FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

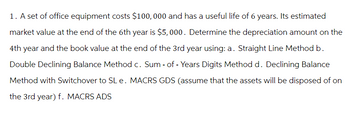

Transcribed Image Text:1. A set of office equipment costs $100,000 and has a useful life of 6 years. Its estimated

market value at the end of the 6th year is $5,000. Determine the depreciation amount on the

4th year and the book value at the end of the 3rd year using: a. Straight Line Method b.

Double Declining Balance Method c. Sum- of - Years Digits Method d. Declining Balance

Method with Switchover to SL e. MACRS GDS (assume that the assets will be disposed of on

the 3rd year) f. MACRS ADS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information create a Double declining, depreciation schedule. Computer Equipment: $3,000 Residual Value: $150 Useful Life: 5 years Example: Straight line depreciation Scheadule. year (beginning of year value) depreciation (end of year value) 1 $3,000 $570 $2,430 2 $2,430 $570 $1,860 3 $1,860 $570 $1,290 4 $1,290 $570 $720 5 $720 $570 $150arrow_forwardonsider the following data on an asset:Cost of the asset, I $235,000Useful life, N 5 yearsSalvage value, S $ 60,000Compute the annual depreciation allowances and theresulting book values, using(a) The straight-line depreciation method.(b) The double-declining-balance methodarrow_forwardA plant asset cost R.O.192,000 and is estimated to have a R.O.24,000 residual value at the end of its 8-year useful life. The book value of the asset at the end of the third year using the double-declining-balance method would be Select one: a. R.O.144,000. b. R.O.108,000. O c. R.O.27,00o. O d. R.O.81,00o.arrow_forward

- The cost of an asset is $1,170,000, and its residual value is $110,000. Estimated useful life of the asset is eight years. Calculate depreciation for the first year using the double-declining - balance method of depreciation. OA. $265,000 OB. $132,500 OC. $146,250 OD. $292,500 ***arrow_forwardThe formula for double-declining-balance depreciation on an asset with a five-year life in its second year is Book Value × 40% = Depreciation Expense. (Book Value – Residual Value) × 40% = Depreciation Expense. (Book Value – Residual Value) × 20% = Depreciation Expense. (Original Cost × 30%) – Residual Value = Depreciation Expense.arrow_forwardH1.arrow_forward

- Using the following information, create a Double declining, depreciation schedule. Van cost:34,440 Residual value: 1,722 Useful Life: 3 Years Example: Straight-line depreciation Schedule. Years Value at the beginning of the year Depreciation End of year Value 1 34,440 10,906 23,535 2 23,535 10,906 12,628 3 12,628 10,906 1,722arrow_forwardPlease show all your workarrow_forwardcomputer equipmenr was purchased 5 years ago for 170,000 with an estimated life of 8 years and a residual value of 10,000. the company used straigh line depreciaton. a. compute the balance of accumlated depreciationas of the end of 5 years. b.if the equipment is 45,000 cash at the end of 5 years. Journalize the sale of the equipment.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education