FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

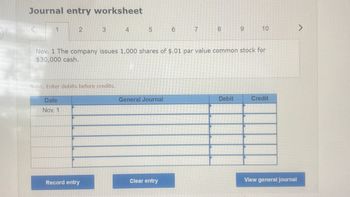

Transcribed Image Text:Journal entry worksheet

1

2

Date

Nov. 1

3

Note: Enter debits before credits.

Record entry

4

5 6

Nov. 1 The company issues 1,000 shares of $.01 par value common stock for

$30,000 cash.

General Journal

7

Clear entry

8

9

Debit

10

Credit

View general journal

>

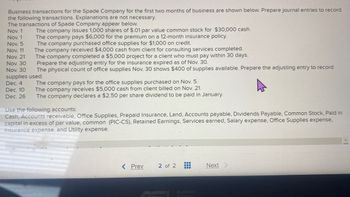

Transcribed Image Text:Business transactions for the Spade Company for the first two months of business are shown below. Prepare journal entries to record

the following transactions. Explanations are not necessary.

The transactions of Spade Company appear below.

Nov. 1

Nov. 1

Nov. 5

Nov. 11

Nov. 21

Nov. 30

Nov. 30

supplies used.

Dec. 4

The company pays for the office supplies purchased on Nov. 5.

Dec. 10

The company receives $5,000 cash from client billed on Nov. 21.

Dec. 26 The company declares a $2.50 per share dividend to be paid in January.

The company issues 1,000 shares of $.01 par value common stock for $30,000 cash.

The company pays $6,000 for the premium on a 12-month insurance policy.

The company purchased office supplies for $1,000 on credit.

The company received $4,000 cash from client for consulting services completed.

The company completed a $5,000 project for a client who must pay within 30 days.

Prepare the adjusting entry for the insurance expired as of Nov. 30.

The physical count of office supplies Nov. 30 shows $400 of supplies available. Prepare the adjusting entry to record

Use the following accounts:

Cash, Accounts receivable, Office Supplies, Prepaid Insurance, Land, Accounts payable, Dividends Payable, Common Stock, Paid in

capital in excess of par value, common (PIC-CS), Retained Earnings, Services earned, Salary expense, Office Supplies expense,

Insurance expense, and Utility expense.

< Prev

‒‒‒‒‒‒‒‒‒‒

2 of 2

Next >

EEE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- kk.2arrow_forwardBusiness transactions for the Spade Company for the first two months of business are shown below. Prepare journal entries to record the following transactions. Explanations are not necessary. The transactions of Spade Company appear below. Nov. 1 Nov. 1 Nov. 5 The company received $4,000 cash from client for consulting services completed. Nov. 11 Nov. 21 Nov. 30 The company completed a $5,000 project for a client who must pay within 30 days. Prepare the adjusting entry for the insurance expired as of Nov. 30. Nov. 30 The physical count of office supplies Nov. 30 shows $400 of supplies available. Prepare the adjusting entry to record supplies used. Dec. 4 The company pays for the office supplies purchased on Nov. 5. The company receives $5,000 cash from client billed on Nov. 21. Dec. 10 Dec. 26 The company declares a $2.50 per share dividend to be paid in January. The company issues 1,000 shares of $.01 par value common stock for $30,000 cash. The company pays $6,000 for the premium on…arrow_forwardQuestion 7 The following information relates to the Snorlax Store, a retail business that buys and sells stylish sleepware. Dr March April 01 Bank 31 Bank 01 Balance b/d CPJ b/d TRADING STOCK 80 000 с ? D March 31 7.1. What would the folio reference for the Cost of Sales entry A be? 7.2. In the trading stock account above, what does the letter B represent? 7.3. In the trading stock account above, what does the letter C represent? 7.4. In the trading stock account above, what does the letter D represent? Cost of sales Balance B12 A c/d B07 CRarrow_forward

- Recording Journal Entries Prepare journal entries for each of the following transactions of Alma Inc. a. Issues stock to shareholders in exchange for $30,000 cash. b. Purchases $9,000 of equipment by signing a note payable. c. Performs $7,500 of services for customers on account. d. Pays $3,000 cash for legal services. Ref. a. b. C d. General Journal Account Name Save Answers + 00 수 0000 # + + ÷ 수 Dr. 0 OOOooooo 0 0 0 0 0 0 Cr. OOOOOOOO 0 0 0 10 0 0arrow_forwardPrinciples of Accounting 1 Chapter 10 Homework Problem 1– Entries for notes payable On January 26, Nyree Co. purchased inventory from Conrad Co. by signing a 45- day note with a face amount of $150,000. A. Determine the proceeds of the note, assuming the note carries an interest rate of 10% B. What journal entries will Nyree Co. 1. At the signing of the note (when the note is issued) 2. After 45 days when the note is paidarrow_forwardListed below are a few events and transactions of Kodax Company. Year 1 January 2 Purchased 40,000 shares of Grecco Company common stock for $431,000 cash. Grecco has 120,000 shares of common stock outstanding, and its activities will be significantly influenced by Kodax. September 1 Grecco declared and paid a cash dividend of $1.70 per share. December 31 Grecco announced that net income for the year is $489,900. Year 2 June 1 Grecco declared and paid a cash dividend of $1.70 per share. December 31 Grecco announced that net income for the year is $705,400. December 31 Kodax sold 9,000 shares of Grecco for $160,000 cash. Prepare journal entries to record the above transactions and events of Kodax Company. (Do not round intermediate calculations and round your final answers to the nearest dollar amount.) View transaction listarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education