FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

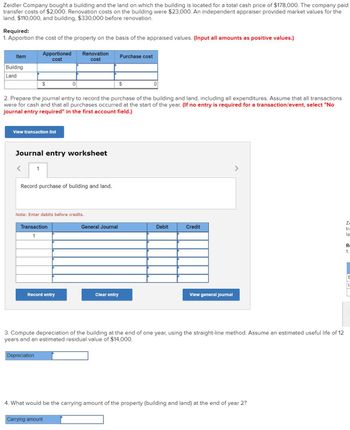

Transcribed Image Text:Zeidler Company bought a building and the land on which the building is located for a total cash price of $178,000. The company paid

transfer costs of $2,000. Renovation costs on the building were $23,000. An independent appraiser provided market values for the

land, $110,000, and building, $330,000 before renovation.

Required:

1. Apportion the cost of the property on the basis of the appraised values. (Input all amounts as positive values.)

Item

Apportioned

cost

Renovation

cost

Purchase cost

Building

Land

$

2. Prepare the journal entry to record the purchase of the building and land, including all expenditures. Assume that all transactions

were for cash and that all purchases occurred at the start of the year. (If no entry is required for a transaction/event, select "No

journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

<

1

Record purchase of building and land.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

>

3. Compute depreciation of the building at the end of one year, using the straight-line method. Assume an estimated useful life of 12

years and an estimated residual value of $14,000.

Depreciation

4. What would be the carrying amount of the property (building and land) at the end of year 2?

Carrying amount

Z

tra

la

R

1.

B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Understanding about lump-sum purchase:

VIEW Step 2: Apportion the cost of the property on the basis of the appraised values:

VIEW Step 3: Record purchase of building and land:

VIEW Step 4: Compute depreciation of the building at the end of one year, using the straight-line method:

VIEW Step 5: Carrying amount of the property at the end of year 2:

VIEW Solution

VIEW Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On April 1, Renner Corporation purchased for $855,000, a tract of land on which was located a warehouse and office building. The following data were collected concerning the property: Current Assessed Valuation Land - $300,000 Warehouse - $200,000 Office Building - $400,000 Vendor's Orginal Cost Land - $280,000 Warehouse - $180,000 Office Building - $340,000 What are the appropriate amounts that Renner should record for land, warehouse, and office buidling respectively? Land, $280,000: warehouse, $180,000, office building. $340,000 Land. $300,000: warehouse. $200,000; office building $400.000 Land. $299.250: warehouse. $192.375: office building $363.375 Land. $285.000: warehouse. $190.000: office building. $380.000arrow_forwardRodriguez Company pays $342,225 for real estate with land, land improvements, and a building. Land is appraised at $245.000; land improvements are appraised at $73,500; and a building is appraised at $171,500. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase.arrow_forwardA company purchased property for a building site. The costs associated with the property were: Purchase price $175,000 Real estate commissions 15,000 Legal fees. Expenses of clearing the land Expenses to remove old building 800 2,000 1,000 What portion of these costs should be allocated to the cost of the land and what portion should be alloca the cost of the new building? $175,800 to Land; $18,800 to Building O $190,000 to Land; $3,800 to Building $190,800 to Land; $1,000 to Building O $192,800 to Land; $0 to Building O $193,800 to Land; $0 to Buildingarrow_forward

- Shahia Company bought a building for $88,000 cash and the land on which it was located for $111,000 cash. The company paid transfer costs of $16,000 ($8,000 for the building and $8,000 for the land). Renovation costs on the building before it could be used were $15,000. 8-3 Part 1 equired: Prepare the journal entry to record the purchase of the property, including all relevant expenditures. Assume that all transaction ere for cash and that all purchases occurred at the start of the year. ote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list View journal entry worksheet No 1 Transaction a Building Land Cash General Journal DHOL S Debit 5 — Credit Next Ⓒarrow_forwardCalculate and allocate basis for the following problems. 1. A property is acquired for a purchase price of $230,000 cash plus acquisition costs of $20,000. The tax assessment for this property is as follows: Assessed Value Land Improvements Total assessments $40,000 160,000 $200,000 a. What is the acquisition basis for this property? b. What is the allocation for land? c. What is the allocation for improvements?arrow_forwardFarley Corporation purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $70,000; broker's fees, $6,000; title search and other fees, $5,000; demolition of an old building on the property, $5,700; grading $1,200; digging foundation for the road, $3,000; laying and paving driveway. $25,000; lighting $7,500; signs, $1,500. List the items and amounts that should be included in the Land account. $ $arrow_forward

- WinCo Foods purchased land and a building for a total price of $2,080,000. Individually, the land was appraised at $336,000 and the building at 1,904,000. How much should be recorded as the acquisition cost of each asset? Select one: a. Land $320,000; Building $1,760,000 b. Land $312,000; Building $1,768,000 c. Land $336,000; Building $1,904,000 d. Land $336,000; Building $1,744,000 e. Land $1,040,000; Building $1,040,000arrow_forwardhomework i Carver Incorporated purchased a building and the land on which the building is situated for a total cost of $846,300 cash. The land was appraised at $194,649 and the building at $778,596. Required: a. What is the accounting term for this type of acquisition? b. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. c. Would the company recognize a gain on the purchase? d. Record the purchase in a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Check my work Record the purchase in a horizontal statements model. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. In the Statement of Cash Flows column, use the initials OA to designate operating IA for investing activity, FA for financing activity, NC for net change in cash and NA for not affected. Enter any decreases to account balances and…arrow_forwardSolvearrow_forward

- Rodriguez Company pays $326,430 for real estate with land, land improvements, and a building. Land is appraised at $225,000; land improvements are appraised at $75,000; and the building is appraised at $200,000.1. Allocate the total cost among the three assets.2. Prepare the journal entry to record the purchase.arrow_forwardNeed answer with this questionarrow_forwardRodriguez Company pays $395,380 for real estate with land, land improvements, and a building. Land is appraised at $157,040; improvements are appraised at $58,890and a building is appraised at $176,670. Required: 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education