FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Ward

Feb. 1

6,300

1,355

Required:

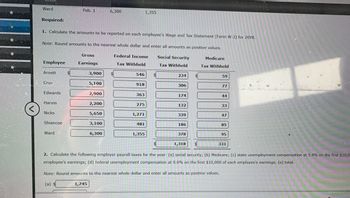

1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form W-2) for 2018.

Note: Round amounts to the nearest whole dollar and enter all amounts as positive values.

Employee

Gross

Earnings

Federal Income

Social Security

Medicare

Tax Withheld

Tax Withheld

Tax Withheld

Arnett

3,900

546

234

$

59

Cruz

5,100

918

306

77

Edwards

2,900

363

174

44

Harvin

2,200

275

132

33

<

Nicks

5,650

1,271

339

47

Shiancoe

3,100

481

186

85

Ward

6,300

1,355

378

95

$

1,318

331

2. Calculate the following employer payroll taxes for the year: (a) social security; (b) Medicare; (c) state unemployment compensation at 5.4% on the first $10,0

employee's earnings; (d) federal unemployment compensation at 0.6% on the first $10,000 of each employee's earnings; (e) total.

Note: Round amounts to the nearest whole dollar and enter all amounts as positive values.

(a) $

1,745

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Exhibit 6-1The totals from the first payroll of the year are shown below. Total Earnings FICA OASDI FICA HI FIT W/H State Tax Union Dues Net Pay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Refer to Exhibit 6-1. Journalize the entry to deposit the FICA and FIT taxes.arrow_forwardFUTA Tax Payable, $84 SUTA Tax Payable, $414 Federal Income Tax Payable, $4,622 Instructions 1. Journalize the payment of the social security, medicare, and federal income tax on April 15. 2. Journalize the payment the FUTA tax on April 28. 3 Journalize the payment the SUTA tax on April 28. Since these are paid to different taxing authorities, they're typically done as separate journal entries. Think carefully about each journal entry. You have tax liability. Now you're paying that liability. It's just like paying any other bill, except you have several "payable" accounts. Date Debit Creditarrow_forwardplease do not give image formatarrow_forward

- Amounts to Be Reported on Wage and Tax Statements (Form W-2) Gross Federal Income Social Security Medicare Employee Earnings Tax Withheld Tax Withheld Tax Withheld Arnett $ 8,250.00 $ 1,416.00 $ 495.00 $ 123.75 Cruz 57,600.00 9,996.00 3,456.00 864.00 Edwards 24,000.00 4,776.00 1,440.00 360.00 Harvin 6,000.00 1,070.00 360.00 90.00 Nicks 110,000.00 25,850.00 6,600.00 1,650.00 Shiancoe 116,000.00 26,000.00 6,960.00 1,740.00 Ward 7,830.00 1,314.00 469.80 117.45 Totals $ 329,680.00 $ 19,780.80 $ 4,945.20 Employer Payroll Taxes a. Social security…arrow_forwardon 4 An employee has total gross wages of $7,000, Federal Unemployment Expense, and State Unemployment Expense. What is the correct journal entry for the employer's payroll taxes and otl expenses? Debit Crédit $535.50 $420.00 FICA Expenses Federal Unemployment Expense State Unemployment $378.00 Expense FICA Payable Federal Unemployment Expense State Unemployment Expense $535.50 $420.00 $378.00 Debit Credit FICA Expenses Federal Unemployment $535.50 $420.00 Expense State Unemployment Expense $378.00 Cash $1,333.50 Debit Credit FICA Payable Federal Unemployment $535.50 $420.00 Expense State Unemployment Payable FICA Expenses Federal Unemployment Expense State Unemployment Expense $378.00 $535.50 $420.00 $378.00 MacBook Airarrow_forwardNeeding some help.arrow_forward

- Exhibit 6-1 The totals from the first payroll of the year are shown below. Total Earnings $36,195.10 FICA OASDI $2,244.10 FICA НІ $524.83 FIT W/H $6,515.00 State Tax $361.95 Refer to Exhibit 6-1. Journalize the entry to record the employer's payroll taxes (assume a SUTA rate of 3.7%). Union Dues $500.00 Net Pay $26,049.22arrow_forwardUse 2020 wage-bracket tablesarrow_forwardPractice Set A 151 PSa 4-3 Calculate Medicare Tax ch of the following employees, calculate the Medicare tax for the weekly pay period described: 1 Paul Robinson's filing status is married filing jointly, and he has earned gross pay of $2,650. Each period he makes a 403(b) contribution of 8% of gross pay. His current year taxable earnings for Medicare tax, to date, are $274,000. 2. Stephen Belcher's filing status is single, and he has earned gross pay of $1,840. Each period he makes a 401(k) contribution of 6% of gross pay and contributes 3% of gross pay to a dependent care flexible spending plan. His current year taxable earnings for Medicare tax, to date, are $198,950. 3. Sidney Black's filing status is head of household, and he has earned gross pay of $970. Each period he contributes $50 to a flexible spending plan. His current year taxable earnings for Medicare tax, to date, are $86,400. 4. Bill Clay's filing status is married filing separately, and he has earned gross pay of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education