FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

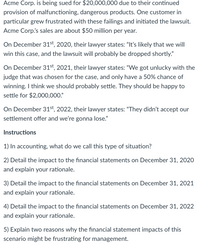

Transcribed Image Text:Acme Corp. is being sued for $20,000,000 due to their continued

provision of malfunctioning, dangerous products. One customer in

particular grew frustrated with these failings and initiated the lawsuit.

Acme Corp's sales are about $50 million per year.

On December 31st, 2020, their lawyer states: "It's likely that we will

win this case, and the lawsuit will probably be dropped shortly."

On December 31st, 2021, their lawyer states: "We got unlucky with the

judge that was chosen for the case, and only have a 50% chance of

winning. I think we should probably settle. They should be happy to

settle for $2,000,000."

On December 31st, 2022, their lawyer states: "They didn't accept our

settlement offer and we're gonna lose."

Instructions

1) In accounting, what do we call this type of situation?

2) Detail the impact to the financial statements on December 31, 2020

and explain your rationale.

3) Detail the impact to the financial statements on December 31, 2021

and explain your rationale.

4) Detail the impact to the financial statements on December 31, 2022

and explain your rationale.

5) Explain two reasons why the financial statement impacts of this

scenario might be frustrating for management.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accounting is sometimes characterized as dealing only with the past. Give examples of how accounting information can be of value in dealing with the future.arrow_forwardIn light of the full disclosure principle, investors and creditors need to know the balances for assets, liabilities, and equity as well as the accounting policies adopted by management to measure the items reported in the balance sheet. Instructions If your school has a subscription to the FASB Codification, go to http://aaahq.org/asclogin.cfm to log in and prepare responses to the following. Provide Codification references for your responses. (a) Identify the literature that addresses the disclosure of accounting policies. (b) How are accounting policies defined in the literature? (c) What are the three scenarios that would result in detailed disclosure of the accounting methods used? (d) What are some examples of common disclosures that are required under this statement?arrow_forwardDiscuss the principles and rules outlined in the Standards on Revenue Recognition, IFRS 15 and ASC 606. In your discussion comment on the 5 steps approach and why you think it was necessary for the accounting bodies to implement the stanarrow_forward

- I need the answer as soon as possiblearrow_forwardWhich fundamental characteristic of accounting requires that financial statements are prepared in a similar way year after year?arrow_forwardExplain the concept of the matching principle in accounting and its significance in the preparation of financial statements. In your response, elaborate on how the matching principle contributes to the accrual basis of accounting and discuss its impact on the recognition of revenues and expenses.arrow_forward

- 2. Provide and explain two general types of prospective financial statements as defined in ISAE 3400 "The Examination of Prospective Financial Informationarrow_forwardwhat criteria do accountants use to decide whether to use present or future values in accounting statements?arrow_forwardWhat are the steps to be completed in preparing the opening IFRS statement of financial position?arrow_forward

- What is the objective of financial reporting? How do general-purpose financial statements help meet this objective? Can I get examples to please to help me keep things straight...arrow_forwardWhat impact will creative accounting have on the accounting profession and annual statements?arrow_forwardEvaluate the company’s latest annual financial statements (balance sheet, income statement, and cash flow statement) and comment on the company's financial performance and position. In your response, use the requirements of IAS 1 as a guide.b) Identify and discuss key accounting principles and standards applied in the company’s financial reporting process indicating their reasons for choosing these and how they were applied. Comment briefly on the appropriateness of the choices made given the company’s industry, location and type (e.g. MNC, regional conglomerate, etc.)c) Critically analyze any significant accounting policies and estimates disclosed in the notes to the financial statements. In your answer, indicate whether the company complied with the accounting standards and conventions.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education