FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

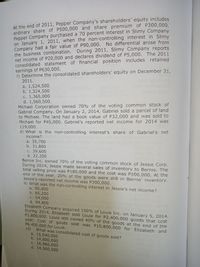

Transcribed Image Text:At the end of 2011, Pepper Company's shareholders' equity includes

ordinary share of P500,000 and share premium of P300,000.

Pepper Company purchased a 70 percent interest in Slimy Company

on January 1, 2011, when the non-controlling interest in Slimy

Company had a fair value of P90,000. No differential arose from

the business combination. During 2011, Slimy Company reports

net income of P20,000 and declares dividend of P5,000. The 2011

consolidated statement of financial position includes retained

earnings of P630,000.

7) Determine the consolidated shareholders' equity on December 31,

2011.

bne

(Gen) inemgiup

21922A 1610T

a. 1,524,500

b. 1,324,500

C. 1,365,000

d. 1,560,500.

Michael Corporation owned 70% of the voting common stock of

Gabriel Company. On January 2, 2014, Gabriel sold a parcel of land

to Michael. The land had a book value of P32,000 and was sold to

Michael for P45,000. Gabriel's reported net income for 2014 was

119,000.

8) What is the non-controlling interest's share of Gabriel's net

income?

000,00

000,08 9

a. 35,700

b. 31,800

C. 39,600

d. 22,200

Bernie Inc. owned 70% of the voting common stock of Jessie Corp.

During 2014, Jessie made several sales of inventory to Bernie. The

total selling price was P180,000 and the cost was P100,000. At the

end of the year, 20% of the goods were still in Bernie' inventory.

Jessie's reported net income was P300,000.

9) What was the non-controlling interest in Jessie's net income?

a. 90,000

b. 85,200

c. 54,000

d. 94,800

Elizabeth Company acquired 100% of Louie Inc. on January 5, 2014.

During 2014, Elizabeth sold Louie for P2,400,000 goods that cost

P1,800,000. Louie still owned 40% of the goods at the end of the

year. Cost of goods sold was P10,800,000 for Elizabeth and

P6,400,000 for Louie.

10) What was consolidated cost of goods sold?

a. 15,040,000

b. 14,800,000

C. 16,960,000

d. 14,560,000

000,01S3

00,003

000.2

000.05

000.00

Transcribed Image Text:000

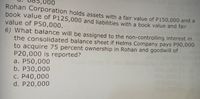

Rohan Corporation holds assets with a fair value of P150,000 and a

book value of P125,000 and liabilities with a book value and fair

value of P50,000.

6) What balance will be assigned to the non-controlling interest in

the consolidated balance sheet if Helms Company pays P90,000

to acquire 75 percent ownership in Rohan and goodwill of

P20,000 is reported?

a. P50,000

b. P30,000

C. P40,000

d. P20,000

eboop to Jaoo be

oisbiloend

000,003

000,00

000,00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- L2-4 Awe Company pays CU500,000,000 for a 30% interest in Groy Company on July 1, 19x2 when the book value of Groy Company's net assets equals fair value. Awe Company amortizes any goodwill from this investment over 20 years. Information related to Groy Company is as follows: 31 Desember 19x1 31 Desember 19x2 Share capital, nominal IDR 1,000 Rp600.000.000 Rp600.000.000 Retained earning 400.000.000 500.000.000 Total Shareholders' Equity 1.000.000.000 1.100.000.000 Net profit earned during the year 19x2 200.000.000 Dividend for the year 19x2 (paid on March 1 of Rp. 50,000,000 and September 1 of Rp. 50,000,000) 100.000.000 Required: calculate Awe Company's revenue from Groy Company for the year 19x2arrow_forward1. Breakspear Co purchased 600,000 of the voting equity shares of Fleet Co when the value of the non-controlling interest in Fleet Co is £150,000. The following information relates to Fleet at the acquisition date. At acquisition £'000 Share capital, £0.5 ordinary shares Retained earnings Revaluation surplus The goodwill arising on acquisition is £70,000. What was the consideration paid by Breakspear Co for the investment in Fleet Co? 500 150 50 700 a) £420,000 b) £770,000 c) £620,000 d) £570,000 Karrow_forward4arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education