FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

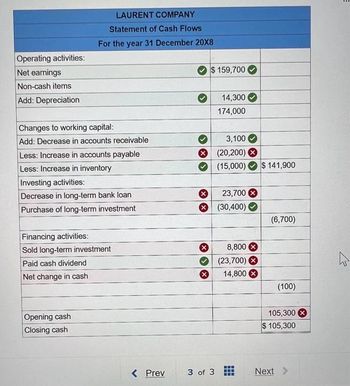

Transcribed Image Text:Operating activities:

Net earnings

Non-cash items

Add: Depreciation

LAURENT COMPANY

Statement of Cash Flows

For the year 31 December 20X8

Changes to working ital:

Add: Decrease in accounts receivable

Less: Increase in accounts payable

Less: Increase in inventory

Investing activities:

Decrease in long-term bank loan

Purchase of long-term investment

Financing activities:

Sold long-term investment

Paid cash dividend

Net change in cash

Opening cash

Closing cash

< Prev

CH

X

$ 159,700

X

X 23,700

X (30,400)

14,300

174,000

3 of 3

3,100

(20,200)

(15,000)

8,800 X

(23,700) X

14,800

H-H

$ 141,900

(6,700)

(100)

105,300

$ 105,300

Next >

Chemisie

ہے

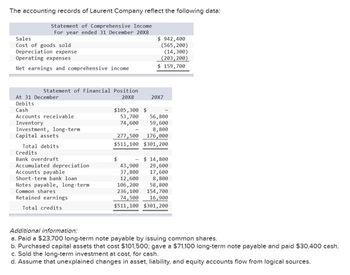

Transcribed Image Text:The accounting records of Laurent Company reflect the following data:

Statement of Comprehensive Income

For year ended 31 December 20X8

Sales

Cost of goods sold

Depreciation expense

Operating expenses

Net earnings and comprehensive income

Statement of Financial Position

20X8

At 31 December

Debits

Cash

Accounts receivable.

Inventory

Investment, long-term

Capital assets

Total debits

Credits

Bank overdraft

Accumulated depreciation.

Accounts payable

Short-term bank loan

Notes payable, long-term

Common shares

Retained earnings

Total credits

$105,300 $

$ 942,400

(565,200)

(14,300)

(203,200)

159,700

20X7

53,700 56,800

74,600 59,600

8,800

277,500 176,000

$511,100 $301,200

43,900

37,800

12,600

106, 200

$ 14,800

29,600

17,600

8,800

58,800

236,100

154,700

74,500

16,900

$511,100 $301,200

Additional information:

a. Paid a $23,700 long-term note payable by issuing common shares.

b. Purchased capital assets that cost $101,500; gave a $71,100 long-term note payable and paid $30,400 cash.

c. Sold the long-term investment at cost, for cash.

d. Assume that unexplained changes in asset, liability, and equity accounts flow from logical sources.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $141,300. Depreciation recorded on store equipment for the year amounted to $23,300. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End Beginning of Year of Year Cash $55,390 $50,400 Accounts receivable (net) 39,710 37,250 Merchandise inventory 54,230 56,700 Prepaid expenses 6,090 4,790 Accounts payable (merchandise creditors) 51,900 47,680 Wages payable 28,360 31,150 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardMohammed Corporation's comparative balance sheet for current assets and liabilities was as follows: Line Item Description Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $16,200 $15,400 Inventory 70,200 70,900 Accounts payable 22,600 21,300 Dividends payable 20,000 22,000 Adjust net income of $100, 400 for changes in operating assets and liabilities to arrive at net cash flows from operating activities. fill in the blank 1 of 1$arrow_forwardFormulating Financial Statements from Raw Data Following is selected financial information from Greenwood Industries, for its fiscal year ended ($ millions). Cash and cash equivalents, end of year Net cash from operations Net sales Stockholders' equity, end of year Cost of goods sold Net cash from financing Total liabilities, end of year Other expenses, including income taxes Noncash assets, end of year Net cash from investing Net income Effect of exchange rate changes on cash Cash and cash equivalents, beginning of year Net income Cost of goods sold REQUIRED a. Prepare an income statement, balance sheet, and statement of cash flows for Greenwood Industries. Note: Do not use negative signs with your answers in the Income Statement. Net cash flows from operations $2,516.7 5,514.3 26,439.9 14,411.2 Greenwood Industries Income Statement ($ millions) # 17,245.1 (2,912.3) 31,798.9 5,878.7 43,693.4 (729.3) 3,316.2 (31.1) 675.0 # # ♦ + ♦ + $ $ $ 0 0 0 0 0 Greenwood Industries Balance Sheet (5…arrow_forward

- Statement of Cash Flows The comparative balance sheet of Orange Angel Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31, 20Y8 Dec. 31, 20Y7 Assets Cash $76,950 $94,390 Accounts receivable (net) 118,230 127,250 Merchandise inventory 168,910 157,720 Prepaid expenses 6,880 4,780 Equipment 344,060 282,580 Accumulated depreciation-equipment (89,460) (69,300) Total assets $625,570 $597,420 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $131,370 $124,860 Mortgage note payable 0 179,230 Common stock, $1 par 21,000 13,000 Excess of paid-in capital over par 304,000 168,000 Retained earnings 169,200 112,330 Total liabilities and stockholders’ equity $625,570 $597,420 Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: Net income, $145,590. Depreciation…arrow_forwardWhat's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardHuluduey Corporation's comparative balance sheet for current assets and liabilities was as follows: Line Item Description Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $17,500 $12,500 Inventory 51,650 44,200 Accounts payable 8,480 5,100 Dividends payable 9,480 6,100 Adjust net income of $75,800 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.arrow_forward

- Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $137,500. Depreciation recorded on store equipment for the year amounted to $22,700. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $53,350 $48,550 Accounts receivable (net) 38,250 35,880 Merchandise inventory 52,230 54,620 Prepaid expenses 5,870 4,610 Accounts payable (merchandise creditors) 49,990 45,930 Wages payable 27,320 30,000 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardStevie recently received 1,080 shares of restricted stock from her employer, Nicks Corporation, when the share price was $9 per share. Stevie's restricted shares vested three years later when the market price was $12. Stevie held the shares for a little more than a year and sold them when the market price was $15. Assuming Stevie made a section 83(b) election, what is the amount of Stevie's ordinary income with respect to the restricted stock?arrow_forwardCash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $154,700. Depreciation recorded on store equipment for the year amounted to $25,500. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $61,730 $56,790 Accounts receivable (net) 44,260 41,970 Merchandise inventory 60,430 63,890 Prepaid expenses 6,790 5,400 Accounts payable (merchandise creditors) 57,840 53,720 Wages payable 31,610 35,100 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: - Net income $ Adjustments to reconcile net income to net cash flows from (used for) operating…arrow_forward

- Assets Line Item Description Amount Cash and short-term investments $42,572 Accounts receivable (net) 33,774 Inventory 37,691 Property, plant, and equipment 215,705 Total assets $329,742 Liabilities and Stockholders’ Equity Line Item Description Amount Current liabilities $68,960 Long-term liabilities 98,919 Common stock, $10 par 64,740 Retained earnings 97,123 Total liabilities and stockholders’ equity $329,742 Income Statement Line Item Description Amount Sales $91,805 Cost of goods sold (41,312) Gross profit $50,493 Operating expenses (28,002) Net income $22,491 Number of shares of common stock 6,474 Market price of common stock $28 What is the current ratio?arrow_forwardRefer to the following selected financial information from Texas Electronics. Compute the company's accounts receivable turnover for Year 2. Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 Year 1 $ 38,300 $ 33,050 98,000 64,000 89,500 83,500 125,000 129,000 12,900 10,500 392,000 342,000 109,400 111,800 715,000 680,000 394,000 379,000arrow_forwardQuestion Content Area The following information pertains to Tanzi Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Cash and short-term investments $41,912 Accounts receivable (net) 29,707 Inventory 28,654 Property, plant and equipment 293,074 Total Assets $393,347 Liabilities and Stockholders' Equity Current liabilities $58,253 Long-term liabilities 97,633 Stockholders' equity-common 237,461 Total Liabilities and stockholders' equity $393,347 Income Statement Sales $80,900 Cost of goods sold 36,405 Gross margin $44,495 Operating expenses 25,209 Net income $19,286 Number of shares of common stock 6,546 Market price of common stock $35 What is the current ratio for this company? Round your answer to two decimal places. Select the correct answer. 1.23 2.22 0.72 1.72arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education