FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

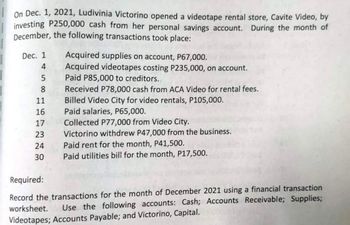

Transcribed Image Text:On Dec. 1, 2021, Ludivinia Victorino opened a videotape rental store, Cavite Video, by

investing P250,000 cash from her personal savings account. During the month of

December, the following transactions took place:

Dec. 1

4

58

11

16

17

23

24

30

Acquired supplies on account, P67,000.

Acquired videotapes costing P235,000, on account.

Paid P85,000 to creditors..

Received P78,000 cash from ACA Video for rental fees.

Billed Video City for video rentals, P105,000.

Paid salaries, P65,000.

Collected P77,000 from Video City.

Victorino withdrew P47,000 from the business.

Paid rent for the month, P41,500.

Paid utilities bill for the month, P17,500.

Required:

Record the transactions for the month of December 2021 using a financial transaction

worksheet. Use the following accounts: Cash; Accounts Receivable; Supplies;

Videotapes; Accounts Payable; and Victorino, Capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PA4. Use the journals and ledgers that follow. Total the journals. Post the transactions to the subsidiary ledger and (using T-accounts) to the general ledger accounts. Then prepare a schedule of accounts receivable.arrow_forwardListed below are the transactions of Joseph Moore, D.D.S., for the month of September. Sept. 1 2 4 4 5 8 10 14 18 19 20 25 30 30 Moore begins practice as a dentist, invests $20,030 cash and issues 2,003 shares of $10 par stock. Purchases dental equipment on account from Green Jacket Co. for $17,820. Pays rent for office space, $690 for the month. Employs a receptionist, Michael Bradley. Purchases dental supplies for cash, $900. Receives cash of $1,770 from patients for services performed. Pays miscellaneous office expenses, $420. Bills patients $5,950 for services performed. Pays Green Jacket Co. on account, $3,760. Pays a dividend of $3,090 cash. Receives $1,060 from patients on account. Bills patients $1,980 for services performed. Pays the following expenses in cash: Salaries and wages $1,700; miscellaneous office expenses $83. Dental supplies used during September, $320. Record depreciation using a 5-year life on the equipment, the straight-line method, and no salvage value.arrow_forwardshow calculations where neededarrow_forward

- What should i do? Accounts payable were paid in the amount of $1,077,500. Note: Enter debits before credits. Transaction General Journal Debit Credit 08arrow_forwardVikrambhaiarrow_forward(a) Describe the detail of the transaction being performed in the following screen. (b) Give the journal entry that MYOB made as a result of the transaction in part (a) (Note: account numbers are not required, just use account names.)arrow_forward

- Your new company paid the invoice for their account with Alli's Broom Supply Company. What would your journal entry look like when you record this transaction? a) Debit Cash; Credit Accounts Payable b) Debit Cash; Credit Supplies Expense c) Debit Accounts Receivable; Credit Cash d) Debit Accounts Payable; Credit Casharrow_forwardAn “Accounts Receivable Customer Balances” report shows revenues by customer for a specified date range customer balances owed as of a specific date cash payments to creditors for a specific date range sales by customer as of a specific datearrow_forwardIn the account below, calculate the balance for September 16, 20-. Then perform the forwarding procedures required to start a new account page. 3. Account: A/R – Manitoba Equipment Co. No. 211 Date(2021) PARTICULARS P.R. DEBIT CREDIT Dr/Cr BALANCE Aug 15 J22 1,600 00 Sep 4 J26 825 00 16 Ј30 176 00 Асcount: No. Date2021) PARTICULARS P.R. DEBIT CREDIT Dr/Cr BALANCEarrow_forward

- Which of the following is the entry to be recorded by alaw firm when it receives a payment from a new client thatwill be earned when services are provided in the future?a. Debit Accounts Receivable; credit Service Revenue.b. Debit Unearned Revenue; credit Service Revenue.c. Debit Cash; credit Unearned Revenue.d. Debit Unearned Revenue; credit Casharrow_forwardAccountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education