Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

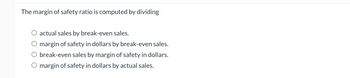

Transcribed Image Text:The margin of safety ratio is computed by dividing

○ actual sales by break-even sales.

margin of safety in dollars by break-even sales.

break-even sales by margin of safety in dollars.

O margin of safety in dollars by actual sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sheridan Bucket Co., a manufacturer of rain barrels, had the following data for 2021: Sales quantity Unit selling price Unit variable costs Fixed costs 2,200 barrels $75 per barrel $45 per barrel $18,480arrow_forwardWhirly has the following information for 2015. They sell Flying Carpets. Sales Contribution Margin Net Income 1. Complete a table for Whirly. Total $400,000 $150,000 $15,000 CVP and BEP Quantity 10,000 Flying Carpets Per Unit Ratio To Salesarrow_forwardCompute the break-even point in sales dollars for the company as a whole and the margin of safety in both dollars and percentage of sales.arrow_forward

- Which of the following is a TRUE statement about sales mix? Select one: O A. Profits will remain constant with an increase in total monetary sales if the total sales in units remains constant. OB. Profits may decline with an increase in total monetary sales if the sales mix shifts to sell more of the high contribution margin product. O C. Profits will remain constant with a decrease in total monetary sales if the sales mix also remains constant. O D. Profits may decline with an increase in total monetary sales if the sales mix shifts to sell more of the lower contribution margin product.arrow_forwardHow many statements below regarding margin of safety are correct? 1. It is the amount by which sales can be reduced without incurring a loss. 2. It is the difference between budgeted sales and breakeven sales. 3. It can be expressed in terms of unit, pesos or percentage of sales. 4. Its presence indicates that the company expects profit. 5. The product of margin of safety units and unit contribution margin is the projected profit for the period. 6. The higher the margin of safety, the lower is the risk of incurring operating loss. 3 4arrow_forwardwhat is margin of safety as a percentage of salesarrow_forward

- What are the answers for the following? Construct a cost-volume-profit chart on your own paper. What is the break-even sales? What is the expected margin of safety in dollars and as a percentage of sales? Determine the operating leverage. Round to one decimal place.arrow_forward4a. Calculate the break-even point in unit sales for each product using method 2. 4b. What will be the company's overall profit if it sells exactly the break-even quantity of each product? 5. Which method should the company use to calculate each product's break-even point in unit sales?arrow_forwardComplete the following problems using the following ratios: Sales level at which operating income is zero o If sales above breakeven, then profit o If sales below breakeven, then loss o Fixed expenses = total contribution margin Total sales = total expenses Break Even Point: Unit Sold = Fixed expenses + Operating Income / Contribution Margin per unit Break Even Point: Sales $ = Fixed expenses + Operating Income / Contribution Margin RatioCalculate the break even sales dollars if the fixed expenses are $7,000 and the contribution ratio is 40%.arrow_forward

- Contribution Margin, Break-Even Sales, Cost-Volume-Profit Chart, Margin of Safety, and Operating Leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: Estimated Estimated Variable Cost Fixed Cost (per unit sold) Production costs: Direct materials $50.00 Direct labor 30.00 Factory overhead $350,000 6.00 Selling expenses: Sales salaries and commissions 340,000 4.00 Advertising 116,000 Travel 4,000 Miscellaneous selling expense 2,300 1.00 Administrative expenses: Office and officers' salaries 325,000 Supplies 6,000 4.00 Miscellaneous administrative expense 8,700 1.00 Total $1,152,000 $96.00 It is expected that 12,000 units will be sold at a price…arrow_forwardIn the month of March, Blossom Salon services 620 clients at an average price of $120. During the month, fixed costs were $18,564 and variable costs were 65% of sales. (a) Your answer is correct. Determine the total contribution margin in dollars, the per unit contribution margin, and the contribution margin ratio. Contribution margin in dollars Contribution margin per unit Contribution margin ratio $ 26040 42 35arrow_forwardIn the month of March, Carla Vista Salon serviced 630 clients at an average price of $160. During the month, fixed costs were $29,952 and variable costs were 60% of sales. (a). Determine the total contribution margin in dollars, the unit contribution margin, and the contribution margin ratio. Contribution margin in dollars Contribution margin per unit Contribution margin ratio $ $ %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning