What is one of the core features of a defined benefit pension plan? Acronyms Calculator A. B. C. The current contribution limits are designed to provide employees with a maximum pension of 2% of pre-retirement earnings per year of service. The combined employer and employee contributions are deductible up to 18% of the employee's current year compensation. The retirement benefit amount is predetermined based on a formula that equally weights years of service and income level. D. The employee's current service contributions are limited to 9% o for the year. This page requires scrolling Next Ou When reviewing the capital structure of a firm, what could an analyst observe that might indicate a potential increase in common shares outstanding? Acronyms Calculator A. An issuance of retractable debentures. B. An increase in paid-up capital. C. A rapidly growing retained earnings account. D. A new issuance of convertible preferreds.

What is one of the core features of a defined benefit pension plan? Acronyms Calculator A. B. C. The current contribution limits are designed to provide employees with a maximum pension of 2% of pre-retirement earnings per year of service. The combined employer and employee contributions are deductible up to 18% of the employee's current year compensation. The retirement benefit amount is predetermined based on a formula that equally weights years of service and income level. D. The employee's current service contributions are limited to 9% o for the year. This page requires scrolling Next Ou When reviewing the capital structure of a firm, what could an analyst observe that might indicate a potential increase in common shares outstanding? Acronyms Calculator A. An issuance of retractable debentures. B. An increase in paid-up capital. C. A rapidly growing retained earnings account. D. A new issuance of convertible preferreds.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter9: Auditing The Revenue Cycle.

Section: Chapter Questions

Problem 26CYBK

Related questions

Question

PLS HELP ASAP

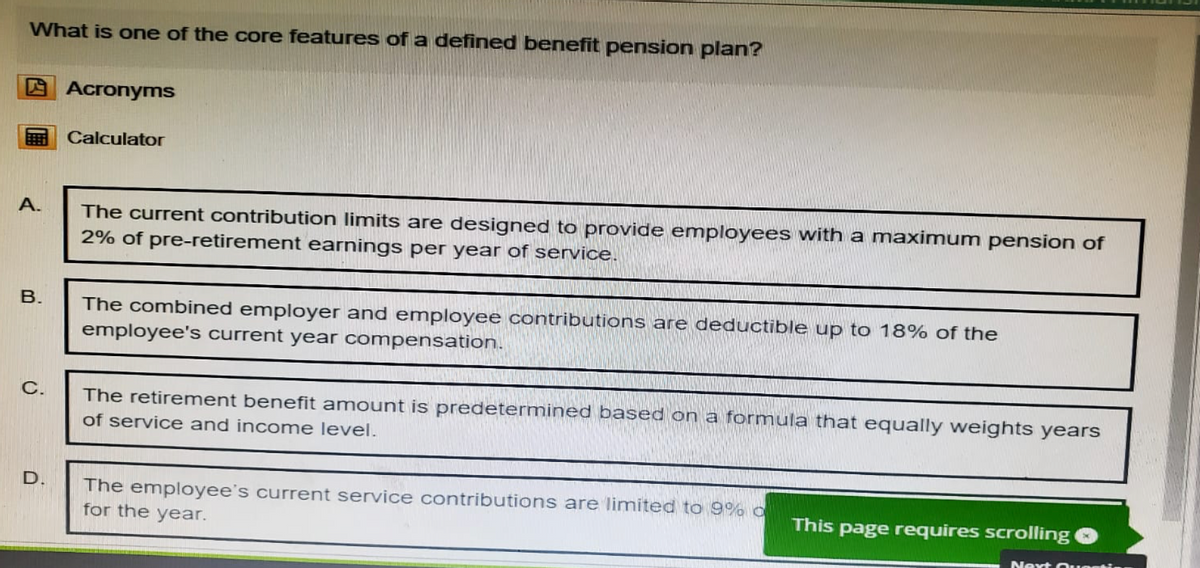

Transcribed Image Text:What is one of the core features of a defined benefit pension plan?

Acronyms

Calculator

A.

B.

C.

The current contribution limits are designed to provide employees with a maximum pension of

2% of pre-retirement earnings per year of service.

The combined employer and employee contributions are deductible up to 18% of the

employee's current year compensation.

The retirement benefit amount is predetermined based on a formula that equally weights years

of service and income level.

D.

The employee's current service contributions are limited to 9% o

for the year.

This page requires scrolling

Next Ou

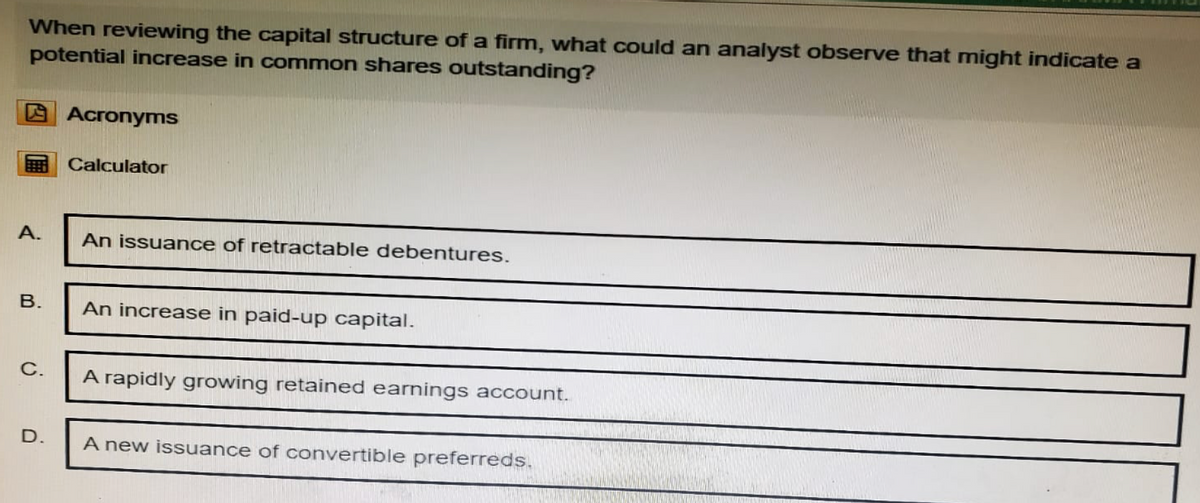

Transcribed Image Text:When reviewing the capital structure of a firm, what could an analyst observe that might indicate a

potential increase in common shares outstanding?

Acronyms

Calculator

A.

An issuance of retractable debentures.

B.

An increase in paid-up capital.

C.

A rapidly growing retained earnings account.

D.

A new issuance of convertible preferreds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning