Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.1E

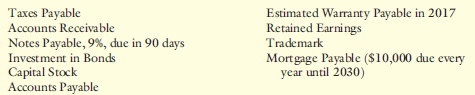

Current Liabilities

The following items are accounts on Smith’s balance sheet of December 31, 2016:

Required

Identify which of the accounts should be classified as a current liability on Smith’s balance sheet. For each item that is not a current liability, indicate the category of the balance sheet in which it would be classified. Assume the company has the following balance sheet categories: current asset; property, plant, and equipment; long-term investment; intangible asset; current liability; long-term liability; and stockholders’ equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following is a December 31, 2021, post-ciosing trial balance for the Jackson Corporation.

Account Title

Cash

Accounts receivable

Inventory

Prepaid rent (for the next 8 months)

Investment in equity securities (short term)

Hachinery

Accumulated depreciation

Patent (net)

Accounts payable

Salaries payable

Income taxes payable

Bonds payable (due in 10 years)

Comnon stock

Retained earnings

Debits Credits

$ 44,000

38,000

79,000

20,000

14,000

165,000

$ 15,000

83,000

10,000

6,000

36,000

180,000

140,000

56,000

Totals

$443,000

$443,000

Required:

Prepare a classified balance sheet for Jackson Corporation at December 31, 2021, by properly classifying each of the accounts.

(Amounts to be deducted should be Indicated by a minus sign.)

Page 1

Calculate the following ratios from the income statement and balance sheet all are required

1-Payables Turnover

2-Debt-Equity Ratio

3-Debt Ratio

4-Total Asset Turnover

5-Fixed Asset Turnover

Statement of financial positionas at 31 December 2018

2018

2017

Note

RO

RO

ASSETS

Non-current assets

Property, plant and equipment

14

8,407,572

9,300,442

Deferred tax assets

12

40,977

18,550

8,448,549

9,318,992

Current assets

Inventories

15

430,885

422,421

Trade and other receivables

16

1,129,440

1,235,724

Due from related parties

24

70,300

73,050

Cash and bank balances

17

6,856,734

6,439,709

Total current assets

8,487,359

8,170,904

Total assets

16,935,908

17,489,896

EQUITY…

Following are the current asset and current liability sections of the balance sheets for Freedom Inc. at January 31, 2020 and 2019 (in

millions):

Current Assets

Cash

Accounts receivable

Inventories

Total current assets

Current Liabilities

Note payable

Accounts payable

Other accrued liabilities

Total current liabilities

January

31, 2020

Working capital

Current ratio

6

EL EL

$ 21

$ 15

January

31, 2019

01/31/2020 01/31/2019

9

18

$ 25

Required:

a. Calculate the working capital and current ratio at each balance sheet date. (Enter "Working capital" in millions of dollars (1.e..

10,000,000 should be entered as 10). Round your "Current ratio" to 2 decimal places.)

$12

b. Evaluate the firm's liquidity at each balance sheet date.

Based on the working capital and current ratio measures, the firm has become more liquid over the 2-year period.

O Based on the working capital and current ratio measures, the firm has become less liquid over the 2-year period.

c. Assume that the firm operated at a loss…

Chapter 9 Solutions

Financial Accounting: The Impact on Decision Makers

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Balance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.arrow_forwardProblem 3-3 (Algo) Balance sheet preparation [LO3-2, 3-3] The following is a December 31, 2021, post-closing trial balance for Almway Corporation. Account Title Cash Investment in equity securities Accounts receivable. Inventory Prepaid insurance (for the next 9 months) Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Patent (net) Accounts payable Notes payable Interest payable Bonds Payable Common stock Retained earnings Totals $ Debits 65,000 130,000 70,000 210,000 8,000 110,000 430,000 120,000 20,000 Credits $ 110,000 70,000 95,000 160,000 30,000 250,000 330,000 118,000 $1,163,000 $1,163,000 Additional information: 1. The investment in equity securities account includes an investment in common stock of another corporation of $40,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $35,000 that the company has…arrow_forwardSome interest cost of Metlock Inc. is capitalized for the year ended May 31, 2026. Compute the amount of each of the items that must be disclosed in Metlock's financial statements. Total actual interest cost $ Total interest capitalized $ Total interest expensed $arrow_forward

- The following information is available for J Ltd. for the year ended 2021: Net working capital Long-term debt Total assets Fixed assets Calculate the amount of the total liabilities. $6,880 $4,970 $2,480 $460 $4,970 $8,390 $5,910 $6,990arrow_forwardFollowing are the current asset and current liability sections of the balance sheets for Freedom Incorporated at January 31, 2023 and 2022 (in millions): Current Assets Cash Accounts receivable Inventories Total current assets Current Liabilities Note payable Accounts payable Other accrued liabilities Total current liabilities Req A January 31, 2023 $12 8 7 $ 27 Req B and C Working capital Current ratio 4 3 $ 11 January 31, 2022 Required: a. Calculate the working capital and current ratio at each balance sheet date. b. Evaluate the firm's liquidity at each balance sheet date. c. Assume that the firm operated at a loss during the year ended January 31, 2023. How could cash have increased during the year? $ 9 11 11 $ 31 Complete this question by entering your answers in the tabs below. 1 3 01/31/2023 01/31/2022 $8 Calculate the working capital and current ratio at each balance sheet date. Note: Enter "Working capital" in millions of dollars (i.e., 10,000,000 should be entered as 10).…arrow_forward1. How much from the list od debt above? (items a to d, excluding accrued interests) should be presented as current as of December 31,2021? 2. How much from the list of debt above should be presented as non current assets as of December 31, 2021? 3. How much should be accrued, if there are any, as a result of the information in item E?arrow_forward

- The following is the ending balances of accounts at December 31, 2018 for the Valley Pump Corporation. Account Title Cash Accounts receivable Inventories Interest payable Marketable securities Land: Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Copyright (net of amortization) Prepaid expenses (next 12 months) Accounts payable Deferred revenues (next 12 months) Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals Additional information: Debits 38,000 82,000 107,000 70,000 146,000 365,000 101,000 25,000 45,000 Credits 23,000 113,000 38,000 78,000 33,000 315,000 8,000 330,000 41,000 979,000 979,000 1. The $145,000 balance in the land account consists of $113,000 for the cost of land where the plant and office buildings are located. The remaining $33,000 represents the cost of land being held for speculation. 2. The $70,000 in the marketable securities account represents an investment in the common stock of…arrow_forwardQUESTION : " The balance sheet of Lara Ltd are as follows: 31/12/2019 Non-Current Assets RM RM RM Equipment (Cost) Less: Accumulated depreciation 28,500 (11,450) 17,050 Current Assets 18,570 Inventory Account receivable 8,470 Less: Provision doubtful debts (420) 8,050 4,060 30,680 Cash and bank Total Assets Current Liabilities Account Payable 4,140 Non-Current Liabilities Loan 10,000 Total Liabilities (14,140) 16,540 Net Assets 33,590 Capital Opening Add: Net profit 35,760 10,240 Cash introduced Less: Drawing Total Capital (12,410) 33,590 31/12/2020 Non-Current Assets RM RM RM Equipment (Cost) Less: Accumulated depreciation 26,100 (13,010) 13,090 Current Assets 16,250 Inventory Account receivable 14,190 Less: Provision doubtful debts (800) 13,390 3,700 33,340 Cash and bank Total Assets Current Liabilities Account Payable 5,730 Non-Current Liabilities Loan 4,000 23,610 36,700 Total Liabilities (9,730) Net Assetsarrow_forwardFollowing are the current asset and current liability sections of the balance sheets for Freedom Inc. at January 31, 2020 and 2019 (in millions): January 31, 2020 January 31, 2019 Current Assets Cash $ 11 $ 8 Accounts receivable 6 9 Inventories 7 11 Total current assets $ 24 $ 28 Current Liabilities Note payable $ 6 $ 6 Accounts payable 6 3 Other accrued liabilities 5 5 Total current liabilities $ 17 $ 14 Required:a. Calculate the working capital and current ratio at each balance sheet date. (Enter "Working capital" in millions of dollars (i.e., 10,000,000 should be entered as 10). Round your "Current ratio" to 2 decimal places.)arrow_forward

- Indicate how the "investment in equity securities -trading" would be classified on a balance sheet prepared on December 31, 2020. a) Current Assets b) Long-term Investments c) Property, Plant, and Equipment d) Intangible Assets e) Other Assets f) Current Liabilities 8) Long-Term Liabilities h) Capital Stock i) Retained Earnings i) Notes to Financial Statements K) Not Reported on Balance Sheetarrow_forwardGecko Investments has the following data regarding their debt investments as of December 31, 2021: Original Cost Amortized Cost Market Value Trading Bonds 95 96 97 Available for Sale Bonds 95 96 97 Held-to-Maturity Bonds 95 96 97 1. What is the total amount of gain or loss to be reported as part of other comprehensive income? Give both the amount and whether it is a gain or loss.arrow_forwardComprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Companys balances sheet accounts and account balances on December 31, 2019: Additional information: 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes. 2. The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, 29,500; buildings, 164,600; store fixtures, 72,600; and office equipment, 30,000. 3. The accumulated depreciation breakdown is as follows: buildings, 54,600; store fixtures, 37,400; and office equipment, 17,300. 4. The long term debt includes 12%, 36,000 face value bonds that mature on December 31, 2024, and have an unamortized bond discount of 1,000; 11%, 48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of 1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of 6,200 and matures on January 1, 2022. 5. The non-interest-bearing note receivable matures on June 1, 2023. 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost. 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, 50,000, 15-year bonds issued by this affiliate, Jay Company. 8. Common stock has a 10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of 13 per share, resulting in 8,000 shares issued at year-end. 9. Preferred stock has a 50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of 55 per share, resulting in 640 shares issued at year-end. 10. On January 15, 2020, before the December 31, 2019, balance sheet was issued, a building with a cost of 20,000 and a book value of 7,000 was totally destroyed. Insurance proceeds will amount to only 5,000. 11. Net income and dividends declared and paid during the year were 50,500 and 21,000, respectively. Required: 1. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare a statement of shareholders equity for 2019. (Hint: Work back from the ending account balances.) 3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies, contingent liabilities, and subsequent events. 4. Next Level Compute the debt-to-assets ratio at the cud of 2019. What is your evaluation of this ratio if it was 39% at the end of 2018? Use the following information for P415 and P416: McCormick Company, Inc. is one of the worlds leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormicks consolidated balance sheets for 20X2 and 20X3 follow.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Current assets and current liabilities; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Jw4TaiP42P4;License: Standard youtube license