FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

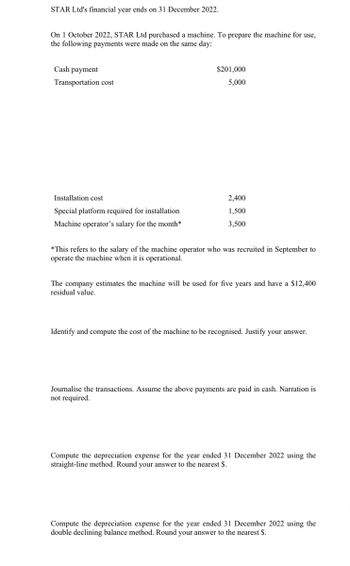

Transcribed Image Text:STAR Ltd's financial year ends on 31 December 2022.

On 1 October 2022, STAR Ltd purchased a machine. To prepare the machine for use,

the following payments were made on the same day:

Cash payment

Transportation cost

$201,000

5,000

Installation cost

Special platform required for installation

Machine operator's salary for the month*

2,400

1,500

3,500

*This refers to the salary of the machine operator who was recruited in September to

operate the machine when it is operational.

The company estimates the machine will be used for five years and have a $12,400

residual value.

Identify and compute the cost of the machine to be recognised. Justify your answer.

Journalise the transactions. Assume the above payments are paid in cash. Narration is

not required.

Compute the depreciation expense for the year ended 31 December 2022 using the

straight-line method. Round your answer to the nearest $.

Compute the depreciation expense for the year ended 31 December 2022 using the

double declining balance method. Round your answer to the nearest $.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sheridan Construction Co. uses the percentage-of-completion method. In 2024, Sheridan began work on a contract for $21300000; it was completed in 2025. The following cost data pertain to this contract: Cost incurred during the year Estimated costs to complete at the end of year Year Ended December 31 $8516000. $2990000. $3680000. $3684000. 2024 $7254000 4836000 2025 $5530000 The amount of gross profit to be recognized on the income statement for the year ended December 31, 2025 isarrow_forwardThree programmers at Feenix Computer Storage, Inc., write an operating systems control manual for Hill-McGraw Publishing, Inc., for which Feenix receives royalties equal to 12% of net sales. Royalties are payable annually on February 1 for sales the previous year. The editor indicated to Feenix on December 31, 2021, that book sales subject to royalties for the year just ended are expected to be $300,000. Accordingly, Feenix accrued royalty revenue of $36,000 at December 31 and received royalties of $36,500 on February 1, 2022. What adjustments, if any, should be made to retained earnings or to the 2021 financial statements?arrow_forwardRoger Inc. began work in 2021 on a contract for $8,400,000. Other data are as follows: 2021 2022 Costs incurred to date $3,600,000 $5,600,000 Estimated costs to complete 2,400,000 — Billings to date 2,800,000 8,400,000 Collections to date 2,000,000 7,200,000 Roger uses the percentage-of-completion method. Calculate the gross profit to be recognized in 2021.arrow_forward

- Cullumber Construction Co. uses the percentage-of-completion method. In 2024, Cullumber began work on a contract for $23200000; it was completed in 2025. The following cost data pertain to this contract: Year Ended December 31 2024 2025 Cost incurred during the year $8736000 $5720000 Estimated costs to complete at the end of year 5824000 The amount of gross profit to be recognized on the income statement for the year ended December 31, 2025 is ○ $3456000. ○ $8744000. $2920000. $3560000.arrow_forwardPlease help mearrow_forwardOn February 1, 2023, Armen Inc. entered into a contract to deliver one of its specialty machines to Idris Inc. The contract requires Idris Inc to pay the contract price of $15,000 in advance on February 20, 2023. Idris Inc. pays Armen Inc on February 20, 2023, and Armen Inc delivers the machine (costing $12,600) on February 28, 2023 and Idris Inc starts using the machine on March 3, 2023. When should Armen Inc recognize revenue?arrow_forward

- Oriole Construction Company began operations on January 1, 2025. During the year, Oriole Construction entered into a contract with Winds Corp. to construct a manufacturing facility. At that time, Oriole estimated that it would take 5 years to complete the facility at a total cost of $4.484,000. The total contract price for construction of the facility is $5,972,000. During the year, Oriole incurred $1,082,400 in construction costs related to the construction project. The estimated cost to complete the contract is $4,329,600. Winds Corp. was billed and paid 25% of the contract price. (a) Prepare schedules to compute the amount of gross profit to be recognized for the year ended December 31, 2025, and the amount to be shown as "costs and recognized profit in excess of billings" or "billings in excess of costs and recognized profit" at December 31, 2025, under each of the following methods. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses…arrow_forwardPlease list all of the journal entries for 2022 the OHIO Contract. Your company name is PP. See below information: Ohio Contract On September 7th of the current year (2022), PP signed a contract with Ohio Contract, a large city in the northeast. PP will provide Ohio with 2,470 scooters for $855 each. Each of the scooters is included in a service agreement, whereby PP will provide all maintenance on the scooters for 3 years. In addition, it will provide labor at no charge for these repairs. At the time of the repair, PP will bill Ohio for the parts needed to accomplish the repair. Ohio paid WTG on September 7th of the current year. PP will deliver 665 scooters on October 1 of the current year, 875 scooters on January 1 of next year, and 930 scooters on April 1 of the next year. Because of the size of Ohio, and its potential to buy many more scooters, PP offers them a volume discount, based on how many scooters they purchase between September 7th of the current year and December 31st of…arrow_forwardA construction company entered into a fixed-price contract to build an office building for $42 million. Construction costs incurred during the first year were $12 million, and estimated costs to complete at the end of the year were $28 million. The company recognizes revenue over time according to percentage of completion. How much revenue and gross profit or loss will appear in the company's income statement in the first year of the contract? Note: Enter your answers in whole dollars and not in millions (i.e., $4 million should be entered as $4,000,000). Revenuearrow_forward

- In 2021, Montana Corp. entered into a contract to begin work on a two-year project. Montana recognizes revenue over time according to percentage of completion for this contract, and provides the following information (dollars in millions): Accounts receivable, 12/31/2021 (from construction progress billings) $37.5 $140 Actual construction costs incurred in 2021 Cash collected on project during 2021 $105 Construction in progress, 12/31/2021 $210 Estimated percentage of completion during 2021 Selected Amounts O $70,000,000 What is the amount of gross profit on the project recognized by Montana during 2021? O $60,000,000 $35,000,000 O $105,000,000 50 %arrow_forwardJohnson Inc. enters into a $300,000 contract for the purchase of customized equipment with Builder Inc. The construction of the equipment is expected to take two years. Johnson Inc. owns the work in process during the two-year period but will not take possession of the equipment until completed. The contractor will bill Johnson monthly for performance completed to date. After year-one, Builder Inc. incurred costs of $120,000 and expects remaining costs to be $108,000. Builder Inc. has billed Johnson $150,000 in total for the year. Johnson has paid $135,000 to Builder Inc. Determine the amount of revenue and expenses that Builder Inc. should recognize in the first year of the contract. a. Revenue Expenses $157,895 $120,000 b. Revenue Expenses $150,000 $114,000 c. Revenue Expenses $78,947 $120,000 d. Revenue Expenses $0 $0 e. Revenue Expenses $150,000 $120,000arrow_forward1. During 2020, Bay Construction started a new construction job with a contract price of $750 million. Bay has a 12/31 fiscal year end. Bay has determined that the contract does not qualify for revenue recognition over time. The contract was completed on 12/31/22 with the following information ($ in millions): Costs incurred in the period (paid in cash) Estimated costs to complete at 12/31 Billings on contract in the period Cash collected in the period 2020 180.0 2021 2022 432.0 150.0 540.0 153.0 -0- 150 350 250 200 400 150 What is the amount of gross profit (loss) on the contract that Bay would recognize on the Income Statement in 2020, 2021 and 2022? You must show supporting work (calculations/explanations) to receive credit for your answers. Gross Profit (Loss) 2020 2021 2022arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education