FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

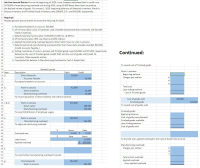

Can somebody check my work on the attached image that I have done so far? Additionally, I am having trouble filling out what to enter into the blank light and blue boxes (where applicable, for

Thanks!

Transcribed Image Text:1 Job Cost Journal Entries Prior to the beginning of 2019, Lowe Company estimated that it would incur

2 $176,000 of manufacturing overhead cost during 2019, using 16,000 direct labor hours to produce

3 the desired volume of goods. On January 1, 2019, beginning balances of Materials Inventory, Work-in-

4 Process Inventory, and Finished Goods Inventory were $28,000, S-0-, and $43,000, respectively.

5

Required

Prepare general journal entries to record the following for 2019:

6

7

a. Purchased materials on account, $39,000.

b. Of the total dollar value of materials used, $31,000 represented direct materials and $11,000

10

indirect materials.

11

c. Determined total factory labor, $135,000 (15,000 hrs. @ $9/hr.)

12

d. Of the factory labor, 80 % was direct and 20 % indirect.

13

e. Applied manufacturing overhead based on direct labor hours to work-in-process.

f. Determined actual manufacturing overhead other than those items already recorded, $92,000.

14

15

(Credit Accounts Payable.)

g. Ending inventories of work-in-process and finished goods were $32,000 and $57,000, respectively.

16

17

Continued:

Determine the cost of finished goods (credit WIP) and the cost of goods sold (credit FG

inventory). Make separate entries.

h. Transferred the balance in Manufacturing Overhead to Cost of Goods Sold.

18

19

20

21

To record cost of finished goods.

22

23

General Journal

Work in process:

24 Item

Debit

Credit

Description

Beginning balance

Charges per entries:

25 a

Direct Materials

39,000

b.

Accounts Payable

Purchased materials on account

39,000

26

27

28

Total cost

Work in process

29 b

42,000

Less ending balance

Cost of finished goods

Direct materials

30

31,000

Manufacturing overhead

31

11,000

To record requisition of direct material and indirect material.

32

Cost of goods sold

Finished goods

328,000

33

328,000

34 c.& d

Work in process

135,000

To record cost of goods sold.

Direct Labor

35

108,000

Manufacturing overhead

To record distribution of employee wages.

36

135,000

Finished goods:

37

Beginning balance

Cost of goods manufactured

Finished goods available

Less: Ending balance

Cost of goods sold

38

Work in process

39 e

165,000

Manufacturing overhead

To apply manufacturing overhead

165,000

40

41

42

43

Hours

Rate

Overhead rate

15,000 $

44

11.00

45

Rate

Hours

To transfer over-applied overhead to the Cost of Goods Sold account.

Labor hours

16,000

46

47

Applied overhead

165,000

Manufacturing overhead:

Charges per entries:

48

b

49 f.

d.

50

f.

To record other manufacturing overhead incurred.

51

Total actual overhead

52

Applied overhead

Finished goods

53 g.

342,000

Over-applied overhead

Work in process

342,000

54

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What exactly are reversing entries, and why do we need them?arrow_forwardMatch the two lists, below, by placing the capital letter from List 1 in each of the cells preceding the five descriptions in List 2 to which they best relate. One description in List 2 can be answered with 2 matches from List 1. Therefore, you should have 2 letters left over from List 1. List 1: Concepts A. Application (i.e., automated) control. B. Corrective control. C. Control environment. D. Input validity. E. Input completeness. F. Input accuracy G. Update completeness. H. Efficient use of resources. List 1: Capital letter List 2: Definitions/Descriptions 1. Insurance policy reimburses a company for losses due to a fire in a warehouse. 2. Shipping notices have a serial number that is tracked to ensure that they are all input. 3. Computer reviews each input to ensure that all the required data are included. 4. Inventory movements are tracked with a scanner to reduce manual counting. 5. Purchase orders are signed to approve the purchase.arrow_forwardcan you please write your solution out and not use excel.arrow_forward

- can you please help solve thisarrow_forwardCan you please enter the information clearly without so many spaces? The information is hard to read.arrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forward

- Could someone please do these calculations by hand? I can't really understand the excel spreadsheet explanations. Thank you!arrow_forwardwhere in quickbooks will i enter itarrow_forwardIn the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forward

- Please also do parts 4 and 5 while showing work so that way I can understand better. Thank you.arrow_forwardIn what format can you distribute T4, T4A, T5, or T4FHSA slips by email or electronic portal without obtaining consent? * 1 point > A) Always B) Only when requested by the recipient Only when the recipient is on extended leave D) Neverarrow_forwardCan you solve it in an Excel spreadsheet? because something is wrong with the asnwer. tyhank you,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education