Requirements 1. Prepare a schedule of depreciation expense per year for the van under the three depreciation methods. 2. Which method best tracks the wear and tear on the van? 3. Which method would Tasty Tongue prefer to use for income tax purposes? Explain in detail why Tasty Tongue prefers this method.

Requirements 1. Prepare a schedule of depreciation expense per year for the van under the three depreciation methods. 2. Which method best tracks the wear and tear on the van? 3. Which method would Tasty Tongue prefer to use for income tax purposes? Explain in detail why Tasty Tongue prefers this method.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11PA: Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and...

Related questions

Question

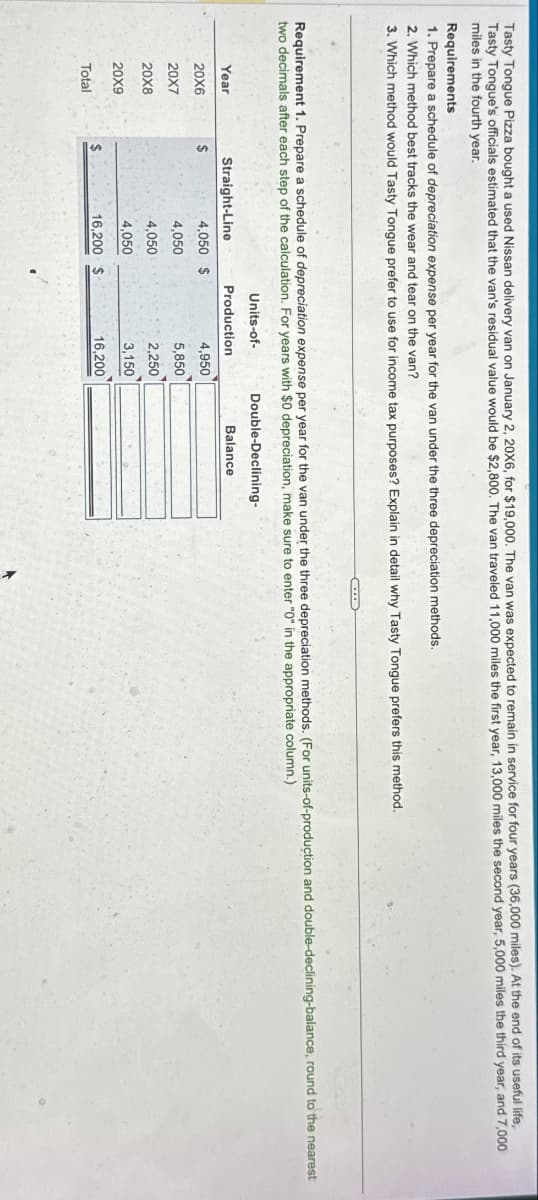

Transcribed Image Text:Tasty Tongue Pizza bought a used Nissan delivery van on January 2, 20X6, for $19,000. The van was expected to remain in service for four years (36,000 miles). At the end of its useful life,

Tasty Tongue's officials estimated that the van's residual value would be $2,800. The van traveled 11,000 miles the first year, 13,000 miles the second year, 5,000 miles the third year, and 7,000

miles in the fourth year.

Requirements

1. Prepare a schedule of depreciation expense per year for the van under the three depreciation methods.

2. Which method best tracks the wear and tear on the van?

3. Which method would Tasty Tongue prefer to use for income tax purposes? Explain in detail why Tasty Tongue prefers this method.

Requirement 1. Prepare a schedule of depreciation expense per year for the van under the three depreciation methods. (For units-of-production and double-declining-balance, round to the nearest

two decimals after each step of the calculation. For years with $0 depreciation, make sure to enter "0" in the appropriate column.)

Year

Straight-Line

Units-of-

Production

Double-Declining-

Balance

20X6

$

4,050 $

4,950

20X7

4,050

5,850

20X8

4,050

2,250

4,050

20X9

3,150

16,200 $

16,200

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT