single $12,550 Married, filing jointly 25,100 Married, filing separately 12,550 Head of household 18,800 Qualifying widow(er) 25,100 a. What is the amount of Rahul and Ruby's adjusted gross income?arrow_forwardMarie Lincoln is a head of household. She is 37 years old and her address is 4110 N.E. 13th Street, Miami, FL 33127. Additional information about Ms. Lincoln is as follows: Social security number: 412-34-5670 Date of birth: 1/14/1983 W-2 for Marie shows these amounts: Wages (box 1) Federal W/H (box 2) Social security wages (box 3) Social security W/H (box 4) Medicare wages (box 5) Medicare W/H (box 6) Form 1099-INT for Marie shows this amount: Box 1-$500.00 from A & D Bank, $ 43,600.00 $2,488.00 S 43.600.00 $2,703.20 $ 43,600.00 $ 632.20 Dependent: Son Steven is 10 years old. His date of birth is 5/11/2010. His social security number is 412-34-5672. Marie is an administrative assistant. Required: Prepare Form 1040 plus all the appropriate Schedules and worksheets for Ms. Lincoin for 2020 She is entitled to a $2.000 child tax credit. For now, enter the credit on the appropriate line of the form. She wants to contribute to the presidential election campaign Ms Lincoln had qualifying…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education