Q: Bl Inc currently has earnings before interest and taxes of P3,000,000, a degree of combined leverage…

A: The degree of operating leverage can be used to estimate change in operating income with respect to…

Q: A firm has a total market value of $10 million while its debt has a market value of $4 million. What…

A: Total market value = $10 million Debt = $4 million Equity = $6 million (i.e. $10 million - $4…

Q: An A firm has sales of $10 million, variable costs of $4 million, fixed expenses of $1.5 million,…

A: 1) Computation of DOL, DFL, DCL is as follows:DOL=Sales -Variable costSales -variable cost-fixed…

Q: What is Walkeshewar's WACC if it's equity costs 11.8 percent, the cost of it's debt is 6.3 percent,…

A: WACC (weighted average cost of capital) refers to the average cost that is paid by a company to…

Q: Vapor Lock Motors’ EBIT is $7,000,000, the company’s interest expense is $2,000,000, and its tax…

A: DFL means how much the earnings of a firm change due to change in the debt-equity ratio of the firm.…

Q: Last year the Rondoelea Products Company had $142 million in annual sales and a net profit margin…

A: EBIT = [ (Sales x net profit margin) / (1 - tax rate) ] + (Amount of debt * Interest rate) EBIT =…

Q: Sixx AM Manufacturing has a target debt-equity ratio of 0.7. Its cost of equity is 17 percent, and…

A: WACC = Weight of debt * Cost of debt + Weight of equity * Cost of equity Cost of debt = Cost * ( 1 -…

Q: It is known that a firm’s Net Operating Profit After Tax (NOPAT) is $58,000 and its Economic Value…

A: We need to use EVA equation below to calculate WACC EVA =Net Operating Profit After Tax (NOPAT)…

Q: A company has $20 billion of sales and $1 billion of net income. Its total assets are $10 billion.…

A: Net income = $1 billion Sales = $20 billion Total assets = $10 billion Total invested capital =…

Q: (a) An MNC has total assets of $150 million and debt of $50 million. firm's before-tax cost of debt…

A: Weighted average cost of capital is the weighted cost of debt and weighted cost of equity and is…

Q: Fama's Llamas has a weighted average cost of capital of 10 percent. The company's cost of equity is…

A: Debt-Equity Ratio is long-term solvency ratio of company. It is calculated by dividing debt by…

Q: Petra plc. has a current and target leverage ratio of 0.8, the finance cost from loans is 16 per…

A: Weighted cost of capital: It can be defined as the rate that is paid by the company on the average…

Q: GTB, Inc. has a 25 percent tax rate and has $67.92 million in assets, currently financed entirely…

A: The cost of debt is 9%.The weight of debt in capital structure is 25%. So, the value of debt must be…

Q: Al-Shamukh Constructors Ltd. currently has sales of OMR 24 million a year, with a stock level of 25…

A: Cost of stock levels = Sales × given paercentage=OMR 24 million × 25%=OMR 6 million Operating…

Q: Parker Investments has EBIT of $20,000, interest expense of $3,000, and preferred dividends of…

A: Financial leverage is a concept that refers to financing the purchase of assets with the borrowed…

Q: McMichael, Inc has expected sales of $40 million. Fixed operating cost is $5 million and the…

A: 1) Computation:

Q: Suppose that TW, Inc. has a capital structure of 25 percent equity, 15 percent preferred stock, and…

A: Weighted Average Cost of Capital (WACC) is the overall cost of capital from all the sources of…

Q: Tomeco Co. has a WACC of 12 percent. Its debt sells at a yield to maturity of 6 percent, and its tax…

A: Equity to total asset ratio is the financial tool to determine the value of asset that the…

Q: Hartman Motors has $18 million in assets, which were financed with$6 million of debt and $12 million…

A: Formula: Beta(levered) = Beta(unlevered) * [1 + {(1 -tax rate)*(Debt /Equity)}]

Q: The H.R. Pickett Corp. has $500,000 of debt outstanding, and it pays an annual interest rate of 10%.…

A: The times earned interest ratio is comparing the earnings before interest and taxes to interest…

Q: PBB Company has a net operating income of $15 million. Further, the company has $100 million of debt…

A: Value of a company is summation of value of equity and value of debt where value of equity can be…

Q: The cost of capital is 15%, the before-tax cost of debt is 9%, and the mar-ginal income tax rate is…

A: The cost of capital is the cost of raising funds a firm has to bear. It is the weighted average cost…

Q: Suppose that TapDance, Inc.’s capital structure features 70 percent equity, 30 percent debt, and…

A: To calculate the WACC we will use the below formula WACC = [Kd*(1-t)*Wd]+[Ke*We] Where Kd - Before…

Q: A firm has a tax burden ratio of .75, a leverage ratio of 1.25, an interest burden of .6, and a…

A: Formula:

Q: Suppose a firm has $10 million in debt that it expects to hold in perpetuity. It the interest rate…

A: The following information has bee provided in the question: Amount of debt= $10 million Interest…

Q: Suppose that TapDance, Inc.'s capital structure features 60 percent equity, 40 percent debt, and…

A: Equity ratio = 60% Debt ratio = 40% Cost of equity = 11% Before tax cost of debt = 6% Tax rate = 21%…

Q: Take It All Away has a cost of equity of 10.57 percent, a pretax cost of debt of 5.29 percent, and a…

A: A company has several sources from where it can raise funds. It can issue equity shares and the…

Q: NUBD had 5 degrees of operating leverage when its profit before taxes was P200,000. If the company's…

A: Given, Degree of operating leverage = 5 Increase in sales = 15%

Q: You expect that Tin Roof will generate a perpetual stream of EBIT at $92,000 annually. The firm's…

A:

Q: A firm has total interest charges of $10,000 per year, sales of $1 million, a tax rate of 40…

A: Solution: The times interest earned ration is a measure to determine company's ability to meet its…

Q: vanhoe Corporation has $310 million of debt outstanding at an interest rate of 9 percent. What is…

A: When a non-operating expense is deductible in the income statement, the amount of tax benefit from…

Q: National Co. has the opportunity to increase its annual sales by P125,000 by selling to a new,…

A: Manufacturing and selling expense = 125,000 x 70% = 87,500 Uncollectible expense = 125,000 x 10% =…

Q: Al-Shamukh Constructors Ltd. currently has sales of OMR 24 million a year, with a stock level of 25…

A: Rate of return on assets is the rate which denotes the return which is earned on the assets of the…

Q: BN had 5 degrees of operating leverage when its profit before taxes was P200,000. If the company’s…

A: Degree of operating leverage = % change in operating income% change in sales…

Q: Gilbert and Sons is a leveraged firm, it has 300,000 shares of stock outstanding with a market price…

A: Computation of debt-equity ratio:

Q: Kountry Kitchen has a cost of equity of 12.5 percent, a pretax cost of debt of 5.8 percent, and the…

A: Cost of equity, Ke = 125%,Pretax cost of debt, Kd = 5.8%Tax rate, T = 35%WACC = 9.16%Let's assume…

Q: Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1…

A: Operating Profit: Operating profit refers to the profit generated by the firm from normal business…

Q: Suppose that TapDance, Inc.'s capital structure features 65 percent equity, 35 percent debt, and…

A: WACC = (Market weight of equity × Cost of equity) + (Market value of debt × post tax Cost of debt)

Q: Mullineaux Corporation has a target capital structure of 65 percent common stock and 35 percent…

A: WACC = Weight of equity * Cost of equity + Weight of debt * cost of debt * (1-tax rate)

Q: What is Ningbo Shipping's WACC if it's after tax cost of retained earnings is 14%, and the firm's…

A: Weighted Average Cost of Capital is referred to as the calculation of the cost of capital of the…

Q: NUBD had 5 degrees of operating leverage when its profit before taxes was P200,000. If the company’s…

A: Solution: Profit before taxes will increase by = Increase in sales * degrees of operating leverage…

Q: AT&T is a profitable company. On its $200 Billion of debt, it pays an interest rate of 5%.…

A: Effective cost of debt is equal to after tax cost of debt.

TnT has $16billion in assets, and its tax rate is 40%. Its BEP ratio is 10% and its ROA is 5%. What is its TIE ratio?

TIE refers to times-interest-earned ratio. TIE ratio measures the ability of a firm to pay off its debt obligations.

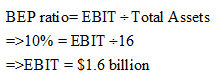

The formula used to calculate BEP (Basic Earnings Power) ratio is:

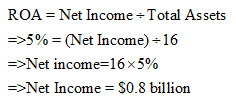

The formula to calculate return on assets (ROA) is:

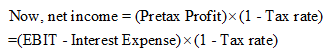

Substituting the values, we get;

Step by step

Solved in 7 steps with 5 images

- Suppose Alcatel-Lucent has an equity cost of capital of 9.2%, market capitalization of $10.95 billion, and an enterprise value of $15 billion. Suppose Alcatel-Lucent's debt cost of capital is 6.9% and its marginal tax rate is 38%. a. What is Alcatel-Lucent's WACC? b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here,? c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is%. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 0 1 FCF ($ million) - 100 50 Print C Done 2 99 3 66 XSuppose Alcatel-Lucent has an equity cost of capital of 10.4%, market capitalization of $11.52 billion, and an enterprise value of $16 billion. Suppose Alcatel-Lucent's debt cost of capital is 6.6% and its marginal tax rate is 34%. a. What is Alcatel-Lucent's WACC? b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ? c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is 9.34 %. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 1 FCF ($ million) 45 Print 0 - 100 Done 2 101 3 66 - XPeterson Packaging Corp. has $9 billion in total assets. The company's basic earning power (BEP) ratio is 9 percent, and its times interest earned ratio is 3.0. Peterson's depreciation and amortization expense totals $1 billion. It has $0.6 billion in lease payments and $0.3 billion must go towards principal payments on outstanding loans and long-term debt. What is Peterson's EBITDA coverage ratio?

- Chipotle has $2,500 million in assets, consisting of $1,055 million in debt, $1,445 million in equity, and its tax rate is 35%. The company’s basic earning power (BEP) is 15%, and its return on assets (ROA) is 7.8%. What is Chipotle’s ROIC?Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?Suppose you are estimating the WACC for Columbus Inc. It has the following data from its balance sheet: total debt = $200 million; total equity=$120 million. It has 20 million shares outstanding, and its stock is trading at $32 per share. Your analysis shows that the company's current borrowing rate is 7%, and that the cost of equity is 13%. If the company marginal tax rate is 30%, what is its WACC?

- A firm has a tax burden ratio of .75, a leverage ratio of 1.25, an interest burden of .6, and a return on sales of 10%. The firm generates $2.40 in sales per dollar of assets. What is the firm’s ROE?Ch 18) Suppose Alcatel-Lucent has an equity cost of capital of 10.1%, market capitalization of $11.52 billion, and an enterprise value of $16 billion. Suppose Alcatel-Lucent's debt cost of capital is 5.7% and its marginal tax rate is 33% a. What is Alcatel-Lucent's WACC? b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is 8.34 % (Round to two decimal places.) b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, The NPV of the project is $87.51 million. (Round to two decimal places.) c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? The debt capacity of the…What is Walkeshewar's WACC if it's equity costs 11.8 percent, the cost of it's debt is 6.3 percent, the debt to equity ratio is .53 and Walkeshewar's tax rate is 39 percent?

- Find the WACC given the following information: A firm has a cost of equity of 8% and cost of debt of 6.5%. The debt - toequity ratio is 0.75. The tax rate is 15%.Harriett Industries has $7.5 billion in total assets. The company’s basic earning power (BEP) ratio is 10 percent, and its times interest earned ratio is 2.5. Harriett’s depreciation and amortization expense totals $1.25 Billion. It has $775 Million in lease payments and $500 Million must go toward principal payments on outstanding loans and long-term debt. What is Harriett’s EBITDA coverage ratio?Give typing answer with explanation and conclusion Suppose Abraxas Corp. has an equity cost of capital of 8.2%, market capitalization of $11.37 billion, and an enterprise value of $17.12 billion. Suppose Abraxas's debt cost of capital is 5.6% and its marginal tax rate is 21%. What is Abraxas's WACC?