FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Solve these two problems with data given - please provide instructions on answers

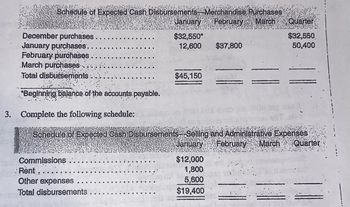

Transcribed Image Text:Schedule of Expected Cash Disbursements Merchandise Purchases

January February March Quarter

December purchases..

January purchases.

February purchases.

March purchases.

Total disbursements.

*Beginning balance of the accounts.payable.

$32,550*

12,600 $37,800

Commissions

Rent.

Other expenses

Total disbursements

$45,150

3. Complete the following schedule:

Schedule of Expected Cash Disbursements Selling and Administrative Expenses

February March Quarter

January

$32,550

50,400

$12,000

1,800

5,600

$19,400

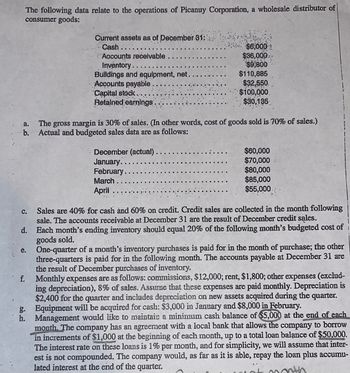

Transcribed Image Text:The following data relate to the operations of Picanuy Corporation, a wholesale distributor of

consumer goods:

a.

b.

C.

d.

e.

f.

g.

h.

Current assets as of December 31:

Cash.

Accounts receivable

Inventory..

Buildings and equipment, net.

Accounts payable

Capital stock..

Retained earnings.

$6,000

$36,000

$9,800

$110,885

$32,550.

$100,000.

$30,135

The gross margin is 30% of sales. (In other words, cost of goods sold is 70% of sales.)

Actual and budgeted sales data are as follows:

December (actual).

January.

February..

March..

April

$60,000

$70,000

$80,000

$85,000

$55,000.

Sales are 40% for cash and 60% on credit. Credit sales are collected in the month following

sale. The accounts receivable at December 31 are the result of December credit sales.

Each month's ending inventory should equal 20% of the following month's budgeted cost of

goods sold.

One-quarter of a month's inventory purchases is paid for in the month of purchase; the other

three-quarters is paid for in the following month. The accounts payable at December 31 are

the result of December purchases of inventory.

Monthly expenses are as follows: commissions, $12,000; rent, $1,800; other expenses (exclud-

ing depreciation), 8% of sales. Assume that these expenses are paid monthly. Depreciation is

$2,400 for the quarter and includes depreciation on new assets acquired during the quarter.

Equipment will be acquired for cash: $3,000 in January and $8,000 in February.

Management would like to maintain a minimum cash balance of $5,000 at the end of each

month. The company has an agreement with a local bank that allows the company to borrow

in increments of $1,000 at the beginning of each month, up to a total loan balance of $50,000.

The interest rate on these loans is 1% per month, and for simplicity, we will assume that inter-

est is not compounded. The company would, as far as it is able, repay the loan plus accumu-

lated interest at the end of the quarter.

moth

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

why did you multiple required purchases by 1/4 & 3/4? I am confused on this as i dont see it in the instructions.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

why did you multiple required purchases by 1/4 & 3/4? I am confused on this as i dont see it in the instructions.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education