FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

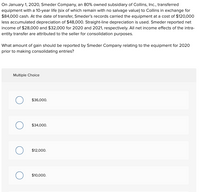

Transcribed Image Text:On January 1, 2020, Smeder Company, an 80% owned subsidiary of Collins, Inc., transferred

equipment with a 10-year life (six of which remain with no salvage value) to Collins in exchange for

$84,000 cash. At the date of transfer, Smeder's records carried the equipment at a cost of $120,000

less accumulated depreciation of $48,000. Straight-line depreciation is used. Smeder reported net

income of $28,000 and $32,000 for 2020 and 2021, respectively. All net income effects of the intra-

entity transfer are attributed to the seller for consolidation purposes.

What amount of gain should be reported by Smeder Company relating to the equipment for 2020

prior to making consolidating entries?

Multiple Choice

$36,000.

$34,000.

$12,000.

$10,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- D2.arrow_forwardAction, Inc. acquired the following assets and assumed the related liabilities of Slacker Corp. in a transaction completed on February 16, 2023: Accounts receivable, net Inventories Property, plant & equipment Non-amortizable intangible assets Carrying value for Slacker Current liabilities Noncurrent liabilities $ 11,000 $ 50,000 $ 100,000 $ 200,000 Fair Value $ 10,000 $ 50,000 $ 150,000 $ 225,000 $ (40,000) $(200,000) $ (40,000) $(200,000) Action paid $205,000 in cash for all of the above from Slacker. a) Determine if Action must record any goodwill. Show any calculations. b) Record the acquisition in Action's general journal on Feb. 16, 2023. Show: any calculations. c) Prepare any adjusting entry for amortization required as of the fiscal year end, December 31, 2023. If no amortization is required, explain why.arrow_forwardin Reynolds buys building (10 year useful life) on January 1, 2019 for $1,000,000. Straight line depreciation is used. On the same day, Reynolds sells building to 90% owned subsidiary for $1,200,000. Subsidiary also uses a remaining useful life of 10 years. What is the appropriate worksheet entry for "excess depreciation" that must be prepared at December 31, 2019? shift O Dr. Depreciation Expense $120,000. Cr. Accumulated Depreciation $120,000 O Dr. Depreciation Expense $20,000. Cr. Accumulated Depreciation $20,000 tab O Dr. Accumulated Depreciation $20,000 Cr. Depreciation Expense $20,000 caps lock O Dr. Accumulated Depreciation $120,000. Cr. Depreciation Expense $120,000 esc 1 9,680 ! 1 Q A T control option Z 72 W S OCT 25 #3 X H command 80 F3 E D $ 4 с 160 000 000 F4 R tv F 175⁰ % F5 V T Garrow_forwardFrodo Corp. bought Aardvark Co. in 2021 and appropriately recorded goodwill related to the purchase. On December 31, 2022, Frodo Corp. reports the following information relating to Aardvark Division: Amount $131,000 $393,000 $658,000 How much loss from goodwill impairment should be recognized by Frodo Corp. in 2022? $265,000 $134.000 Item Goodwill Book value of net assets (including goodwill) Fair value $0 $131,000arrow_forwardParent buys building (useful life 10 years) for $3,000,000 on January 1, 2020. On that same date, the parent sells the building to an 80% owned subsidiary for $4.000,000. The subsidiary will use the same 10-year useful life. How much Depreciation Expense will the subsidiary record in 2020 How much is consolidated Depreciation expense in 2020 What two worksheet entries are required for year-end 2020 (hint: entries TA and ED)arrow_forwardValaarrow_forwardarrow_back_iosarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education