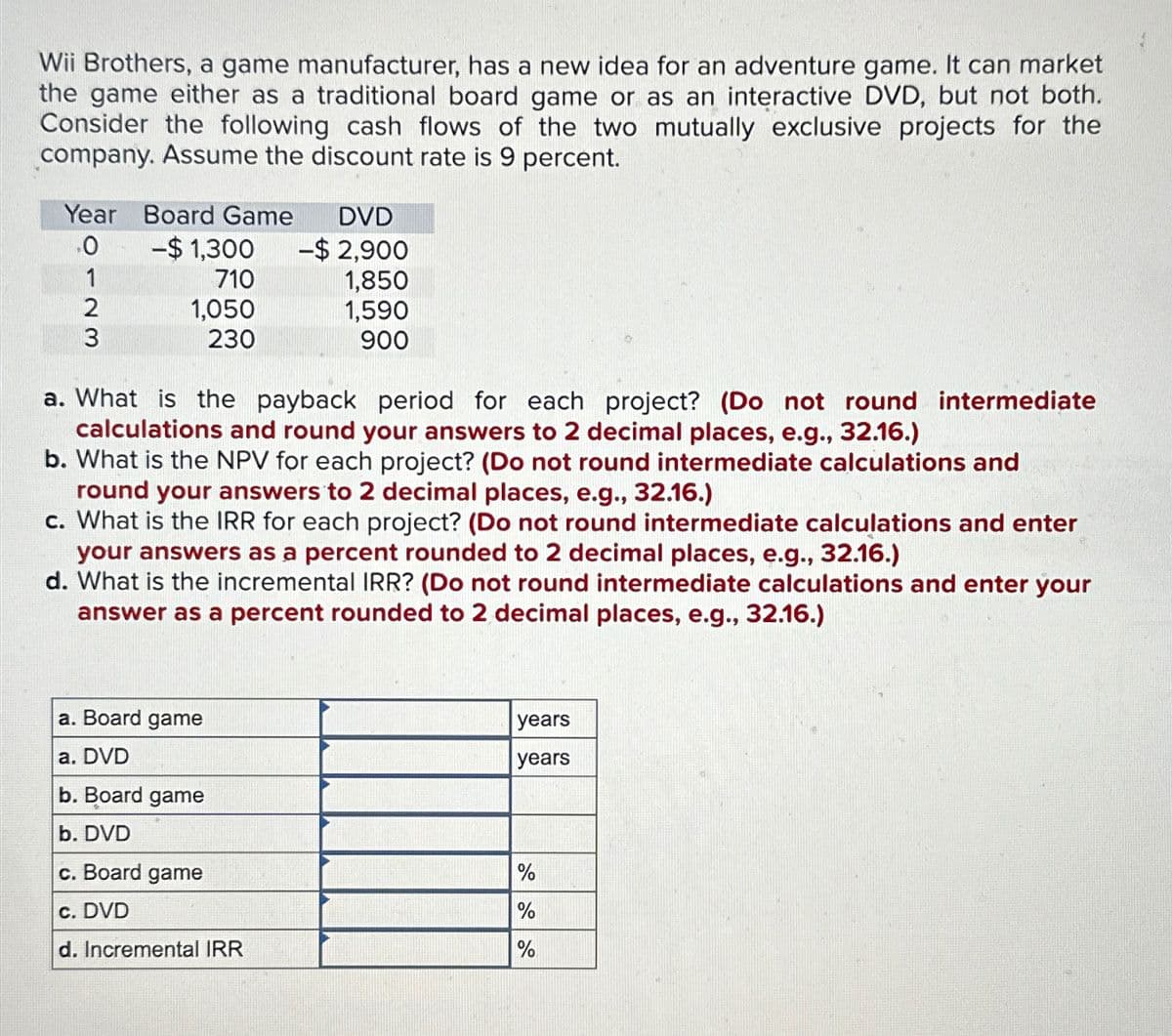

Wii Brothers, a game manufacturer, has a new idea for an adventure game. It can market the game either as a traditional board game or as an interactive DVD, but not both. Consider the following cash flows of the two mutually exclusive projects for the company. Assume the discount rate is 9 percent. Year Board Game DVD .0 -$1,300 -$ 2,900 1 710 1,850 2 1,050 1,590 3 230 900 a. What is the payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) d. What is the incremental IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Board game a. DVD b. Board game b. DVD c. Board game c. DVD d. Incremental IRR years years % % %

Wii Brothers, a game manufacturer, has a new idea for an adventure game. It can market the game either as a traditional board game or as an interactive DVD, but not both. Consider the following cash flows of the two mutually exclusive projects for the company. Assume the discount rate is 9 percent. Year Board Game DVD .0 -$1,300 -$ 2,900 1 710 1,850 2 1,050 1,590 3 230 900 a. What is the payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) d. What is the incremental IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Board game a. DVD b. Board game b. DVD c. Board game c. DVD d. Incremental IRR years years % % %

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 9E: Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required:...

Related questions

Question

Wii Brothers, a game manufacturer, has a new idea for an adventure game. It can market the game either as a traditional board game or as an interactive DVD, but not both. Consider the following cash flows of the two mutually exclusive projects for the company. Assume the discount rate is 9 percent. \table[[Year,Board Game,DVD],[0,-$1,300,-$2,900

Transcribed Image Text:Wii Brothers, a game manufacturer, has a new idea for an adventure game. It can market

the game either as a traditional board game or as an interactive DVD, but not both.

Consider the following cash flows of the two mutually exclusive projects for the

company. Assume the discount rate is 9 percent.

Year Board Game

DVD

0

-$1,300

-$ 2,900

1

710

1,850

2

1,050

1,590

3

230

900

a. What is the payback period for each project? (Do not round intermediate

calculations and round your answers to 2 decimal places, e.g., 32.16.)

b. What is the NPV for each project? (Do not round intermediate calculations and

round your answers to 2 decimal places, e.g., 32.16.)

c. What is the IRR for each project? (Do not round intermediate calculations and enter

your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

d. What is the incremental IRR? (Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. Board game

a. DVD

b. Board game

b. DVD

c. Board game

c. DVD

d. Incremental IRR

years

years

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning