FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

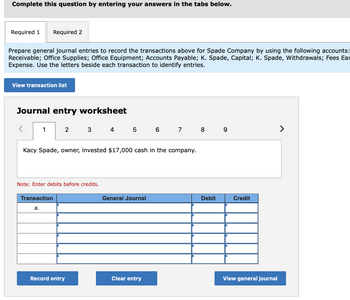

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare general journal entries to record the transactions above for Spade Company by using the following accounts:

Receivable; Office Supplies; Office Equipment; Accounts Payable; K. Spade, Capital; K. Spade, Withdrawals; Fees Ear

Expense. Use the letters beside each transaction to identify entries.

View transaction list

Journal entry worksheet

1

2

3

4 5 6 7 8 9

>

Kacy Spade, owner, invested $17,000 cash in the company.

Note: Enter debits before credits.

Transaction

General Journal

a.

Record entry

Clear entry

Debit

Credit

View general journal

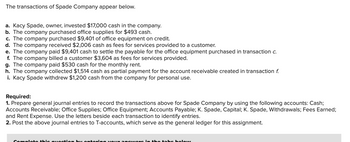

Transcribed Image Text:The transactions of Spade Company appear below.

a. Kacy Spade, owner, invested $17,000 cash in the company.

b. The company purchased office supplies for $493 cash.

c. The company purchased $9,401 of office equipment on credit.

d. The company received $2,006 cash as fees for services provided to a customer.

e. The company paid $9,401 cash to settle the payable for the office equipment purchased in transaction c.

f. The company billed a customer $3,604 as fees for services provided.

g. The company paid $530 cash for the monthly rent.

h. The company collected $1,514 cash as partial payment for the account receivable created in transaction f.

i. Kacy Spade withdrew $1,200 cash from the company for personal use.

Required:

1. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash;

Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; K. Spade, Capital; K. Spade, Withdrawals; Fees Earned;

and Rent Expense. Use the letters beside each transaction to identify entries.

2. Post the above journal entries to T-accounts, which serve as the general ledger for this assignment.

Comploto this question by ontoring your answers in the tabo holow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Omega Transportation Inc., headquartered in Atlanta, Georgia, uses accrual-basis accounting and engaged in the following transactions: • billed customers $2,413,650 for transportation services collected cash from customers in the amount of $1,381,975 • purchased fuel supplies for $1,333,800 cash • used fuel supplies that cost $1,304,750 . • employees earned salaries of $297,100 • paid employees $280,300 cash for salaries Required: Determine the amount of sales revenue and total expenses for Omega's income statement. Sales Revenue Total Expenses $arrow_forwardAustin Land Company sold land for $59,930 in cash. The land was originally purchased for $34,230. At the time of the sale, $12,300 was still owed to Regions Bank. After the sale, Austin Land Company paid off the loan. Explain the effect of the sale and the payoff of the loan on the accounting equation. Enter all dollar amounts as positive numbers. Line Item Description Effect Amount Total assets Total liabilities Stockholders' equityarrow_forward38arrow_forward

- 7. Purchased more office supplies from General Office Company for $1,500 on account. Identify the two parties to this transaction. Describe the activity of each party Which party is being accounted for Describe the impact on company value Maquoketa Services adds a liability (Accounts Payable) for $1,500 pertaining to office supplies. Describe the portions of the transaction occurring currently and describe portions of transaction that is being deferred (postponed) Was cash exchanged in the transaction?arrow_forwardA company has posted the following transaction: Debit Equipment 7000; Credit Accounts Payable 2000; Credit Cash 4000; and Credit Bank 1000. Which of the following best describes the actual transaction? Select one: a. The company purchased equipment for 7000, paying 4000 in cash, 1000 in cheque, and the remaining on credit. b. The company sold equipment worth 7000, receiving 4000 in cash and 2000 still owed. c. The company purchased equipment for 7000, paying 4000 in cash and the remaining 2000 is to be paid later. ↓ d. The company purchased equipment for 7000 entirely on credit.arrow_forwardRequired information [The following information applies to the questions displayed below.] The transactions of Spade Company appear below. a. K. Spade, owner, invested $19,750 cash in the company in exchange for common stock. b. The company purchased supplies for $573 cash. c. The company purchased $10,922 of equipment on credit. d. The company received $2,331 cash for services provided to a customer. e. The company paid $10,922 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $4,187 for services provided. g. The company paid $510 cash for the monthly rent. h. The company collected $1,759 cash as partial payment for the account receivable created in transaction f. i. The company paid a $1,100 cash dividend to the owner (sole shareholder). Required: 1. Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Common…arrow_forward

- Krespy Corp. has a cash balance of $7,500 before the following transactions occur:- received customer payments of $965 supplies purchased on account $435 services worth $850 performed, 25% is paid in cash the rest will be billed corporation pays $275 for an ad in the newspaper bill is received for electricity used $235. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?arrow_forwardThe following transactions were completed by the company: a. The owner invested $17,600 cash in the company. b. The company purchased supplies for $1,150 cash. c. The owner invested $11,300 of equipment in the company in exchange for more common stock. d. The company purchased $330 of additional supplies on credit. e. The company purchased land for $10,300 cash. Required: Enter the impact of each transaction on individual items of the accounting equation. Note: Enter decreases to account balances with a minus sign. a. b. Balance after a and b C. Transactions Number Balance after c d. Balance after d e. Balance after e Cash 0 0 + 0 + + + + + + 0 + + Assets Supplies 0 0 + Equipment + 0 + + + 0 + + + + + + 0 0 + 0 + + + + 0 + + + Land 0 0 = II 0 11 11 11 0 = 11 || 11 || Liabilities + Accounts Payable 0 + + 0 + + + 0 + + 0 + + + Common Stock 0 0 0 0 I - - 1 I 1 Equity Dividends 0 + 0 + + + + 0 + + + + 0 + Revenue 0 0 0 0 - T - I I F Expenses 0 0 0 0arrow_forwardNeed Answer please providearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education