FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

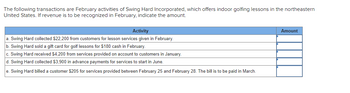

Transcribed Image Text:The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern

United States. If revenue is to be recognized in February, indicate the amount.

Activity

a. Swing Hard collected $22,200 from customers for lesson services given in February.

b. Swing Hard sold a gift card for golf lessons for $180 cash in February.

c. Swing Hard received $4,200 from services provided on account to customers in January.

d. Swing Hard collected $3,900 in advance payments for services to start in June.

e. Swing Hard billed a customer $205 for services provided between February 25 and February 28. The bill is to be paid in March.

Amount

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Geoff and Sandy Harland own and operate Wayward Kennel and Pet Supply. Their motto is, “If your pet is not becoming to you, he should be coming to us.” The Harlands maintain a sales tax payable account throughout the month to account for the 6% sales tax. They use a general journal, general ledger, and accounts receivable ledger. The following sales and cash collections took place during the month of September: September Transactions: Sept. 2 Sold a fish aquarium on account to Ken Shank, $125 plus tax of $7.50, terms n/30. Sale No. 101. 3 Sold dog food on account to Nancy Truelove, $68.25 plus tax of $4.10, terms n/30. Sale No. 102. 5 Sold a bird cage on account to Jean Warkentin, $43.95 plus tax of $2.64, terms n/30. Sale No. 103. 8 Cash sales for the week were $2,332.45 plus tax of $139.95. 10 Received cash for boarding and grooming services, $625 plus tax of $37.50. 11 Jean Warkentin stopped by the store to point out a minor defect in the bird cage…arrow_forwardDuring the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for $7,700 from Diamond Incorporated with terms 2/10, n/30. June 5 Returned goods costing $2,900 to Diamond Incorporated for credit on account. June 6 Purchased goods from Club Corporation for $2,800 with terms 2/10, n/30. June 11 Paid the balance owed to Diamond Incorporated. June 22 Paid Club Corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list No 1 2 3 4 5 Date June 03 June 05 June 06 June 11 June 22 View journal entry worksheet Inventory Accounts Payable Accounts Payable Inventory Inventory Accounts Payable Accounts Payable Cash Accounts Payable Cash General Journal Debit 7,700 2,900 2,800 7,546…arrow_forwardThe City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements summarizes the activity in the program's bank account for the year. 1. At the beginning of 2020, the program had unrestricted cash of $30,000. Cash receipts: Registration fees Borrowing from bank Total deposits Cash disbursements: Wages Payroll taxes Insurance (paid monthly) Purchase of bus Interest on bank note Total checks Excess of receipts over disbursements Cash Basis 12 months $134,000 60,000 194,000 74,000 9,900 6,900 69,000 1,800 161,600 $ 32,400 2. The loan from the bank is dated April 1 and is for a five-year period. Interest (6 percent annual rate) is paid on October 1 and April 1 of each year, beginning October 1, 2020. 3. The bus was purchased on April 1 with the proceeds provided by the bank loan and has an estimated useful…arrow_forward

- Collins Book Distributors distributes books to retail stores and extends credit terms of 2/10, n/30 to all its customers. During the month of June, the following merchandising transactions occurred: June Purchased 170 books on account for $6 each from Alpha Publishers, terms 3/10, n/30. 6 Received $60 credit for 10 books returned to Alpha Publishers. 6. Paid Alpha Publishers for balance due. 17 Sold 140 books on account to Cozy Bookstore for $11 each. 24 Received payment in full from Cozy Bookstore. 28 Sold 10 books on account to Ivy Bookstore for $11 each. 30 Granted Ivy Bookstore $22 credit for 2 books returned total cost was $12. Journalize the transactions for the month of June for Collins Book Distributors, using a perpetual inventory system. Assume the purchase cost of each book sold was $6.arrow_forwardChipolo sells a coin-sized tracking tag that attaches to keys, wallets, and other personal items. Chipolo began January with an inventory of 200 tags purchased from its supplier in November last year at a cost of $12 per tag, plus 100 tags purchased in December last year at a cost of $15 per tag. Chipolo sells the tags at a price of $30 per tag, on account with terms n/30, FOB destination. Chipolo uses a perpetual inventory system to account for the following transactions. Jan. 8 Chipolo gave 250 tags to a courier company (FedEx) to deliver to customers. Jan. 9 FedEx confirmed that all 250 tags were delivered today to customers. Jan. 11 Chipolo ordered 350 tags from its supplier. The supplier was out of stock but promised to send them to Chipolo as soon as possible. Chipolo agreed to a cost of $21 per tag, n/30. Jan. 17 Chipolo received cash payment from customers for 125 of the tags delivered 8 days earlier. Jan. 21 The 350 tags ordered on January 11…arrow_forwardGeoff and Sandy Harland own and operate Wayward Kennel and Pet Supply. Their motto is, “If your pet is not becoming to you, he should be coming to us.” The Harlands maintain a sales tax payable account throughout the month to account for the 6% sales tax. They use a general journal, general ledger, and accounts receivable ledger. The following sales and cash collections took place during the month of September: September Transactions: Sept. 2 Sold a fish aquarium on account to Ken Shank, $125 plus tax of $7.50, terms n/30. Sale No. 101. 3 Sold dog food on account to Nancy Truelove, $68.25 plus tax of $4.10, terms n/30. Sale No. 102. 5 Sold a bird cage on account to Jean Warkentin, $43.95 plus tax of $2.64, terms n/30. Sale No. 103. 8 Cash sales for the week were $2,332.45 plus tax of $139.95. 10 Received cash for boarding and grooming services, $625 plus tax of $37.50. 11 Jean Warkentin stopped by the store to point out a minor defect in the bird cage…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education