FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

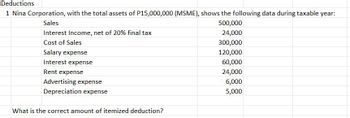

| Nina Corporation, with the total assets of P15,000,000 (MSME), shows the following data during taxable year: | |

| Sales | |

| Interest Income, net of 20% final tax | |

| Cost of Sales | |

| Salary expense | |

| Interest expense | |

| Rent expense | |

| Advertising expense | |

| What is the correct amount of itemized deduction? |

Transcribed Image Text:Deductions

1 Nina Corporation, with the total assets of P15,000,000 (MSME), shows the following data during taxable year:

Sales

500,000

Interest Income, net of 20% final tax

24,000

Cost of Sales

300,000

Salary expense

120,000

60,000

Interest expense

Rent expense

24,000

6,000

5,000

Advertising expense

Depreciation expense

What is the correct amount of itemized deduction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Regine Company computed a pre-tax financial income of P6,000,000 for the year ended December 31, 2020. The following differences are noted between taxable and accounting income:· Nontaxable revenue: P600,000· Nondeductible expense: P200,000· Warranty provision accrued and expensed in 2020 but tax-deductible when paid: P300,000· Excess tax depreciation over accounting depreciation: P250,000· Excess of accounting revenue over tax revenue (timing difference): P200,000Current tax rate for 2020 is 32% while tax rate for 2021 and forward is 30%. How much is the total tax expense? a. 1,744,000 b. 1,699,000 c. 1,789,000 d. 1,792,000arrow_forwardBeckett Corporation has nexus with States A and B. Apportionable income for the year totals $1,190,000 . Beckett's apportionment factors for the year use the following data. Compute Beckett's B taxable income for the year; B uses a three-factor apportionment formula with a double-weighted sales factor. State AState BTotalSales$1,428,000$856,800$2,284,800Property$238,000$0 $238,000Payroll$357,000$0 $357,000arrow_forwardIn March 1, 2019, Tina Corporation reported the following business income and expenses: Sales P1,000,000, Cost of sales P600,000, Operating expenses P200,000; Gain from sale of old furniture P20,000. If 20% of operating expenses of Tina is prepaid expenses, how much is the taxable income?arrow_forward

- For the year ended December 31, 2006, Grim Company's pretax financial income was P2,000,000 and its taxable income was P1,500,000. the difference is due to the following:Interest income as savings deposit, 700,000Premium expense on keyman life insurance, (200,000)Total 500,000The income tax rate is 35%. In its 2006 income statement, what amount should Grim report as current provision for income tax expense?a. 525,000 b. 700,000 c. 595,000 d. 770,000arrow_forwardHow much is the balance of AMSTERDAM's retained earnings account at December 31, 2021?arrow_forwardPlease answer it in good accounting formarrow_forward

- Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses Pretax accounting income (income statement) Taxable income (tax return) 760 800 $ 128 $ 116 $ 180 $ 200 Tax rate: 25% a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint View this as two temporary differences-one reversing in 2021; one originating in 2021. d. 2021 expenses included a $14 million unrealized loss from reducing…arrow_forward*see attached problem REQUIRED: What is the total income tax expense for the current year?arrow_forwardThornton, Inc., had taxable income of $129632 for the year. The company's marginal tax rate was 34 percent and its average tax rate was 24.7 percent. How much did the company have to pay in taxes for the year? a.30432 b.44075 c.30776 d.29074arrow_forward

- Required Answer each of the following questions by providing supporting computations. 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the three items labeled pretax. 2. Compute the amount of income from continuing operations before income taxes. What is the amount of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of net income for the year?arrow_forwardFlip's Pizzeria Inc. has the following financial items for the current year: Adjusted Taxable Income before Interest $43,400,000 Business Interest Income $550,000 Interest Expense $16,100,000 How much interest expense can Flip deduct in the current year? A В C D E 1 2 Interest Expense Deduction = 4 7 8 9. 10 3. 6.arrow_forwardWhat amount of current income tax liability should be reported at year end? a. ₱ 1,780,000 b. ₱ 2,280,000 c. ₱ 2,880,000 d. ₱ 2,580,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education