FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PLEASE ANSWER ASAP AND I WILL GIVE THUMBS UP PLEASEE

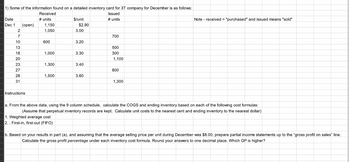

Transcribed Image Text:1) Some of the information found on a detailed inventory card for 3T company for December is as follows:

Issued

# units

Date

Dec 1

2

7

10

13

18

20

23

27

28

31

(open)

Instructions

Received

# units

1,150

1,050

600

1,000

1,300

1,500

$/unit

$2.90

3.00

3.20

3.30

3.40

3.60

700

500

300

1,100

800

1,300

Note - received = "purchased" and issued means "sold"

a. From the above data, using the 9 column schedule, calculate the COGS and ending inventory based on each of the following cost formulas:

(Assume that perpetual inventory records are kept. Calculate unit costs to the nearest cent and ending inventory to the nearest dollar)

1. Weighted average cost

2.. First-in, first-out (FIFO)

b. Based on your results in part (a), and assuming that the average selling price per unit during December was $8.00, prepare partial income statements up to the "gross profit on sales" line.

Calculate the gross profit percentage under each inventory cost formula. Round your answers to one decimal place. Which GP is higher?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardname the account to be debited and the name of the account to be credited for each transaction. *arrow_forwardAnswer the following questions by writing down the correct letter next to the relevant number:arrow_forward

- please help with the question that is attached as a picture. thanksarrow_forwardAll blanks need to be filled please and thank you, it's incomplete as of now.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- When matching bank or credit card downloaded transactions to a transaction already recorded in QuickBooks Online, what are the possible actions that appear in the Action column?arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardWhat does the QuickBooks Online Check Register do?arrow_forward

- Q1: Write an e-mail to technical support team of your college to retrieve your login credentials. In order to make your e- mail effective mention all the important details and reasons to prioritize your responsearrow_forwardWhat does the COSO abbreviation mean? What is the group's purpose and who are it's members? On their website, look under the guidance tab. Pick one of the papers that interests you and describe what issue it covers and guidance it provides. https://www.coso.org/Pages/default.aspxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education