FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

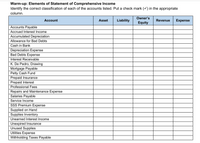

Transcribed Image Text:Warm-up: Elements of Statement of Comprehensive Income

Identify the correct classification of each of the accounts listed. Put a check mark (v) in the appropriate

column.

Owner's

Account

Asset

Liability

Revenue

Expense

Equity

Accounts Payable

Accrued Interest Income

Accumulated Depreciation

Allowance for Bad Debts

Cash in Bank

Depreciation Expense

Bad Debts Expense

Interest Receivable

K. De Pedro, Drawing

Mortgage Payable

Petty Cash Fund

Prepaid Insurance

Prepaid Interest

Professional Fees

Repairs and Maintenance Expense

Salaries Payable

Service Income

SSS Premium Expense

Supplied on Hand

Supplies Inventory

Unearned Interest Income

Unexpired Insurance

Unused Supplies

Utilities Expense

Withholding Taxes Payable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Classify each as an asset, liability, cash inflow, or cash outflow:arrow_forwardRecorded credit sales. Select the accounts) that would be debited and credited when recording the above transaction. If a second debit or credit does not apply, select "None" as a match. Debit = ? Credit = ? Options: Note Payable Accounts Receivable Salaries Expense Supplies Paid in Capital Common Stock Sales Revenue Salaries Payable Prepaid Insurance Unearned Revenue Cash Interest Expense Insurance Expense Supplies Expense Common Stock Equipment Accounts Payable Note Receivablearrow_forwardPaid interest expense on Note recorded previously (above). Select the account(s) that would be debited and credited when recording the above transaction. If a second debit or credit does not apply, select "None" as a match. Debit Debit Credit Credit Interest Expense Interest Payable Interest Payable Casharrow_forward

- Analyze each transaction and match it with the correct journal entry as stated. Be sure to look at each transaction carefully to ensure you make the correct choice. Purchase on account some office equipment Paid for utilities expense Paid the bank back the money previously borrowed on a note Paid the telephone bill received Made a partial payment to a creditor on account Took cash out of the business to pay for a personal bill Record revenues earned, but not collected yet Record internet expenses incurred, but not paid yet Received cash for the return of some equipment that was defective Received Payment from customer on an accounts receivable Made payment to an accounts payable Paid salary for office administrator Dr. Office Equipment; Cr. Acc Dr. Utilities Expense; Cr. Casl Dr. Accounts Payable; Cr. Cas Dr. Telephone Expense; Cr. C✓ Dr. Cash; Cr. Account Receivi Dr. Accounts Payable; Cr. Ca: ✓ Dr. Internet Expense; Cr. Acc Dr. Internet Expense; Cr. Acc Dr. Cash; Cr. Account Receiv:…arrow_forwardWhat is the total liabilities, please break down.arrow_forwardFill the table as per Format only.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education