FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

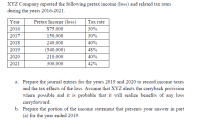

Transcribed Image Text:XYZ Company reported the following pretax income (loss) and related tax rates

during the years 2016-2021.

Year

Pretax Income (loss)

Таx rate

2016

$75,000

30%

2017

150,000

30%

2018

240,000

40%

2019

(540,000)

48%

2020

210,000

40%

2021

300,000

42%

a. Prepare the journal entries for the years 2019 and 2020 to record income taxes

and the tax effects of the loss. Assume that XYZ elects the carryback provision

where possible and it is probable that it will realize benefits of any loss

carryforward.

b. Prepare the portion of the income statement that presents your answer in part

(a) for the year ended 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Now assume that Syer does account for its NOL under the CARES Act. Prepare the appropriate journal entry to record Syer’s 2020 income taxes, and indicate Syer’s 2020 net income(loss). Syer Company reports net operating income (loss) for financial reporting and tax purposes in each year as follows ($ in millions): 2016 2017 2018 2019 2020 $ 330) $ 130 $ 0 $0 $ (660) Syer’s 2020 NOL is driven by an unfortunate obsolescence of its primary product. Given great uncertainty in Syer’s future profitability, Syer’s management does not believe it is more likely than not that it will be able to realize deferred tax assets in future years. Syer’s federal tax rate decreased from 35% to 21% starting in 2018.arrow_forwardMusic Media Ltd. prepares statements quarterly. Port Ai Required: 1. Based on 2019 results, Music's estimated tax liability for 2020 is $303,960. Music will accrue 1/18 of this amount at the end of each month (assume the installments are paid the next day) Prepare the entry on January 31, 2020, to accrue the tax liability and on February 1 to record the payment. View transaction list Journal entry worksheet 1arrow_forwardThe pretax financial income (or loss) figures for Shamrock Company are as follows. 2017 81,000 2018 (51,000 ) 2019 (35,000 ) 2020 111,000 2021 95,000 Pretax financial income (or loss) and taxable income (loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years.Prepare the journal entries for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforwards. All income and losses relate to normal operations. (In recording the benefits of a loss carryforward, assume that no valuation account is deemed necessary.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit 2017 enter an account title to record carryback enter a debit amount enter a…arrow_forward

- Cullumber Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.75 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal installments in 2025 and 2026. The related deferred tax liability at the beginning of the year is $1,125,000. In the third quarter of 2024, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2026. Taxable income for 2024 is $6,250,000, and taxable income is expected in all future years.arrow_forwardNovak Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 20 % 2019 20 % 2020 25 % 2021 25 % $123,000 98,000 (105,000) 110,000 The tax rates listed were all enacted by the beginning of 2018.arrow_forwardHow much is the restated balance of AMSTERDAM's retained earnings account at January 1, 2021?arrow_forward

- Delta has interest receivable which has a carrying amount of $75,000 in its statement of financial position at 31 December 2020. The related interest revenue will be taxed on a cash basis in 2021. Delta has trade receivables that have a carrying amount of $105,000 in its statement of financial position at 31 December 2020. The related revenue has been included in its statement of profit or loss for the year to 31 December 2020. Required: According to HKAS 12 ‘Income Taxes’, what is the total tax base of interest receivable and trade receivables for Delta at 31 December 2020? A. $105,000 B. $75,000 C. Nil D. $180,000arrow_forwardAt the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.arrow_forwardBonita Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $124,000 20 % 2019 86,000 20 % 2020 (89,000 ) 25 % 2021 126,000 25 % The tax rates listed were all enacted by the beginning of 2018. Prepare the journal entries for years 2018-2021 to record income tax expense (benefit) and income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-half of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

- A company reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year Pretax Income (Loss) Tax Rate 2018 $138,000 18% 2019 81,000 18 2020 (258,700) 21 2021 303,200 21 Assuming that the company can carryforward its 2020 net operating loss, what is the amount of deferred tax asset the company would report at the end of 2020 related to this loss carryforward?arrow_forwardBalance Sheet Presentation Thiel Company reports the following deferred tax items at the end of 2019: Deferred TaxItem # AccountBalance Related Asset or LiabilityCreating the Deferred Tax Item 1 $6,700 debit Current asset 2 7,200 credit Current liability 3 10,600 debit Noncurrent asset 4 15,500 credit Noncurrent liability Required: Show how the preceding deferred tax items are reported on Thiel's December 31, 2019, balance sheet. THIEL COMPANYBalance Sheet (Tax Items)December 31, 2019 Noncurrent Liabilities Deferred Tax asset or liability $arrow_forwardA company reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year Pretax Income (Loss) Tax Rate 2018 $167,000 18% 2019 56,000 18 2020 (579,300) 23 2021 320,100 27 2022 580,700 31 Assuming that the company can carryforward its 2020 net operating loss, what is the amount of deferred tax asset the company would report at the end of 2020 related to this loss carryforward?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education