FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

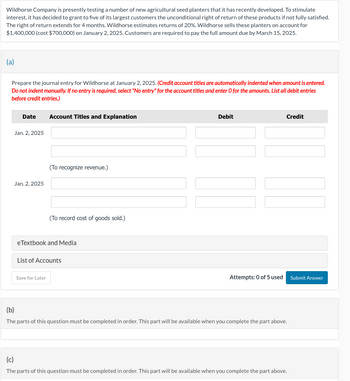

Transcribed Image Text:Wildhorse Company is presently testing a number of new agricultural seed planters that it has recently developed. To stimulate

interest, it has decided to grant to five of its largest customers the unconditional right of return of these products if not fully satisfied.

The right of return extends for 4 months. Wildhorse estimates returns of 20%. Wildhorse sells these planters on account for

$1,400,000 (cost $700,000) on January 2, 2025. Customers are required to pay the full amount due by March 15, 2025.

(a)

Prepare the journal entry for Wildhorse at January 2, 2025. (Credit account titles are automatically indented when amount is entered.

Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries

before credit entries.)

Date Account Titles and Explanation

Jan. 2, 2025

Jan. 2, 2025

(To recognize revenue.)

(To record cost of goods sold.)

eTextbook and Media

Save for Later

List of Accounts

Debit

Attempts: 0 of 5 used

Credit

(b)

The parts of this question must be completed in order. This part will be available when you complete the part above.

(c)

The parts of this question must be completed in order. This part will be available when you complete the part above.

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- New Style Corporation is a company that manufactures and sells chairs. On 1/1/20, the company purchases a piece of manufacturing equipment for $3,100,000 cash. The expected residual value is $200,000 and the useful life is 5 years. The company expects to produce 5,000,000 chairs with the equipment – 1,200,000 chairs in 2020; 1,400,000 chairs in 2021; 1,000,000 chairs in 2022; and 600,000 chairs 2023; and 800,000 chairs in 2024. Show your work. Round per unit to the nearest cent. Assume that New Style Corporation uses the Units-of-Activity method of depreciation.arrow_forwardWildhorse Company manufactures a check-in kiosk with an estimated economic life of 10 years and leases it to Sheffield Chicken for a period of 9 years. The normal selling price of the equipment is $172,124, and its unguaranteed residual value at the end of the lease term is estimated to be $26,200. Sheffield will pay annual payments of $20,800 at the beginning of each year. Wildhorse incurred costs of $141,100 in manufacturing the equipment and $2,400 in sales commissions in closing the lease. Wildhorse has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sheffield Chicken has an incremental borrowing rate of 5%. The lessor's implicit rate is unknown to the lessee.arrow_forwardOn January 3, 2020, Gagne Inc. paid $320,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $2,500, $6,400 sales tax, and $21,100 for special installation. Management estimates that the computer will remain in service for five years and have a residual value of $20,000. The computer will process 50,000 documents the first year, decreasing annually by 5,000 during each of the next four years (that is 45,000 documents in 2021, 40,000 documents is 2022, and so on). In trying to decide which depreciation method to use, the company president has requested a depreciation schedule for each of three depreciation methods (straight-line, units-of-production, and double-diminishing-balance). Before completing the straight-line depreciation schedule, calculate the straight-line depreciation rate. First, select the labels for the formula and then compute the rate. (Round the rate to two decimal places.) Date January 3, 2020 December 31, 2020 December…arrow_forward

- Benford Inc. is planning to open a new sporting goods store in a suburban mall. Benford will lease the needed space in the mall. Equipment and fixtures for the store will cost $450,000 and be depreciated to $0 over a 5-year period on a straight-line basis. The new store will require Benford to increase its net working capital by $450,000 at time 0.First-year sales are expected to be $1.05 million and to increase at an annual rate of 8 percent over the expected 10-year life of the store. Operating expenses (including lease payments but excluding depreciation) are projected to be $850,000 during the first year and to increase at a 7 percent annual rate. The salvage value of the store’s equipment and fixtures is anticipated to be $13,000 at the end of 10 years. Benford’s marginal tax rate is 40 percent. Calculate the store’s net present value, using an 18 percent required return. Use Table II to answer the question. Round your answer to the nearest dollar.$ Should Benford accept the…arrow_forwardThe Wildcat Oil Company is trying to decide whether to lease or buy a new computer-assisted drilling system for its oil exploration business. Management has decided that it must use the system to stay competitive; it will provide $1.9 million in annual pretax cost savings. The system costs $7.7 million and will be depreciated straight-line to zero over five years. Wildcat's tax rate is 21 percent, and the firm can borrow at 6 percent. Lambert Leasing Company is willing to lease the equipment to Wildcat. Lambert's policy is to require its lessees to make payments at the start of the year. Suppose it is estimated that the equipment will have an aftertax residual value of $650,000 at the end of the lease. What is the maximum lease payment acceptable to Wildcat? (Do not round intermediate calculations and enter yuor answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) Maximum lease payment $ 1,114,590.00arrow_forwardSolar Shade Inc. currently sells 40,000 basic solar shade devices per year at $60,000 each, and 16,800 custom-made solar shade devices per year at $150,000 each. The company wants to introduce a new portable solar shade to fill out its product line; it hopes to sell 26,000 of these per year at $16,000 each. An independent consultant has determined that if the company introduces the new solar shades, it should boost the sales of its basic solar shades by 6,000 units per year, and reduce the sales of custom-made solar shades by 1,200 units per year. What is the amount to use as the annual sales figure when evaluating this project?arrow_forward

- Global Lawn, a manufacturer of lawn mowers, predicts that it will purchase 228,000 spark plugs next year. Global Lawn estimates that 19,000 spark plugs will be required each month. A supplier quotes a price of $11.00 per spark plug. The supplier also offers a special discount option: If all 228,000 spark plugs are purchased at the start of the year, a discount of 4% off the $11.00 price will be given. Global Lawn can invest its cash at 10% per year. It costs Global Lawn $260 to place each purchase order. Read the requirements. Requireme Let's begin t Differer Requirements 1. What is the opportunity cost of interest forgone from purchasing all 228,000 units at the start of the year instead of in 12 monthly purchases of 19,000 units per order? C---- 2. Would this opportunity cost be recorded in the accounting system? Why? 3. Should Global Lawn purchase 228,000 units at the start of the year or 19,000 units each month? Show your calculations. 4. What other factors should Global Lawn…arrow_forwardTeal Company is presently testing a number of new agricultural seed planters that it has recently developed. To stimulate interest, it has decided to grant to five of its largest customers the unconditional right of return to these products if not fully satisfied. The right of return extends for 4 months. Teal estimates returns of 20%. Teal sells these planters on account for $1,500,000 (cost $825,000) on January 2, 2020. Customers are required to pay the full amount due by March 15, 2020. (a) Prepare the journal entry for Teal at January 2, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2, 2020 (To recognize revenue.) (To record cost of goods sold.) eTextbook and Mediaarrow_forwardYummy Rice Cereal started a program at the beginning of 2024 in which it would provide an all-star bowl in exchange for four proof-of-purchase box tops. Yummy Rice estimates that 25% of box tops will be redeemed. The bowls cost Yummy Rice $1.10 each. In 2024, 5,240,000 boxes of cereal were sold. By year- end 906,000 box tops had been redeemed. Required: Calculate the premium expense that Yummy Rice should recognize for the year ended December 31, 2024.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education