Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

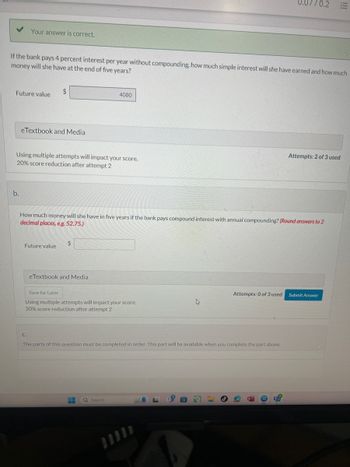

Transcribed Image Text:Your answer is correct.

7/0.2 E

If the bank pays 4 percent interest per year without compounding, how much simple interest will she have earned and how much

money will she have at the end of five years?

$

Future value

eTextbook and Media

4080

Using multiple attempts will impact your score.

20% score reduction after attempt 2

b.

Attempts: 2 of 3 used

How much money will she have in five years if the bank pays compound interest with annual compounding? (Round answers to 2

decimal places, e.g. 52.75.)

Future value

C.

$

eTextbook and Media

Save for Later

Using multiple attempts will impact your score.

20% score reduction after attempt 2

Attempts: 0 of 3 used

Submit Answer

The parts of this question must be completed in order. This part will be available when you complete the part above.

Search

SAMBUNG

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Answer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote.arrow_forwardou have discovered an investment opportunity that earns a 3% rate of interest compounded semiannually. What amount should you deposit today to have $7000 in three years? (Use spreadsheet software or a financial calculator to calculate your answer. Do not round any intermediary calculations, and round your final answer to the nearest dollar.) $6400 $6370 $6406 $6402arrow_forwardI SAVED, I PROFIT! Situation 1: Suppose you started a savings account when you were 10 years old with P 500.00, but you have not added any amount to it thereafter. a. Creatively make charts showing the patterns which would lead to the formula in computing your savings account now using 3% simple interest and 3% compound interest quarterly. The chart must contain the important details like the table below; Simple Interest t Principa Annual Balance at End of Interest the Year 1 2 Compound Interest t Principal Annual Balance at End of & Interest Interest the Year 1 2 the difference the b. Describe between created. 3 charts you Which do you think best interest when you save money? Situation 2: You started with the same amount at 10 years old, but this time you add P 100.00 a month until you turn 18 years old. a. How much money do you have now assuming it still gets 3% interest? b. How much money did you actually put on it? c. How much was the interest earned?arrow_forward

- You are saving for a new car. You place $14,200 into an investment account today. How much will you have after four years if the account earns (a) 4%, (b) 6%, or (c) 8% compounded annually? Note: Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places. (FV of $1, PV of $1, FVA of $1, and PVA of $1)arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education