Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

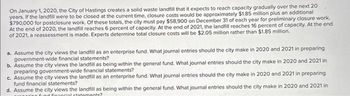

Transcribed Image Text:On January 1, 2020, the City of Hastings creates a solid waste landfill that it expects to reach capacity gradually over the next 20

years. If the landfill were to be closed at the current time, closure costs would be approximately $1.85 million plus an additional

$790,000 for postclosure work. Of these totals, the city must pay $58,900 on December 31 of each year for preliminary closure work.

At the end of 2020, the landfill reaches 6 percent of capacity. At the end of 2021, the landfill reaches 16 percent of capacity. At the end

of 2021, a reassessment is made. Experts determine total closure costs will be $2.05 million rather than $1.85 million.

a. Assume the city views the landfill as an enterprise fund. What journal entries should the city make in 2020 and 2021 in preparing

government-wide financial statements?

b. Assume the city views the landfill as being within the general fund. What journal entries should the city make in 2020 and 2021 in

preparing government-wide financial statements?

c. Assume the city views the landfill as an enterprise fund. What journal entries should the city make in 2020 and 2021 in preparing

fund financial statements?

d. Assume the city views the landfill as being within the general fund. What journal entries should the city make in 2020 and 2021 in

fund financial statements?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?arrow_forwardOn January 1, 2020, the City of Hastings creates a solid waste landfill that it expects to reach capacity gradually over the next 20 years. If the landfill were to be closed at the current time, closure costs would be approximately $1.65 million plus an additional $900,000 for postclosure work. Of these totals, the city must pay $63,900 on December 31 of each year for preliminary closure work. At the end of 2020, the landfill reaches 4 percent of capacity. At the end of 2021, the landfill reaches 18 percent of capacity. At the end of 2021, a reassessment is made. Experts determine total closure costs will be $1.85 million rather than $1.65 million. a. Assume the city views the landfill as an enterprise fund. What journal entries should the city make in 2020 and 2021 in preparing government-wide financial statements? b. Assume the city views the landfill as being within the general fund. What journal entries should the city make in 2020 and 2021 in preparing government-wide financial…arrow_forwardOn January 1, 2020, the City of Hastings creates a solid waste landfill that it expects to reach capacity gradually over the next 20 years. If the landfill were to be closed at the current time, closure costs would be approximately $1.88 million plus an additional $750,000 for postclosure work. Of these totals, the city must pay $63,500 on December 31 of each year for preliminary closure work. At the end of 2020, the landfill reaches 3 percent of capacity. At the end of 2021, the landfill reaches 11 percent of capacity. At the end of 2021, a reassessment is made. Experts determine total closure costs will be $2.08 million rather than $1.88 million. Assume the city views the landfill as an enterprise fund. What journal entries should the city make in 2020 and 2021 in preparing government-wide financial statements? Assume the city views the landfill as being within the general fund. What journal entries should the city make in 2020 and 2021 in preparing government-wide financial…arrow_forward

- On January 1, 2017, the City of Hastings created a solid waste landfill that it expects to reach capacity gradually over the next 20 years. If the landfill were to be closed at the current time, closure costs would be approximately $1.2 million plus an additional $700,000 for postclosure work. Of these totals, the city must pay $50,000 on December 31 of each year for preliminary closure work. At the end of 2017, the landfill reached 3 percent of capacity. At the end of 2018, the landfill reached 9 percent of capacity. Also at the end of 2018, a reassessment is made; total closure costs are determined to be $1.4 million rather than $1.2 million.a. Assuming that the landfill is viewed as an enterprise fund, what journal entries are made in 2017 and 2018 on the government-wide financial statements?b. Assuming that the landfill is reported within the general fund, what journal entries are made in 2017 and 2018 on the government-wide financial statements?c. Assuming that the landfill is…arrow_forwardOn January 1, 2017, the City of Hastings created a solid waste landfill that it expects to reach capacity gradually over the next 20 years. If the landfill were to be closed at the current time, closure costs would be approximately $1.2 million plus an additional $700,000 for postclosure work. Of these totals, the city must pay $50,000 on December 31 of each year for preliminary closure work. At the end of 2017, the landfill reached 3 percent of capacity. At the end of 2018, the landfill reached 9 percent of capacity. Also at the end of 2018, a reassessment is made; total closure costs are determined to be $1.4 million rather than $1.2 million. Assuming that the landfill is viewed as an enterprise fund, what journal entries are made in 2017 and 2018 on the government-wide financial statements? Assuming that the landfill is reported within the general fund, what journal entries are made in 2017 and 2018 on the government-wide financial statements? Assuming that the landfill is viewed…arrow_forwardThe City of Lawrence opens a solid waste landfill in 2017 that is at 54 percent of capacity on December 31, 2017. The city had initially anticipated closure costs of $2 million but later that year decided that closure costs would actually be $2.4 million. None of these costs will be incurred until 2021 when the landfill is scheduled to be closed. What will appear on the government-wide financial statements for this landfill for the year ended December 31, 2017? Assuming that the landfill is recorded within the general fund, what will appear on the fund financial statements for this landfill for the year ended December 31, 2017?arrow_forward

- The City of Lawrence opens a solid waste landfill in 2017 that is at 54 percent of capacity on December 31, 2017. The city had initially anticipated closure costs of $2 million but later that year decided that closure costs would actually be $2.4 million. None of these costs will be incurred until 2021 when the landfill is scheduled to be closed.a. What will appear on the government-wide financial statements for this landfill for the year ended December 31, 2017?b. Assuming that the landfill is recorded within the general fund, what will appear on the fund financial statements for this landfill for the year ended December 31, 2017?arrow_forwardOn January 1, 2020, Optimistic Company was granted by a local government authority 5,000 hectares of land located near the slums outside the city limits. The condition attached to this grant was that the entity shall clean up this land and lay roads by employing laborers from the village where the land is located. The government has fixed the minimum wage payable to the workers. The entire operation will take 3 years and is estimated to cost P10,000,000. This amount will be spent P2,000,000 for 2020, P2,000,000 for 2021 and P6,000,000 for 2022. The fair value of this land is P12,000,000. Prepare the journal entry for 2020 in connection with this grantarrow_forwardDuring 2024, YellowCard constructed a small manufacturing facility specifically to manufacture one particular accessory. YellowCard paid the construction contractor $5,000,000 cash (which was the total contract price) and placed the facility into service on January 1, 2025. Because of technological change, YellowCard anticipates that the manufacturing facility will be useful for no more than 10 years. The local government where the facility is located required that, at the end of the 10-year period, YellowCard remediate the facility so that it can be used as a community center. YellowCard estimates the cost of remediation will be $500,000. YellowCard uses straight-line depreciation with $0 salvage value for its plant asset and a 10% discount rate for asset retirement obligations. Instructions Prepare the journal entries to record the January 1, 2025, transactionsPrepare adjusting entries to record depreciation and interest expense on December 31, 2025.arrow_forward

- During 2024, Novak constructed a small manufacturing facility specifically to manufacture one particular accessory. Novak paid the construction contractor $4,851,000 cash (which was the total contract price) and placed the facility into service on January 1, 2025. Because of technological change, Novak anticipates that the manufacturing facility will be useful for no more than 10 years. The local government where the facility is located required that, at the end of the 10-year period, Novak remediate the facility so that it can be used as a community center. Novak estimates the cost of remediation will be $402,100. Novak uses straight-line depreciation with $0 salvage value for its plant asset and a 9% discount rate for asset retirement obligations. Prepare adjusting entries to record depreciation and accretion expense on December 31, 2025. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"…arrow_forwardGreen County is planning to construct a bridge across the south branch of Carey Creek to facilitate traffic flow though Clouser Canyon. The first cost for the bridge will be $9,500,000. Annual maintenance and repairs the first year of operation, estimated to be $10,000, are expected to increase by $1000 each year thereafter. In addition to regular maintenance, every 5 years the roadway will be resurfaced at a cost of $750,000, and the structure must be painted every 3 years at a cost of $100,000. If Green County uses 5% as its cost of money and the bridge is expected to last for 20 years, what is the EUAC?arrow_forwardDuring 2024, Sheffield constructed a small manufacturing facility specifically to manufacture one particular accessory. Sheffield paid the construction contractor $5,053,000 cash (which was the total contract price) and placed the facility into service on January 1, 2025. Because of technological change, Sheffield anticipates that the manufacturing facility will be useful for no more than 10 years. The local government where the facility is located required that, at the end of the 10-year period, Sheffield remediate the facility so that it can be used as a community center. Sheffield estimates the cost of remediation will be $542,400. Sheffield uses straight-line depreciation with $0 salvage value for its plant asset and a 9% discount rate for asset retirement obligations. (a) Prepare the journal entries to record the January 1, 2025, transactions. Use the Plant Assets account for the tanker depot. (Credit account titles are automatically indented when the amount is entered. Do not…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning