FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

H1.

Account

Transcribed Image Text:1.

2.

3.

4.

5.

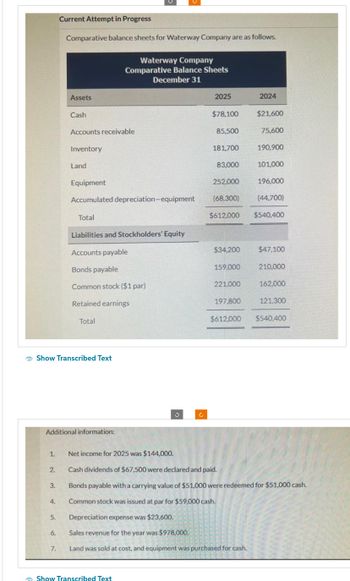

Current Attempt in Progress

Comparative balance sheets for Waterway Company are as follows.

Show Transcribed Text

6.

Assets

Additional information:

7.

Cash

Accounts receivable

Inventory

Land

Equipment

Accumulated depreciation-equipment

Total

Liabilities and Stockholders' Equity

Accounts payable

Bonds payable

Common stock ($1 par)

Retained earnings

Total

Waterway Company

Comparative Balance Sheets

December 31

Show Transcribed Text

J

2025

$78,100

85,500

181,700

83,000

$34,200

159,000

252,000

196,000

(68,300)

(44,700)

$612,000 $540,400

221,000

2024

197,800

$21,600

75,600

190,900

101,000

$47,100

210,000

162,000

121.300

$612,000 $540,400

Net income for 2025 was $144,000.

Cash dividends of $67,500 were declared and paid.

Bonds payable with a carrying value of $51,000 were redeemed for $51,000 cash.

Common stock was issued at par for $59,000 cash.

Depreciation expense was $23,600.

Sales revenue for the year was $978,000.

Land was sold at cost, and equipment was purchased for cash.

Transcribed Image Text:Balance Sheet Accounts

Total

$

Debits

Show Transcribed Text

Balance

12/31/24

Credits

$

Debit

$

$

WATERWAY COMPANY

Worksheet-Statement of Cash Flows

Balance

12/31/24

$

Credit

Debit

$

$

$

Reconciling Items

Balance

12/31/25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you answer part E of this quarrow_forwardSegment Contribution Margin Analysis The Walt Disney Company (DIS) is a global entertainment company that is organized into four business segments as follows: Media Networks:Television production and distribution, including ABC television network, ESPN, National Geographic. Parks, Experiences, and Products:Theme parks and resorts, including Walt Disney World and Disneyland; Experiences, including Disney Cruise Line and Disney Vacation Club; Products, including Disney and Pixar characters, comic books, and magazines. Studio Entertainment:Music and motion picture production and distribution, including Twentieth Century Studios, Marvel, and Lucasfilm. Direct-to-Consumer & International:Streaming services, including Disney+, ESPN+, and Hulu. For a recent year, Disney reported the following segment results (in millions): Line Item Description SegmentMediaNetworks SegmentParks, Experiences,and Products SegmentEntertainment Direct-to-Consumer& International Revenues $28,393…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education