The book I use for study: Principles of Managerial Finance [Global Edition] 16th Edition. Chad J. Zutter & Scott B. Smart Questions in image Neraca = Balance Sheet

Q: Determine the amount of the fourth payment and make an amortization plan for this loan.

A: The sum of PV of all installments should be equal to the loan amount. We can determine the missing…

Q: A UK importer contracts to pay 18 million Yen for raw material from a supplier in Japan on one…

A: We have to find the total cost of the import in domestic currency. Spot rate and forward rate quotes…

Q: You have been asked to value Brilliant Enterprises, a publicly traded IT services firm, and have…

A: The free cash flows refer to the company’s cash balance after paying for operating expenses and…

Q: Pepito Catamco is excited to own a brand new Toyota car. Toyota is selling the for P1.2million. The…

A: Down payment Whenever an asset (like a car, building, land, etc.) is bought an advance payment is…

Q: 3. Excess capacity adjustments Water and Power Co. (W&P) currently has $610,000 in total assets and…

A: HONOR CODE: Since you have posted a question with multiple sub parts, we will provide the solution…

Q: Demonstrate how FRAs, BAB futures and interest rate swaps establishes the company's cost of funds…

A: Interest rates for a future time period are expressed as "forward rates." A specific forward rate…

Q: a’Mila makes a $350 purchase with her new credit card. The card has a 21% annual interest rate and…

A: The bank offers credit cards to its customers. The bank charges interest on the purchases made…

Q: a. Explain SWOT analysis on business risks exposure of McDonalds in Japan. b. Explain market…

A: (A) SWOT Analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses,…

Q: Based on a one-factor (single index) model, consider a portfolio of two stocks with the following…

A: As per the given information: StockFactor SensitivityNon-factor…

Q: DeCablo, Inc. owns a machine costing P105,000. This has an estimated useful life of 6 years with a…

A: Internal rate of return: It is the rate at which the project or investment will yield zero net…

Q: Historical Analysis of the Verses of Riba.

A: The Arabic word 'riba' can be roughly translated as the concept of exceeding, or increasing. It is…

Q: Is the analyst's firm likely to be buying or selling credit default swaps on a distressed firm? OA.…

A: Credit Default Swaps (CDS) are a derivative instrument where the seller of the CDS, pays a payoff to…

Q: Could you please explain it more or show your calculations. Thanks

A: Call option A call option gives its holder the right to purchase stock at the prespecified price…

Q: The terms of futures contracts such as the quality and quantity of the commodity and the delivery…

A: Solution Specified by the futures exchange

Q: You own 6% coupon bonds from Zoom Video Communications, Inc. Their face value is $1,000. The bonds…

A: Bond valuation determines the intrinsic price of the bond as the sum of the present value of all the…

Q: Consider the following data for a certain share. Current Price = S0…

A: The value of a call or put option using a normal distribution table can be determined by using the…

Q: Consider property level cash flows: NOI Y1 Y2 Y3 Y4 Y5 Y6 Y7 a property with the following $200,000…

A: The company raises finance by issuing debt or equity. The firm that does not have debt in the…

Q: Suppose that the yield to maturity of the 5% coupon, 25-year maturity bond falls to 7% by the end of…

A: Investing in bonds is a great way to generate steady income while minimizing risk. However, it is…

Q: B. Volume leads price. C. Volume contracts when prices decline. D. All of the above 19.If price…

A: The general law is when the prices are high the volume gets contracted and vice versa.

Q: If an individual saved no money for the year from income sources, could their net worth increase? a.…

A: Several statements have been provided explaining why net worth may or may not go up if a person…

Q: The price of Bobco stock is currently $60. In one year, the price will either be $66 or $54. If the…

A: The pricing of options by the means of a replicating portfolio is the process by which the payoffs…

Q: Problem 1: Interest on capital and bonus A and B formed a partnership. The partnership agreement…

A: An agreement that consists of all clauses relating to partnership is known as partnership deed. A…

Q: 2.Consider a portfolio of 3 bond A and 2 Annuity B, the yield rate is i-5% for A and B. Bond A:…

A: HONOR CODE: Since you have posted a question with multiple sub-parts, we will provide the solution…

Q: Bob-Bye, Inc. has asked its financial manager to measure the cost of each specific type of capital…

A: The weighted average cost of capital refers to the rate paid by the securities holders for financing…

Q: If you leave $5500 in an account earning 9% interest, compounded daily, how much money will be in…

A: Principal amount (P) = $ 5,500 Interest rate (R) = 9% or .09 For compounded daily, Interest rate per…

Q: I am trying to get the 3M stock price using the Dividend Reinvestment Model. I think I should be…

A: First let us list the formula used to determine the dividend growth rate. This is calculated on the…

Q: Pierre is a freelance chef. He works as a personal cook, a caterer for special events, and a menu…

A: Given: Pierre is a self-employed person. Since Pierre is a self-employed person, he can be able to…

Q: The Global Advertising Company has a tax rate of 40%. The company can raise debt at a 12% interest…

A: The collection of multiple sources from where an entity has acquired funding is regarded as its…

Q: Draw a cash flow diagram for easy understanding. b. In the year 2020, the stock market fell because…

A: The concept of money's time worth indicates that the sum of money is worth more currently as…

Q: Calculate the simple interest earned. Round to the nearest cent. P = $9080, r = 5.25%, t = 4 months

A: Simple interest means that the borrower only needs to calculate interest each year on the principal…

Q: 5. The universe of available securities includes two risky stock funds, A and B, and T-bills. The…

A: As per the given information: Expected returnStandard deviationA10%20%B30%60%T-bills50 Correlation…

Q: Using leverage to expand your business will increase profitability if your a. return on equity…

A: We have to find the situation when usage of leverage to expand the business will increase the…

Q: After graduation, you just got hired by an engineering company and you were planning to take a loan…

A: Annual interest rate: This is the rate which is multiplied by the principal amount of the loan and…

Q: Let's assume today is Feb 15, 2020 and call and put options for 10,000 euros at $1.3700 per euro are…

A: The contract that provides its buyer with a right to purchase or sell the underlying possession on a…

Q: A person has an amount of € 10 000 which he wants to use as a provision for old age. He decides to…

A: A pool of capital is split between debt fund and equity fund. Both of them offer different returns.…

Q: 3. Consider the following options available to a mortgage borrower: Loan Amount Interest Rate (%)…

A: In a points system, the borrower pays 1% of the loan up front for 1 point and gets a certain %…

Q: etermine the value of the following American put option using both the bino- mial lattice and the…

A: STEP 1 The two most common approaches for resolving option pricing issues are the Black Scholes…

Q: The British pound (£) is currently worth 1.45 euros (€). This can either increase by u = 1.1 or…

A: The Binomial Tree option pricing model is used to find out the value of options on an underlying…

Q: Imprudential, Incorporated, has an unfunded pension liability of $757 million that must be paid in…

A:

Q: Problem. 6: Gator Office Supplies sells two models of fax machines. The wholesale cost of the Blue…

A: Optimal product mix: It means the right mix of products and the company earning its potential…

Q: You work as a trader for the arbitrage desk at RawTrade, monitoring spot and futures foreign…

A: The value of one country's currency in presented terms of the value of another country's currency is…

Q: A company is considering the opportunity to invest into a new 12- year project: manufacturing and…

A: Break-even sales refer to the point at which the profit earns from selling goods or services are…

Q: Suppose Kashweka purchases 100 shares of ZB on 1 January at K50 per share. ZB pays K2.30 annual…

A: As per the given information: Shares purchases on 1 January - K50 per shareAnnual dividend per share…

Q: ULIP has a component of Opions are health insurance, accident insurance life insurance…

A: The insurance is the contract under which it promises to pay or indemnify the losses caused to the…

Q: Assume that F, and Fy are the futures prices of two contracts on the same non-dividend- paying…

A: The future price of a contract is the agreed-upon price of the underlying commodity which is…

Q: Daily Volatility< weight Portfolio value Correlation < Stock 1 5% 65% Stock 2 6% 25% 50 mln 0.6

A: A portfolio is a combination of different securities in one basket to eliminate the unsystematic…

Q: Dj 1 finance An ARM is made for $240,000 for 30 years with the following terms: Initial interest…

A: STEP 1 Interest is stated to be 7% for the first year. Interest rates are determined for each of the…

Q: Calculate the simple interest rate. (Round your answer to one decimal place.) P = $4300, I = $660,…

A: Simple interest is the interest calculated on the principal amount over some time whereas compound…

Q: is it incorrect to use coupon rate of debt towards cost of debt? Briefly explain.

A: The organization needs money to run the business and achieve its goal. The company raises money by…

Q: Question 4 Analyzing the stock market produces the following information about the returns of two…

A: Portfolio Standard Deviation: Portfolio standard deviation represents the volatility of the…

Step by step

Solved in 2 steps with 2 images

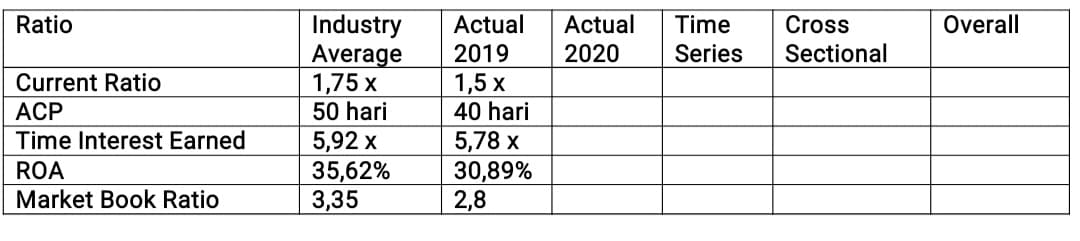

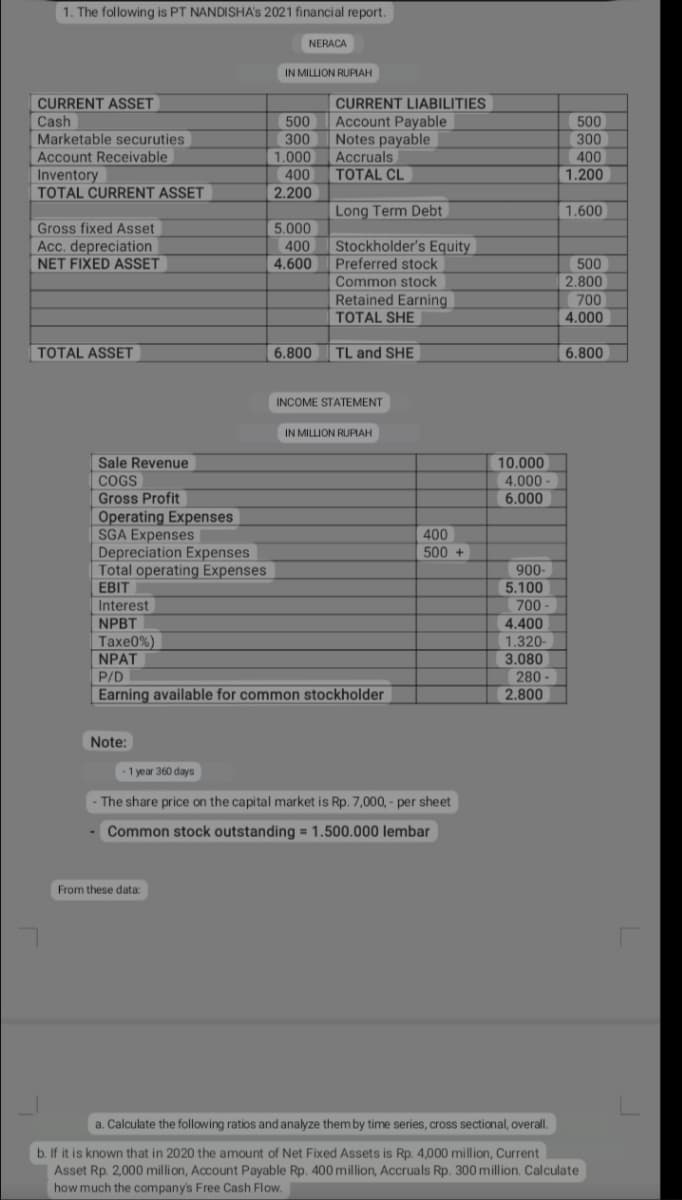

- The following statements was extracted from the books of ShafNita Sdn. Bhd. at 31 December2019 and 2020. ShafNita Sdn. Bhd. Statement of Financial Position as at 31 December2019 2020RM RM RM RM Non Current AssetsBuilding 100,000 100,000Fixtures less accumulated depreciation 3,600 4,000Van less accumulated depreciation 7,840 14,800111,440 118,800 Current AssetInventory 11,200 24,800Trade account receivable 12,800 16,400Bank 1,800 -Cash 440 400 26,240 41,600Total assets 137,680 160,400Finance by:Capital account:Balance at 1 January 74,080 105,080Add: Net profit for the year 70,400 42,320Cash introduced - 20,000144,480 167,400Less: Drawings (39,400) (43,200)105,080 124,200 Non Current LiabilitiesLoan (repayable in 10 years time) 20,000 30,000Current LiablitiesAccount Payable 12,600 6,012Bank overdraft - 188Retained earnings 32,600 36,200Total liabilities and equity 137,680 160,400 Additional information at 31 December 2020: Fixtures bought in 2020 cost RM800. Van bought in 2020 cost…classify the given items as (operating / investing / financing), share the correct classification with logical reasoning Loss on sale of asset 95780 dividend income 26000 interest income 35000 finance cost paid on debentures 12000 gain on sale of investment 45000 Depreciation on fixed assets 85000 Amortisation Expenses 110000The following are Statement of Financial Position and Statement of ComprehensiveIncome of Lala Electronics Sdn. Bhd.Table 3: Statement of Financial Position and Statement of Comprehensive Income of Lala Electronics Sdn. Bhd. Lala Electronics Sdn. Bhd. Statement of Financial Position as at 31/12/2020Non-Current Asset: RM RMInvestment 270,000Fixed Assets at cost 1,596,000Accumulated Depreciation (857,000)Net Book Value 739,000Current Asset:Cash 178,000Account Receivable 678,000Inventory 1,329,000Prepaid Expenses 56,000 2,241,000Total assets 3,250,000Current Liabilities:Account Payable 148,000Interest Payable 36,000Income Taxes Payable 448,000Other Accrued Liabilities 191,000Total Current Liabilities 823,000Long Term Liabilities:Bank Loan 631,000Total Liabilities 1,454,000Equity:Capital 782,000Appropriate Profit (RetainedEarnings) 1,014,000 1,796,0003,250,000Lala Electronics Sdn. Bhd. Statement of Comprehensive Income for the year ended 31/12/2020RM RM Sales 3,992,000(-) COGS…

- The comparative statement of financial position for Moose Jaw Ltd. is as follows:Moose Jaw Ltd.Comparative Statement of Financial PositionAs at December 312021 2020Cash $20,500 $12,500Accounts receivable 34,000 25,500Inventories 20,000 30,000Prepaid insurance 2,500 2,000Equipment 102,000 90,000Accumulated depreciation - equipment (22,500) (12,500)Total assets $156,500 $147,500Accounts payable $23,000 $20,000Interest payable 2,000 3,000Wages payable 4,000 2,000Income taxes payable 4,000 5,000Long-term note payable 30,000 34,500Common shares 65,000 65,000Retained earnings 28,500 18,000Total liabilities and equity $156,500 $147,500More information about Moose Jaw’s operations for 2021:• A machine which the company paid $10,000 for was sold for a gain of$1,000. The equipment’s accumulated depreciation was $7,000.• The company had net income for of $13,500.RequiredConstruct the operating activities section of Moose Jaw Ltd.’s statement of cashflows using the indirect method. Use proper…The following are the financial statement Kin Ltd. for the year ended 31 March 2020: Kin Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 Kin Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities:…The following Statement of Financial Position was extracted from the books ofGagah Perkasa Sdn Bhd at 31 December 2018 and 2019.Gagah Perkasa Sdn Bhd Statement of Financial Position as at 31 December2018 2019RM RM RM RM Non-current AssetsBuildings 50,000 50,000Fixtures less Depreciation 1,800 2,000Van less Depreciation 3,920 7,40055,720 59,400 Current AssetsInventory 5,600 12,400Trade accounts receivables 6,400 8,200Bank 900 -Cash 220 200 13,120 20,800TOTAL ASSETS 68,840 80,200Financed by :Capital account :Balance as at 1 January 37,040 52,540Add : Net Profit 35,200 21,160Cash introduced - 10,00072,240 83,700Less : Drawings (19,700) (21,600) 52,540 62,100 Non-current LiabilitiesLoan (repayable in 10 years’ time) 10,000 15,000Current LiabilitiesAccount payable 6,300 3,006Bank overdraft - 94TOTAL LIABILITIES 16,300 18,100TOTAL LIABILITIES AND CAPITAL 68,840 80,200Additional information at 31 December 2019: Fixtures bought in 2019 cost RM400. Van bought in 2019 cost RM5,500. Prepared…

- I need to know how to calculate the gain on the equipment sold in part C The balance sheets of HiROE Inc. showed the following at December 31, 2020 and 2019: December 31, 2020 December 31, 2019 Equipment, less accumulated depreciation of $212,625 at December 31, 2020, and $151,875 at December 31, 2019. $ 273,375 $ 334,125 Required: If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amount of the depreciation expense for 2020? Assume the same facts as in part a, and assume that the estimated useful life of the equipment to HiROE Inc., is eight years and that there is no estimated salvage value. Determine: What the original cost of the equipment was. What depreciation method is apparently being used. When the equipment was acquired. Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model and record the journal…The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows:Dec 31 20Y9 Dec 31 20Y8ASSETSCash $ 70,720 $ 47,940Accounts Receivable 207,230 188,190Inventories 298,520 289,850Investments - 102,000Land 295,800 -Equipment 438,600 358,020Accumulated Depreciation-Equipment (99,110) (84,320)Total Assets $ 1,211,760 $ 901,680LIABILITIES AND STOCKHOLDERS' EQUITYAccounts Payable $ 205,700 $ 194,140Accrued Expenses Payable (operating expenses) 30,600 26,860Dividends Payable 25,500 20,400Common Stock, $1 par 202,000 102,000Paid-in Capital; Excess of issue price over par-common stock 354,000 204,000Retained Earnings 393,960 354,280Total Liabilities and Stockholders Equity: $ 1,211,760 $ 901,680Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows:A. Equipment and land were acquired for cashB. There were no disposals of equipment during the year.C. The investments were sold for $91,800 cash.D. The common stock was…The following information is for Swifty Real Estate: SwiftyReal EstateBalance SheetDecember 31, 2020 Cash $ 25500 Accounts Payable $ 60500 Prepaid Insurance 29700 Salaries and Wages Payable 15100 Accounts Receivable 50600 Mortgage Payable 84500 Inventory 68600 Total Liabilities 160100 Land Held for Investment 83500 Land 120600 Buildings $98100 Less Accumulated Depreciation Owner's Capital 366400 (19600) 78500 Trademark 69500 Total Liabilities and Owner’s Equity Total Assets $526500 $526500 The total dollar amount of liabilities to be classified as current liabilities is $160100. $15100. $60500. $75600.

- Complete the Form 4562 using the following information provided. Himple RetailFixed Asset Rollforward12/31/2019(book basis) DEPR COST 2017 2018 2019 ACCUM NET BOOK ASSET IN SERVICE METHOD LIFE BASIS DEPR DEPR DEPR DEPR VALUE CASH REGISTER 2/15/2017 SL 5 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 2017 TOTAL ADDITIONS 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 RETAIL FIXTURES 10/12/2018 SL 7 4,750.00 169.64 678.57 848.21 3,901.79 FURNITURE 10/12/2018 SL 7 3,900.00 139.29 557.14 696.43 3,203.57 2018 TOTAL ADDITIONS 8,650.00 - 308.93 1,235.71 1,544.64 7,105.36 TOTAL 18,550.00 1,815.00 2,288.93 3,215.71 7,319.64 11,230.36 DELIVERY TRUCK 6/1/2019 SL 5 37,500.00 4,375.00 4,375.00 33,125.00 DESK AND CABINETRY 6/1/2019 SL 7 11,900.00 991.67 991.67 10,908.33 COMPUTER 6/1/2019 SL 5 2,800.00 326.67 326.67 2,473.33 2019 TOTAL ADDITIONS 52,200.00 - - 5,693.34 5,693.34 46,506.66 TOTAL…The following assets are included in the December 31, 2022, balance sheet ofFortible Auto Parts, Inc.Accounts Receivable(net of Allowance for Uncollectible Accounts) $ 75,000Accumulated Depreciation, Building 20,000Building 170,000Cash 90,000Land 145,000Merchandise Inventory 92,000Trademark 125,500The total dollar amount of assets classified as property, plant, and equipment onFortible Auto Part's December 31, 2022, classified balance sheet is ____The comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is:Dec. 31, 20Y9 Dec. 31, 20Y8AssetsCash $70,720 $47,940Accounts receivable (net) 207,230 188,190Inventories 298,520 289,850Investments 0 102,000Land 295,800 0Equipment 438,600 358,020Accumulated depreciation—equipment (99,110) (84,320)Total assets $1,211,760 $901,680Liabilities and Stockholders' EquityAccounts payable (merchandise creditors) $205,700 $194,140Accrued expenses payable (operating expenses) 30,600 26,860Dividends payable 25,500 20,400Common stock, $1 par 202,000 102,000Paid-in capital: Excess of issue price over par—common stock 354,000 204,000Retained earnings 393,960 354,280Total liabilities and stockholders' equity $1,211,760 $901,680The income statement for the year ended December 31, 20Y9, is as follows:Sales $2,023,898Cost of goods sold 1,245,476Gross profit $778,422Operating expenses:Depreciation expense $14,790Other operating expenses 517,299Total operating expenses 532,089Operating…