ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

2

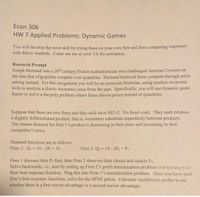

Transcribed Image Text:Econ 306

HW 7 Applied Problems: Dynamic Games

You will develop the most skill by trying these on your own first and then comparing responses

with fellow students. Come see me or your TA for assistance.

Research Prompt

Joseph Bertrand was a 20th century French mathematician who challenged Antoine Cournot on

the idea that oligopolies compete over quantities. Bertrand believed firms compete through price

setting instead. For this assignment you will be an economic historian, using modern economic

tools to analyze a classic economic issue from the past. Specifically, you will use dynamic game

theory to solve a duopoly problem where firms choose prices instead of quantities.

Suppose that there are two firms and they each have MC=2. No fixed costs. They each produce

a slightly differentiated product; that is, consumers substitute imperfectly between products.

This means demand for firm 1's product is decreasing in their price and increasing in their

competitor's price.

Demand functions are as follows:

Firm 1: Qi = 10- 2P1+ P2

Firm 2: Q2 = 10 - 2P2 + Pi

Firm 1 chooses their Pi first, then Firm 2 observes their choice and selects P2.

Solve backwards, i.e., start by setting up Firm 2's profit maximization problem and solving it for

their best response function. Plug this into Firm 1's maximization problem. Once you have each

firm's best response functions, solve for the SPNE prices. Calculate equilibrium profits to see

whether there is a first mover advantage or a second mover advantage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Typed plz and asap please provide a quality solution and take care of plagiarism alsoarrow_forwardThere is a bar on Off‐Main Street called the Rock‐n‐Roll Bar. All the people that go to that bar like to listen to rock‐n‐roll music, and they love live bands. If the bar owner brings bands in to play music on a Saturday night, she will make a lot of money. However there are tenants in this building who get annoyed by the loud music. The benefits/costs to the owner/tenants of having zero, one, two or three bands on a Saturday night are listed in the attached table. If the tenants have the right to be free of loud music enforced through a property rule, how many bands will play in Rock‐n‐Roll Bar on a Saturday night? A. Zero B. One C. Two D. Three E. It depends on transaction costsarrow_forwardwhy choose A?arrow_forward

- There is a bar on Off‐Main Street called the Rock‐n‐Roll Bar. All the people that go to that bar like to listen to rock‐n‐roll music, and they love live bands. If the bar owner brings bands in to play music on a Saturday night, she will make a lot of money. However there are tenants in this building who get annoyed by the loud music. The benefits/costs to the owner/tenants of having zero, one, two or three bands on a Saturday night are listed below. If the tenants have the right to be free of loud music enforced through aproperty rule, how many bands will play in Rock‐n‐Roll Bar on a Saturday night? A. ZeroB. OneC. TwoD. ThreeE. It depends on transaction costsarrow_forwardE2arrow_forwardBusinesses that offer repayment plans for purchases are required by law to disclose the interest rate. But that dosent mean they let you go out of there way to let you know what it is. you have to read all the paper work. Find the interest rate for the follwing purchase. For a 312 square- foot family room, you choose carpert that costs $1.44 per square foot. The tax rate is 6.1% and youre offered 24 payemnts of 27.61. Round to one decimal, if necessary.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education