CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

NEED FULL STEPS AND EXPLANATIONS PLS. WILL UPVOTE IF DONE PROPERLY

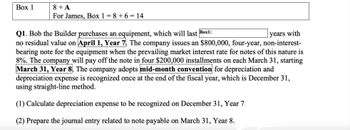

Transcribed Image Text:Вох 1

8 + A

For James, Box 1 = 8 +6 = 14

Q1. Bob the Builder purchases an equipment, which will last Boxl:

no residual value on April 1, Year 7. The company issues an $800,000, four-year, non-interest-

bearing note for the equipment when the prevailing market interest rate for notes of this nature is

8%. The company will pay off the note in four $200,000 installments on each March 31, starting

March 31, Year 8. The company adopts mid-month convention for depreciation and

depreciation expense is recognized once at the end of the fiscal year, which is December 31,

using straight-line method.

years with

раy

(1) Calculate depreciation expense to be recognized on December 31, Year 7.

(2) Prepare the journal entry related to note payable on March 31, Year 8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual interest rate of 6%, and payable in four months. How much interest will Marathon Peanuts owe at the end of four months? A. $2,600 B. $7,800 C. $137,800 D. $132,600arrow_forwardLime Co. incurs a $4,000 note with equal principal installment payments due for the next eight years. What is the amount of the current portion of the noncurrent note payable due in the second year? A. $800 B. $1,000 C. $500 D. nothing, since this is a noncurrent note payablearrow_forwardChemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forward

- Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $500,000. The terms of the loan are 2.9% annual interest rate and payable in 8 months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. Round to the nearest cent if required.arrow_forwardJain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual interest rate of 3.5%, due in 6 months. What journal entry is created when Jain honors the note?arrow_forward5arrow_forward

- On January 1 2021 Gundy Enterprises purchases an office building for $ 184,000 , paying $ 44.000 down and borrowing the remaining , signing a 7 % , 10 - year mortgage . Installment payments of are due at the end of each month , with the first payment due on January 31 , 2021 \$140,000 \$1,625.52 \$195,062(\$1,625.52*120 monthly payments ) . How much of this is interest expense 4. Total payments over the 10 years are and how much is actual payment of the loan ?arrow_forwardPlease help mearrow_forwardAndrews Inc. issues a $497,000, 10% 3-year mortgage note on January 1. The note will be paid in three annual installments of $200,000, each payable at the end of the year. What is the amount of interest expense that should be recognized by Andrews Inc. in the second year? $347,600 $49,740 $34,670 $16,567arrow_forward

- More Info Borrowed $975,000 from Nelson Bank. The 15-year, 7% note requires payments due annually, on March 1. Each payment consists of $65,000 principal plus one year's interest. Mortgaged the warehouse for $500,000 cash with Sawyer Bank. The mortgage requires monthly payments of $5,000. The interest rate on the note is 6% and accrues monthly. The first payment is due on January 1, 2019. Mar. 1, 2018 Dec. 1, 2018 Dec. 31, 2018 Recorded interest accrued on the Sawyer Bank note. Dec. 31, 2018 Recorded interest accrued on the Nelson Bank note. Jan. 1, 2019 Paid Sawyer Bank monthly mortgage payment. Feb. 1, 2019 Paid Sawyer Bank monthly mortgage payment. Mar. 1, 2019 Paid Sawyer Bank monthly mortgage payment. Mar. 1, 2019 Paid first installment on note due to Nelson Bank. Print Done all the journal entries are recorded. e first three payments, then the remaining months one at a time. (Round your answers to the nearest whole dollar.) Requirements 1. Journalize the transactions in the Right…arrow_forwardMark signs a note promising to pay $825 in 3.5 years with simple interest at 10.75%. Then, 9 months before the note comes due, the holder of the note sells it to a local bank which discounts the note based on a bank discount rate of 18%. (a) What did the bank pay the holder of the note when it was sold 9 months before maturity? $ Xarrow_forwardSh5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning