FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental

What is the incremental cost per unit produced?

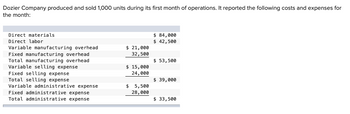

Transcribed Image Text:Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for

the month:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Total manufacturing overhead

Variable selling expense

Fixed selling expense

Total selling expense

Variable administrative expense

Fixed administrative expense

Total administrative expense

$ 21,000

32,500

$ 15,000

24,000

$ 5,500

28,000

$ 84,000

$ 42,500

$ 53,500

$ 39,000

$ 33,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 1. A company wants to produce a new product. In order to produce this product, the fixed cost is $40,000 and the variable cost is $15 per product. a. Assume that the purchase price for the product is $55, and the estimated demand for this product is 2000 units. Then, what is your suggestion to the company? To produce or not, and if yes, how many? [provide your reasonings] b. Answer part (a) but with an estimated demand of 900 units. [provide your reasonings] c. Assume that demand depends on the purchase price so that it would be 1000 and 2000 if the purchase price is $100 and $55 respectively. Then, what purchase price do you suggest to the company? [provide your reasonings]arrow_forwardAA Company produces and sells refrigerator magnets to be sold as novelty items by resorts. Last year, the company sold 198,400 units. The income statement for AA Company for last year is as follow: $992,000 545,600 $446,400 Sales Less: Variable expenses Contribution margin Less: Fixed expenses 180,000 $266,400 Operating Income How much was the margin of safety in revenue for last year? (Answer format: $123,456.78) * Your answer Suppose that the selling price decreases by 8 percent. How much is the revised breakeven point in units? (Answer format: 123.45) * Your answerarrow_forward28.2) Use this information for Carmen Co. to answer the question that follow. Carmen Co. can further process Product J to produce Product D. Product J is currently selling for $22.15 per pound and costs $14.65 per pound to produce. Product D would sell for $39.45 per pound and would require an additional cost of $10.35 per pound to produce. What is the differential cost of producing Product D? a.$8.28 per pound b.$12.42 per pound c.$6.21 per pound d.$10.35 per poundarrow_forward

- hello, help please with B and Carrow_forward1. What is the payback period for the flexible manufacturing system? 2. What is the NPV for the flexible manufacturing system? (use 3 decimal places for the PV factor) 3. What is the IRR for the flexible manufacturing system?arrow_forwardurrently, the unit selling price of a product is $410, the unit variable cost is $340, and the total fixed costs are $1,176,000. A proposal is being evaluated to increase the unit selling price to $460. a. Compute the current break-even sales (units).fill in the blank 1 of 1 units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant.fill in the blank 1 of 1 unitsarrow_forward

- Can you please explain the statement with an example? Also, check whether my understanding of the example is correct. "If using the same unit fixed costs at different output levels, managers may reach erroneous conclusions. Total fixed costs should be used." My Understanding: For example, if the capacity is 1000 and currently we produce 1000 units and sell it for $20 per unit, variable cost $5 and the fixed cost $10 per unit (within the relevant range); and we have a special order to produce 1200 units for $8 per unit. Should we include additional the Total Fixed Cost of $10000, which is (10*1000) for the range (1001-2000) plus $10000 for the range (0-1000), which means, we will have a total fixed cost of $20000.arrow_forward1. What is the differential cost to manufacture part Q? 2. What is the cost savings from manufacturing Part Q?arrow_forwardYou are an industry analyst that specializes in an industry where the market inverse demand is P = 100 - 2Q. The external marginal cost of producing the product is MCExternal = 8Q, and the internal cost is MCInternal = 18Q.Instructions: Enter your responses rounded to the nearest two decimal places.a. What is the socially efficient level of output? unitsb. Given these costs and market demand, how much output would a competitive industry produce? unitsc. Given these costs and market demand, how much output would a monopolist produce? unitsd. Which of the following are actions the government could take to induce firms in this industry to produce the socially efficient level of output.Instructions: For correct answers place a check mark. check all that apply Nonrival consumptionunanswered Pollution taxesunanswered Pollution permitsunansweredarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education