Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Snackums, Incorporated, purchases wheat for use in its food manufacturing process. Snackums operates in a highly competitive

industry and is rarely able to increase its sales price.

• On January 1, 2024, Snackums estimates that it only has enough wheat inventory to meet its manufacturing needs for the first

half of 2024, and forecasts the purchase of 20,000 bushels of wheat on June 30, 2024, from its supplier, Trigo Farms.

⚫ Because Snackums is concerned that the price of wheat will increase during the coming months it enters into four June wheat

futures contracts on January 1, 2024, to purchase wheat.

• Each futures contract is based on the purchase of 5,000 bushels of wheat at $6.73 per bushel on June 30, 2024, and will settle

in cash at maturity. (For purposes of this problem, the daily margin accounts with the clearinghouse are ignored.)

• The company must report changes in the fair value of its hedging instruments each quarter. The fair value of the futures contract

at inception is zero.

⚫ Snackums designates the futures contract as a hedge of the variability of cash flows attributed to changes in the spot price of

wheat for its forecasted purchase of wheat.

• Since the critical terms of the forward contract and the forecasted purchase are exactly the same, Snackums concludes that the

hedging relationship is expected to be 100% effective. The spot and forward prices per bushel of wheat and the fair value of the

forward contract are as follows:

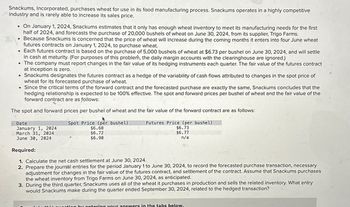

The spot and forward prices per bushel of wheat and the fair value of the forward contract are as follows:

Date

January 1, 2024

March 31, 2024

June 30, 2024

Required:

Spot Price (per bushel)

$6.68

$6.72

$6.90

1. Calculate the net cash settlement at June 30, 2024.

Futures Price (per bushel)

$6.73

$6.77

n/a

2. Prepare the journal entries for the period January 1 to June 30, 2024, to record the forecasted purchase transaction, necessary

adjustment for changes in the fair value of the futures contract, and settlement of the contract. Assume that Snackums purchases

the wheat inventory from Trigo Farms on June 30, 2024, as anticipated.

3. During the third quarter, Snackums uses all of the wheat it purchases in production and sells the related inventory. What entry

would Snackums make during the quarter ended September 30, 2024, related to the hedged transaction?

en by entering your answers in the tabs below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Yum, Inc. is a producer of potato chips. A single production process at Yum, Inc., yields potato chips as the main product, as well as a byproduct that can be sold as a snack. Both products are fully processed by the splitoff point, and there are no separable costs. For September 2020, the cost of operations is $485,000. Production and sales data are as follows: Note: There were no beginning inventories on September 1, 2020. Requirements Dialog content starts 1. What is the gross margin forbYum,Inc., under the production method and the sales method of byproduct accounting? 2. What are the inventory costs reported in the balance sheet on September 30, 2020, for the main product and byproduct under the two methods of byproduct accounting in requirement 1? 3. Prepare the journal entries to record the byproduct activities under (a) the production method and (b) the sales method. Briefly discuss the effects on the financial statements.arrow_forwardExplain why proponents of LIFO argue that it provides a better match of revenue and expenses. In what situations would it not provide a better match? Be specific. The management of the Esquire Oil Company believes that the wholesale price of heating oil that they sell to homeowners will increase again as the result of increased political problems in the Middle East. The company is currently paying $0.80 per gallon. If they are willing to enter an agreement in November 2021 to purchase a million gallons of heating oil during the winter of 2022, their supplier will guarantee the price at $0.80 per gallon. However, if the winter is a mild one, Esquire would not be able to sell a million gallons unless they reduced their retail price and thereby increase the risk of a loss for the year. On the other hand, if the wholesale price did increase substantially, they would be in a favorable position with respect to their competitors. The company’s fiscal year-end is December 31. Discuss the…arrow_forwardLeo Consulting enters into a contract with Highgate University to restructure Highgate’s processes for purchasing goods from suppliers. The contract states that Leo will earn a fixed fee of $66,000 and earn an additional $13,000 if Highgate achieves $130,000 of cost savings. Leo estimates a 70% chance that Highgate will achieve $130,000 of cost savings. Assuming that Leo determines the transaction price as the expected value of expected consideration, what transaction price will Leo estimate for this contract? Transaction price for the contract ?arrow_forward

- Security Technology Incorporated (STI) is a manufacturer of an electronic control system used in the manufacture of certain special- duty auto transmissions used primarily for police and military applications. The part sells for $45 per unit and STI had sales of 24,800 units in the current year, 2021. STI had no inventory on hand at the beginning of 2021 and is projecting sales of 28,400 units in 2022 STI is planning the same production level for 2022 as in 2021, 26,600 units. The variable manufacturing costs for STI are $16, and the variable selling costs are only $0.70 per unit. The fixed manufacturing costs are $133,000 per year, and the fixed selling costs are $660 per year. Required: 1. Prepare an income statement for each year using full costing. 2 Prepare an income statement for each year using variable costing. 3. Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods.arrow_forwardPlease help mearrow_forwardAlberto Technologies, manufacture and sells an electronic control device for $297. It has costs of $231 to manufacture it. A competitor is bringing a new electronic control device to market that will sell for $253. Marketing manager at Alberto believes it must lower the price to $253 to compete in the market for electronic control device. Marketing manager believes that the new price will cause sales to increase by 12%, even with a new competitor in the market. Alberto's sales are currently 6,000 units per year. What is the target cost per unit if the target operating income is 25% of salesarrow_forward

- please answer in textarrow_forwardWinnebagel Corp. currently sells 25,544 motor homes per year at $59,558 each, and 8,375 luxury motor coaches per year at $115,975 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 20,619 of these campers per year at $20,526 each. An independent consultant has determined that if Winnebagel introduces the new campers, it should boost the sales of its existing motor homes by 7,988 units per year, and reduce the sales of its motor coaches by 504 units per year. What is the amount to use as the annual sales figure when evaluating this project?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education