Your accounting company has been hired to prepare the payroll and everything that goes along with it for Ol'Fashion Industries which has 4 employees. The necessary payroll information is listed below and in the Excel spreadsheet for the current year. The employees are paid monthly (last day of the current month) and were last paid Sept. 30th. Assume this is an Indiana company and use the Indiana withholding rates. Their SUTA rate is 3.5%. The company utilizes the "Quick Chart" for all eligible employees, otherwise the longer method must be used to calculate Federal withholding tax. Employee Gross Wages per check Marital Status Hire date Termination Denise 15,800 Married/Joint 7 years ago Erin 7,200 Single 7 years ago Frank 3,400 Single Aug. 1st Nov. 30th Grant 3,300 Married/Joint Sept. 1st *All Medical Premium Insurance and Flexible Spending are part of a cafeteria plan Denise - Has $450/ pay deducted for 401K, $500/pay deducted for Medical Premium insurance and $400 withheld for Flexible Spending (FSA). Step 3 of W4 = $2,500. Spouse does not work. Erin - Has $300/ pay deducted for 401K, $250/pay deducted for Medical Premium insurance and $150 withheld for FSA. Step 3 of W4 = $500 Frank- Has $50/ pay deducted for 401K, $200/pay deducted for Medical Premium insurance and $150 withheld for FSA. Nothing for Step 3 or 4 Grant- Has $50/ pay deducted for 401K, $350/pay deducted for Medical Premium insurance and $400 withheld for FSA. Spouse makes the same and checked step 2 on W4. **Employer will match 401K contributions up to $500. Employer's portion of the Medical Premiums is twice what the employee pays.** Instructions: 1. Using the attached Excel Spreadsheet as a guide to the proper layout, adapt your own preformatted payroll template. Add a new sheet for Nov. and Dec. and copy and paste your template. Copy and paste the trial balances given for each month in 3 separate new sheets (copy the opening trial balance as well to reference). Make sure your sheets contain all the answers requested in the nonformatted attachment (ie. 5 Your accounting company has been hired to prepare the payroll and everything that goes along with it for Ol'Fashion Industries which has 4 employees. The necessary payroll information is listed below and in the Excel spreadsheet for the current year. The employees are paid monthly (last day of the current month) and were last paid Sept. 30th. Assume this is an Indiana company and use the Indiana withholding rates. Their SUTA rate is 3.5%. The company utilizes the "Quick Chart" for all eligible employees, otherwise the longer method must be used to calculate Federal withholding tax. Employee Gross Wages per check Marital Status Hire date Termination Denise 15,800 Married/Joint 7 years ago Erin 7,200 Single 7 years ago Frank 3,400 Single Aug. 1st Nov. 30th Grant 3,300 Married/Joint Sept. 1st *All Medical Premium Insurance and Flexible Spending are part of a cafeteria plan Denise - Has $450/ pay deducted for 401K, $500/pay deducted for Medical Premium insurance and $400 withheld for Flexible Spending (FSA). Step 3 of W4 = $2,500. Spouse does not work. Erin - Has $300/ pay deducted for 401K, $250/pay deducted for Medical Premium insurance and $150 withheld for FSA. Step 3 of W4 = $500 Frank- Has $50/ pay deducted for 401K, $200/pay deducted for Medical Premium insurance and $150 withheld for FSA. Nothing for Step 3 or 4 Grant- Has $50/ pay deducted for 401K, $350/pay deducted for Medical Premium insurance and $400 withheld for FSA. Spouse makes the same and checked step 2 on W4. **Employer will match 401K contributions up to $500. Employer's portion of the Medical Premiums is twice what the employee pays.** Instructions: 1. Using the attached Excel Spreadsheet as a guide to the proper layout, adapt your own preformatted payroll template. Add a new sheet for Nov. and Dec. and copy and paste your template. Copy and paste the trial balances given for each month in 3 separate new sheets (copy the opening trial balance as well to reference). Make sure your sheets contain all the answers requested in the nonformatted attachment (ie. 5

Your accounting company has been hired to prepare the payroll and everything that goes along with it for Ol'Fashion Industries which has 4 employees. The necessary payroll information is listed below and in the Excel spreadsheet for the current year. The employees are paid monthly (last day of the current month) and were last paid Sept. 30th. Assume this is an Indiana company and use the Indiana withholding rates. Their SUTA rate is 3.5%. The company utilizes the "Quick Chart" for all eligible employees, otherwise the longer method must be used to calculate Federal withholding tax. Employee Gross Wages per check Marital Status Hire date Termination Denise 15,800 Married/Joint 7 years ago Erin 7,200 Single 7 years ago Frank 3,400 Single Aug. 1st Nov. 30th Grant 3,300 Married/Joint Sept. 1st *All Medical Premium Insurance and Flexible Spending are part of a cafeteria plan Denise - Has $450/ pay deducted for 401K, $500/pay deducted for Medical Premium insurance and $400 withheld for Flexible Spending (FSA). Step 3 of W4 = $2,500. Spouse does not work. Erin - Has $300/ pay deducted for 401K, $250/pay deducted for Medical Premium insurance and $150 withheld for FSA. Step 3 of W4 = $500 Frank- Has $50/ pay deducted for 401K, $200/pay deducted for Medical Premium insurance and $150 withheld for FSA. Nothing for Step 3 or 4 Grant- Has $50/ pay deducted for 401K, $350/pay deducted for Medical Premium insurance and $400 withheld for FSA. Spouse makes the same and checked step 2 on W4. **Employer will match 401K contributions up to $500. Employer's portion of the Medical Premiums is twice what the employee pays.** Instructions: 1. Using the attached Excel Spreadsheet as a guide to the proper layout, adapt your own preformatted payroll template. Add a new sheet for Nov. and Dec. and copy and paste your template. Copy and paste the trial balances given for each month in 3 separate new sheets (copy the opening trial balance as well to reference). Make sure your sheets contain all the answers requested in the nonformatted attachment (ie. 5 Your accounting company has been hired to prepare the payroll and everything that goes along with it for Ol'Fashion Industries which has 4 employees. The necessary payroll information is listed below and in the Excel spreadsheet for the current year. The employees are paid monthly (last day of the current month) and were last paid Sept. 30th. Assume this is an Indiana company and use the Indiana withholding rates. Their SUTA rate is 3.5%. The company utilizes the "Quick Chart" for all eligible employees, otherwise the longer method must be used to calculate Federal withholding tax. Employee Gross Wages per check Marital Status Hire date Termination Denise 15,800 Married/Joint 7 years ago Erin 7,200 Single 7 years ago Frank 3,400 Single Aug. 1st Nov. 30th Grant 3,300 Married/Joint Sept. 1st *All Medical Premium Insurance and Flexible Spending are part of a cafeteria plan Denise - Has $450/ pay deducted for 401K, $500/pay deducted for Medical Premium insurance and $400 withheld for Flexible Spending (FSA). Step 3 of W4 = $2,500. Spouse does not work. Erin - Has $300/ pay deducted for 401K, $250/pay deducted for Medical Premium insurance and $150 withheld for FSA. Step 3 of W4 = $500 Frank- Has $50/ pay deducted for 401K, $200/pay deducted for Medical Premium insurance and $150 withheld for FSA. Nothing for Step 3 or 4 Grant- Has $50/ pay deducted for 401K, $350/pay deducted for Medical Premium insurance and $400 withheld for FSA. Spouse makes the same and checked step 2 on W4. **Employer will match 401K contributions up to $500. Employer's portion of the Medical Premiums is twice what the employee pays.** Instructions: 1. Using the attached Excel Spreadsheet as a guide to the proper layout, adapt your own preformatted payroll template. Add a new sheet for Nov. and Dec. and copy and paste your template. Copy and paste the trial balances given for each month in 3 separate new sheets (copy the opening trial balance as well to reference). Make sure your sheets contain all the answers requested in the nonformatted attachment (ie. 5

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 8PB

Related questions

Question

Just need the october payroll and

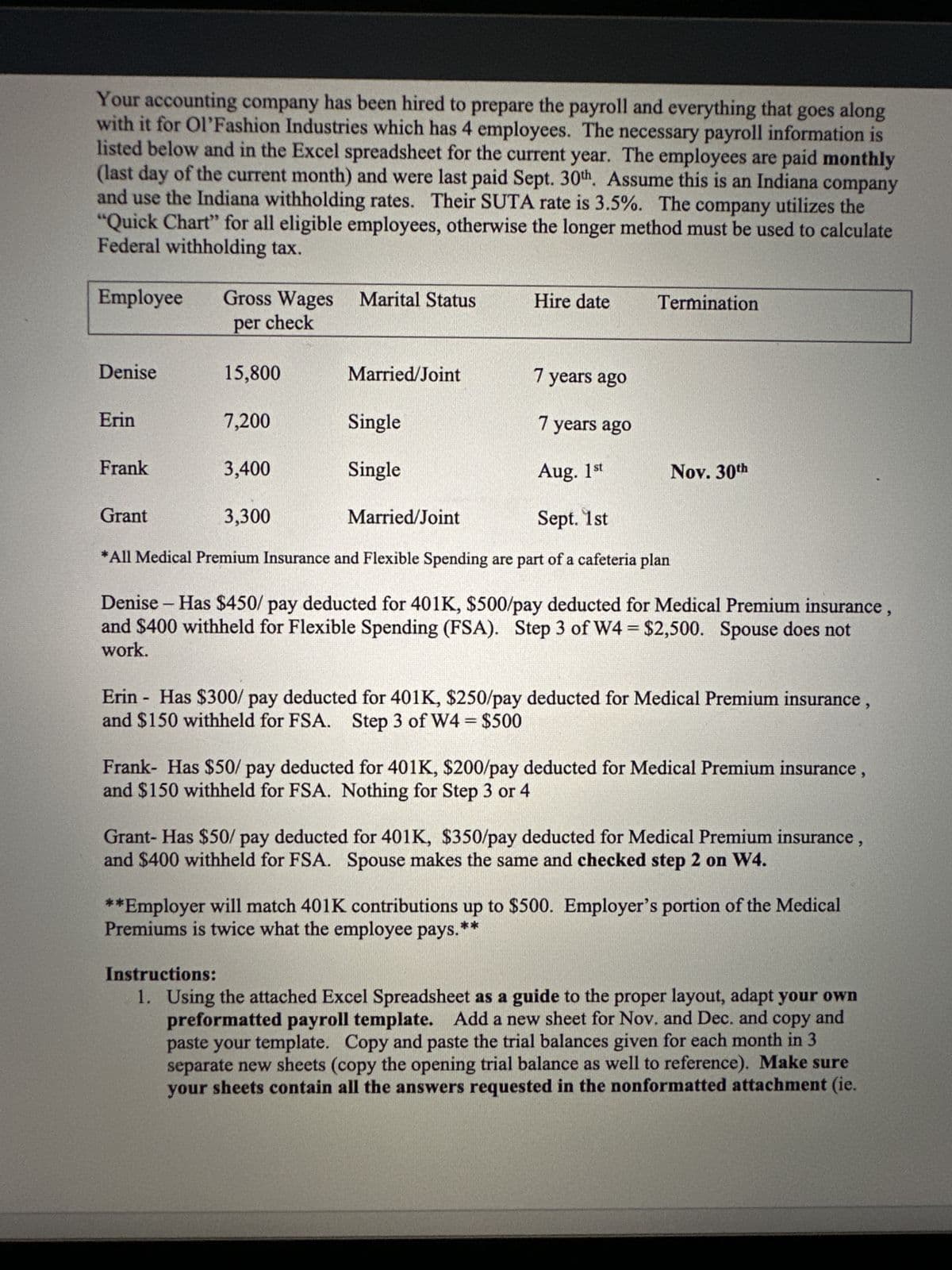

Transcribed Image Text:Your accounting company has been hired to prepare the payroll and everything that goes along

with it for Ol'Fashion Industries which has 4 employees. The necessary payroll information is

listed below and in the Excel spreadsheet for the current year. The employees are paid monthly

(last day of the current month) and were last paid Sept. 30th. Assume this is an Indiana company

and use the Indiana withholding rates. Their SUTA rate is 3.5%. The company utilizes the

"Quick Chart" for all eligible employees, otherwise the longer method must be used to calculate

Federal withholding tax.

Employee

Gross Wages

per check

Marital Status

Hire date

Termination

Denise

15,800

Married/Joint

7 years ago

Erin

7,200

Single

7 years ago

Frank

3,400

Single

Aug. 1st

Nov. 30th

Grant

3,300

Married/Joint

Sept. 1st

*All Medical Premium Insurance and Flexible Spending are part of a cafeteria plan

Denise - Has $450/ pay deducted for 401K, $500/pay deducted for Medical Premium insurance

and $400 withheld for Flexible Spending (FSA). Step 3 of W4 = $2,500. Spouse does not

work.

Erin - Has $300/ pay deducted for 401K, $250/pay deducted for Medical Premium insurance

and $150 withheld for FSA. Step 3 of W4 = $500

Frank- Has $50/ pay deducted for 401K, $200/pay deducted for Medical Premium insurance

and $150 withheld for FSA. Nothing for Step 3 or 4

Grant- Has $50/ pay deducted for 401K, $350/pay deducted for Medical Premium insurance

and $400 withheld for FSA. Spouse makes the same and checked step 2 on W4.

**Employer will match 401K contributions up to $500. Employer's portion of the Medical

Premiums is twice what the employee pays.**

Instructions:

1. Using the attached Excel Spreadsheet as a guide to the proper layout, adapt your own

preformatted payroll template. Add a new sheet for Nov. and Dec. and copy and

paste your template. Copy and paste the trial balances given for each month in 3

separate new sheets (copy the opening trial balance as well to reference). Make sure

your sheets contain all the answers requested in the nonformatted attachment (ie.

5

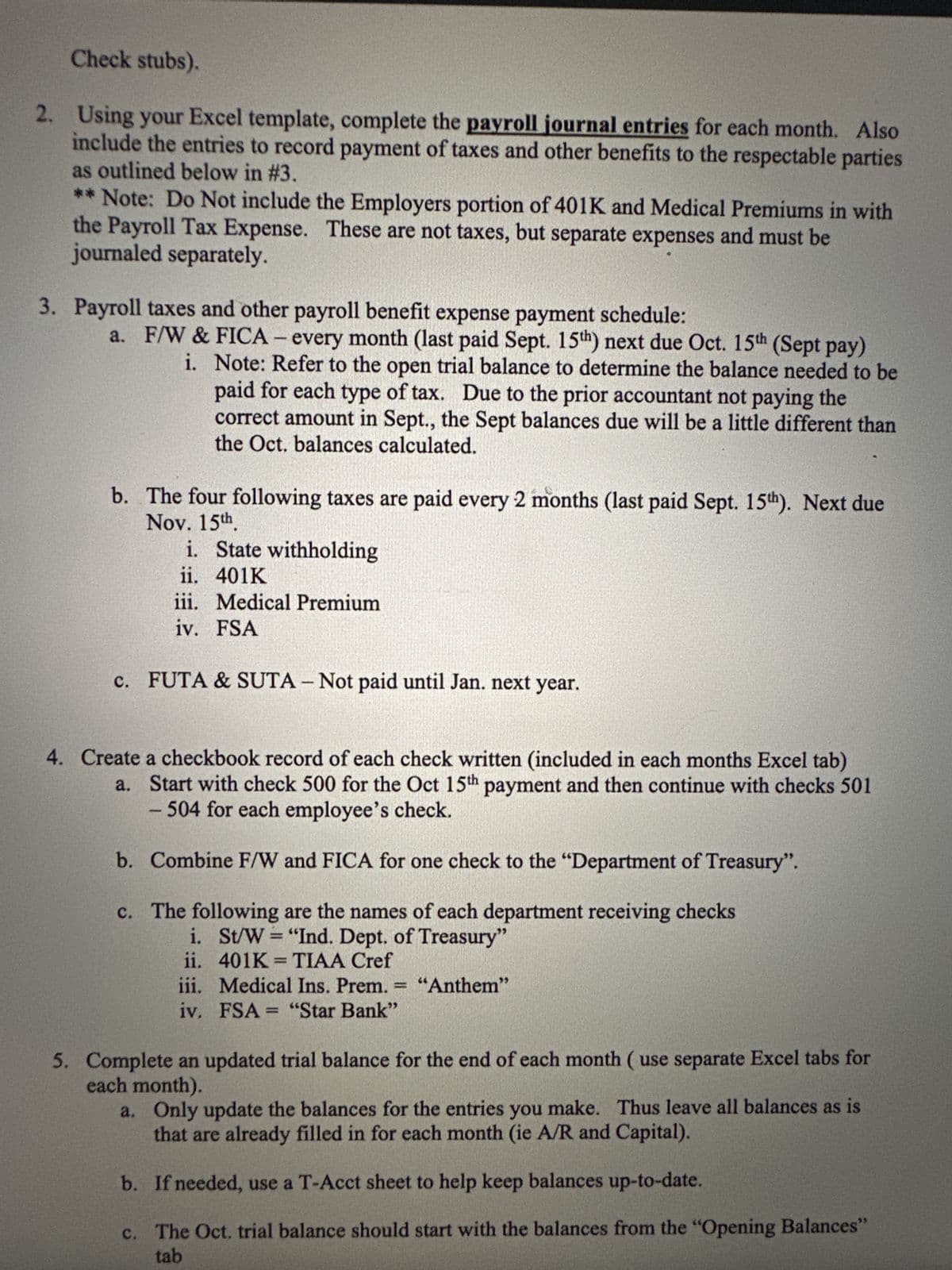

Transcribed Image Text:Your accounting company has been hired to prepare the payroll and everything that goes along

with it for Ol'Fashion Industries which has 4 employees. The necessary payroll information is

listed below and in the Excel spreadsheet for the current year. The employees are paid monthly

(last day of the current month) and were last paid Sept. 30th. Assume this is an Indiana company

and use the Indiana withholding rates. Their SUTA rate is 3.5%. The company utilizes the

"Quick Chart" for all eligible employees, otherwise the longer method must be used to calculate

Federal withholding tax.

Employee

Gross Wages

per check

Marital Status

Hire date

Termination

Denise

15,800

Married/Joint

7 years ago

Erin

7,200

Single

7 years ago

Frank

3,400

Single

Aug. 1st

Nov. 30th

Grant

3,300

Married/Joint

Sept. 1st

*All Medical Premium Insurance and Flexible Spending are part of a cafeteria plan

Denise - Has $450/ pay deducted for 401K, $500/pay deducted for Medical Premium insurance

and $400 withheld for Flexible Spending (FSA). Step 3 of W4 = $2,500. Spouse does not

work.

Erin - Has $300/ pay deducted for 401K, $250/pay deducted for Medical Premium insurance

and $150 withheld for FSA. Step 3 of W4 = $500

Frank- Has $50/ pay deducted for 401K, $200/pay deducted for Medical Premium insurance

and $150 withheld for FSA. Nothing for Step 3 or 4

Grant- Has $50/ pay deducted for 401K, $350/pay deducted for Medical Premium insurance

and $400 withheld for FSA. Spouse makes the same and checked step 2 on W4.

**Employer will match 401K contributions up to $500. Employer's portion of the Medical

Premiums is twice what the employee pays.**

Instructions:

1. Using the attached Excel Spreadsheet as a guide to the proper layout, adapt your own

preformatted payroll template. Add a new sheet for Nov. and Dec. and copy and

paste your template. Copy and paste the trial balances given for each month in 3

separate new sheets (copy the opening trial balance as well to reference). Make sure

your sheets contain all the answers requested in the nonformatted attachment (ie.

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning