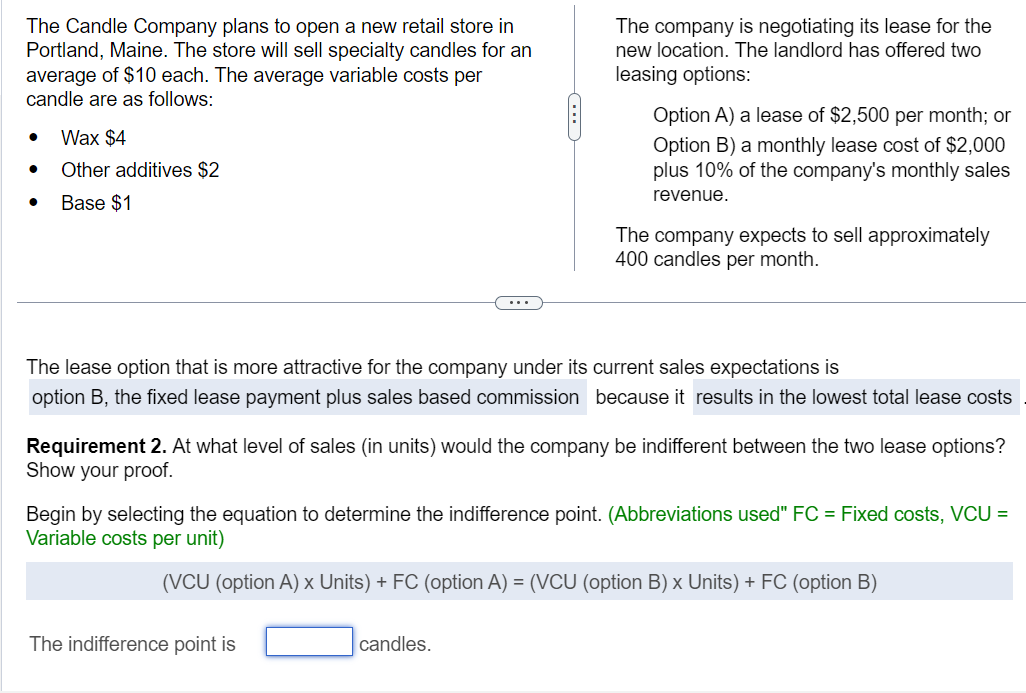

The Candle Company plans to open a new retail store in Portland, Maine. The store will sell specialty candles for an average of $10 each. The average variable costs per candle are as follows: • Wax $4 • Other additives $2 • Base $1 ---- The company is negotiating its lease for the new location. The landlord has offered two leasing options: Option A) a lease of $2,500 per month; or Option B) a monthly lease cost of $2,000 plus 10% of the company's monthly sales revenue. The company expects to sell approximately 400 candles per month. The lease option that is more attractive for the company under its current sales expectations is option B, the fixed lease payment plus sales based commission because it results in the lowest total lease costs Requirement 2. At what level of sales (in units) would the company be indifferent between the two lease options? Show your proof. Begin by selecting the equation to determine the indifference point. (Abbreviations used" FC = Fixed costs, VCU = Variable costs per unit) (VCU (option A) x Units) + FC (option A) = (VCU (option B) x Units) + FC (option B) The indifference point is candles.

The Candle Company plans to open a new retail store in Portland, Maine. The store will sell specialty candles for an average of $10 each. The average variable costs per candle are as follows: • Wax $4 • Other additives $2 • Base $1 ---- The company is negotiating its lease for the new location. The landlord has offered two leasing options: Option A) a lease of $2,500 per month; or Option B) a monthly lease cost of $2,000 plus 10% of the company's monthly sales revenue. The company expects to sell approximately 400 candles per month. The lease option that is more attractive for the company under its current sales expectations is option B, the fixed lease payment plus sales based commission because it results in the lowest total lease costs Requirement 2. At what level of sales (in units) would the company be indifferent between the two lease options? Show your proof. Begin by selecting the equation to determine the indifference point. (Abbreviations used" FC = Fixed costs, VCU = Variable costs per unit) (VCU (option A) x Units) + FC (option A) = (VCU (option B) x Units) + FC (option B) The indifference point is candles.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter5: Network Models

Section5.3: Assignment Models

Problem 12P

Related questions

Question

100%

Transcribed Image Text:The Candle Company plans to open a new retail store in

Portland, Maine. The store will sell specialty candles for an

average of $10 each. The average variable costs per

candle are as follows:

Wax $4

Other additives $2

Base $1

The company is negotiating its lease for the

new location. The landlord has offered two

leasing options:

Option A) a lease of $2,500 per month; or

Option B) a monthly lease cost of $2,000

plus 10% of the company's monthly sales

revenue.

The lease option that is more attractive for the company under its current sales expectations is

option B, the fixed lease payment plus sales based commission because it results in the lowest total lease costs

The indifference point is

The company expects to sell approximately

400 candles per month.

Requirement 2. At what level of sales (in units) would the company be indifferent between the two lease options?

Show your proof.

candles.

Begin by selecting the equation to determine the indifference point. (Abbreviations used" FC = Fixed costs, VCU =

Variable costs per unit)

(VCU (option A) x Units) + FC (option A) = (VCU (option B) x Units) + FC (option B)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning