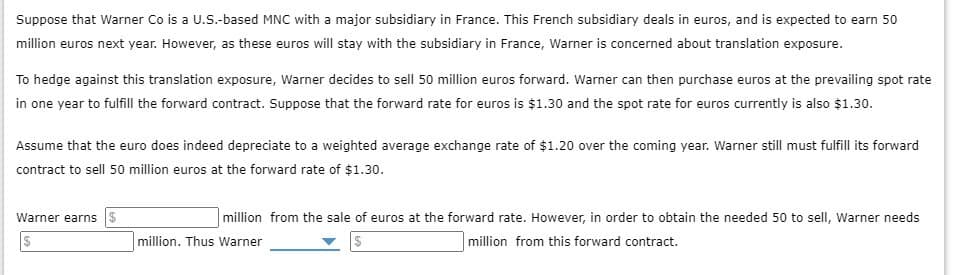

Suppose that Warner Co is a U.S.-based MNC with a major subsidiary in France. This French subsidiary deals in euros, and is expected to earn 50 million euros next year. However, as these euros will stay with the subsidiary in France, Warner is concerned about translation exposure. To hedge against this translation exposure, Warner decides to sell 50 million euros forward. Warner can then purchase euros at the prevailing spot rate in one year to fulfill the forward contract. Suppose that the forward rate for euros is $1.30 and the spot rate for euros currently is also $1.30. Assume that the euro does indeed depreciate to a weighted average exchange rate of $1.20 over the coming year. Warner still must fulfill its forward contract to sell 50 million euros at the forward rate of $1.30. Warner earns $ million from the sale of euros at the forward rate. However, in order to obtain the needed 50 to sell, Warner needs million from this forward contract. million. Thus Warner

Suppose that Warner Co is a U.S.-based MNC with a major subsidiary in France. This French subsidiary deals in euros, and is expected to earn 50 million euros next year. However, as these euros will stay with the subsidiary in France, Warner is concerned about translation exposure. To hedge against this translation exposure, Warner decides to sell 50 million euros forward. Warner can then purchase euros at the prevailing spot rate in one year to fulfill the forward contract. Suppose that the forward rate for euros is $1.30 and the spot rate for euros currently is also $1.30. Assume that the euro does indeed depreciate to a weighted average exchange rate of $1.20 over the coming year. Warner still must fulfill its forward contract to sell 50 million euros at the forward rate of $1.30. Warner earns $ million from the sale of euros at the forward rate. However, in order to obtain the needed 50 to sell, Warner needs million from this forward contract. million. Thus Warner

Chapter20: Short-term Financing

Section: Chapter Questions

Problem 12QA

Related questions

Question

Suppose that warner co

Transcribed Image Text:Suppose that Warner Co is a U.S.-based MNC with a major subsidiary in France. This French subsidiary deals in euros, and is expected to earn 50

million euros next year. However, as these euros will stay with the subsidiary in France, Warner is concerned about translation exposure.

To hedge against this translation exposure, Warner decides to sell 50 million euros forward. Warner can then purchase euros at the prevailing spot rate

in one year to fulfill the forward contract. Suppose that the forward rate for euros is $1.30 and the spot rate for euros currently is also $1.30.

Assume that the euro does indeed depreciate to a weighted average exchange rate of $1.20 over the coming year. Warner still must fulfill its forward

contract to sell 50 million euros at the forward rate of $1.30.

Warner earns $

$

million. Thus Warner

million from the sale of euros at the forward rate. However, in order to obtain the needed 50 to sell, Warner needs

million from this forward contract.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning