FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Requirements:

a. Prepare

b. Prepare a partial

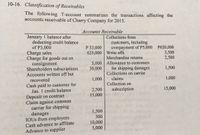

Transcribed Image Text:10-16. Classification of Receivables

The following T-account summarizes the transactions affecting the

accounts receivable of Charry Company for 2015.

Accounts Receivable

January 1 balance after

deducting credit balance

of P3,000

Charge sales

Charge for goods out on

consignment

Shareholders subscriptions

Accounts written off but

Collections from

customers, including

P 53,000

625,000 Write offs

overpayment of P5,000 P620,000

3,500

2,500

Merchandise returns

5,000 Allowance to customers

for shipping damages

Collections on carrier

30,000

1,500

1,000

claims

1,000

recovered

Collection on

Cash paid to customer for

Jan. 1 credit balance

Deposit on contract

Claim against common

carrier for shipping

subscription

15,000

2,500

15,000

o damages

IOUS from employees

1,500

500

10,000

5,000

Cash advance to affiliate

Advance to supplier

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Accounts Question: What does it mean when Drawings has a normal debit balance or a normal credit balance? Please explain/examples.arrow_forwardWhich of the following items is considered an original source document? Select one: a. accounts receivable b. company expense account c. purchase order d. general ledgerarrow_forwardHow to determine the unadjusted balances of accounts receivable by using the percent of sales method and the analysis of receivables method , please , thank You!arrow_forward

- The accounting concept that supports reporting revenues in the period in which they are earned is called the: revenue recognition concept. B) accounting period concept. timing concept. D) adjusting concept.arrow_forwardIf an adjustment includes an entry to a payable or receivable account, which type of adjustment is it? a. Estimate b. Accruals c. Deferrals d. Provisionarrow_forwardHow do you write out an adjusted account balance?arrow_forward

- The purchase of supplies on account is debited to supplies and credited to account receivable. Is this statement correctarrow_forwardProvide an example of an account that would be listed under Current Liabilities on a balance sheet and briefly explain why it would be categorized this way. How would we categorize the balance in a Notes Payable account: under Current Liabilities or Noncurrent Liabilities? Why?arrow_forwardThe journal entry to record the sale of services on credit should include: a debit to Cash and a credit to Accounts Receivable. a debit to Accounts Receivable and a credit to Capital. a debit to Fees Income and a credit to Accounts Receivable. a debit to Accounts Receivable and a credit to Fees Income.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education