Requirement 1. Assume that the ending merchandise inventory was accidentally overstated by $2,400. What are the correct amounts for cost of goods sold and gross profit for year ended December 31, 2026? Cost of goods sold in 2026 would be Inventory data Requirements 1. Assume that the ending merchandise inventory was accidentally overstated by $2,400. What are the correct amounts for cost of goods sold and gross profit for year ended December 31, 2026? 2. How would the inventory error affect Salt Lake Pool Supplies' cost of goods sold and gross profit for the year ended December 31, 2027, if the error is not corrected in 2026? Print Done Salt Lake Pool Supplies Income Statement (Partial) Year Ended December 31, 2026 Net Sales Revenue $ 60,000 Cost of Goods Sold: Beginning Merchandise Inventory $ 4,200 Plus: Net Cost of Inventory Purchased 26,600 Cost of Goods Available for Sale Less: Ending Merchandise Inventory Cost of Goods Sold 30,800 6,200 24,600 $ Gross Profit 35,400

Requirement 1. Assume that the ending merchandise inventory was accidentally overstated by $2,400. What are the correct amounts for cost of goods sold and gross profit for year ended December 31, 2026? Cost of goods sold in 2026 would be Inventory data Requirements 1. Assume that the ending merchandise inventory was accidentally overstated by $2,400. What are the correct amounts for cost of goods sold and gross profit for year ended December 31, 2026? 2. How would the inventory error affect Salt Lake Pool Supplies' cost of goods sold and gross profit for the year ended December 31, 2027, if the error is not corrected in 2026? Print Done Salt Lake Pool Supplies Income Statement (Partial) Year Ended December 31, 2026 Net Sales Revenue $ 60,000 Cost of Goods Sold: Beginning Merchandise Inventory $ 4,200 Plus: Net Cost of Inventory Purchased 26,600 Cost of Goods Available for Sale Less: Ending Merchandise Inventory Cost of Goods Sold 30,800 6,200 24,600 $ Gross Profit 35,400

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 7PB: Selected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as...

Related questions

Question

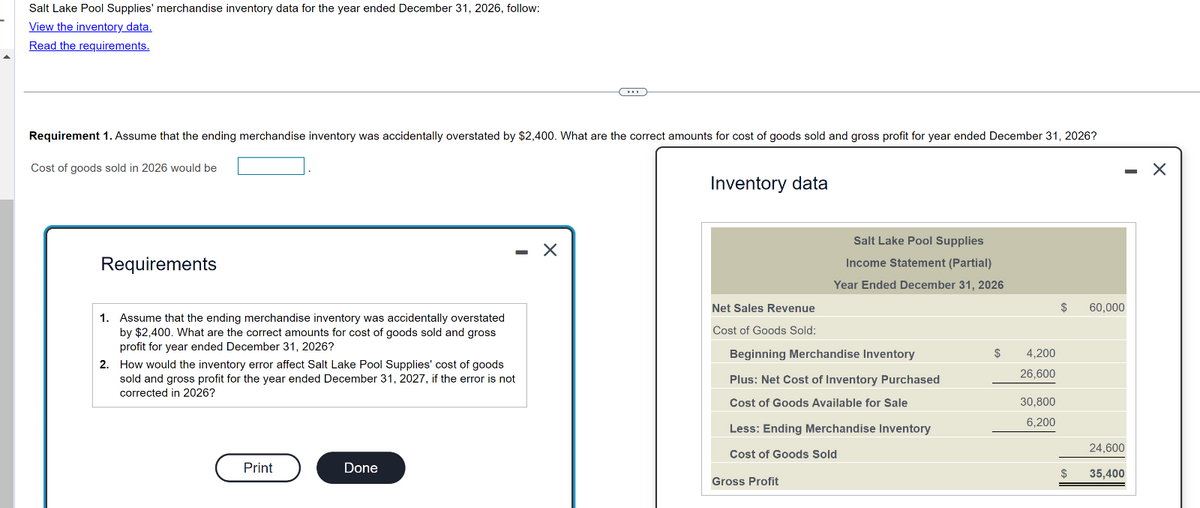

Transcribed Image Text:Salt Lake Pool Supplies' merchandise inventory data for the year ended December 31, 2026, follow:

View the inventory data.

Read the requirements.

Requirement 1. Assume that the ending merchandise inventory was accidentally overstated by $2,400. What are the correct amounts for cost of goods sold and gross profit for year ended December 31, 2026?

Cost of goods sold in 2026 would be

Requirements

1. Assume that the ending merchandise inventory was accidentally overstated

by $2,400. What are the correct amounts for cost of goods sold and gross

profit for year ended December 31, 2026?

2. How would the inventory error affect Salt Lake Pool Supplies' cost of goods

sold and gross profit for the year ended December 31, 2027, if the error is not

corrected in 2026?

Print

Done

Inventory data

Salt Lake Pool Supplies

Income Statement (Partial)

Year Ended December 31, 2026

Net Sales Revenue

60,000

Cost of Goods Sold:

Beginning Merchandise Inventory

4,200

26,600

Plus: Net Cost of Inventory Purchased

Cost of Goods Available for Sale

30,800

6,200

Less: Ending Merchandise Inventory

Cost of Goods Sold

24,600

35,400

Gross Profit

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning