FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

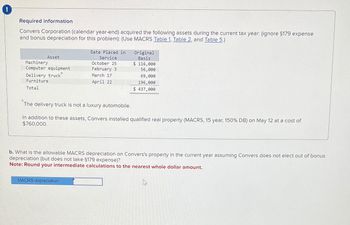

Transcribed Image Text:Required information

Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore §179 expense

and bonus depreciation for this problem): (Use MACRS Table 1, Table 2, and Table 5.)

Asset

Machinery

Computer equipment

Delivery truck

Furniture

Date Placed in

Service

October 25

February 3

March 17

April 22

Original

Basis

$ 116,000

56,000

69,000

196,000

Total

$ 437,000

The delivery truck is not a luxury automobile.

In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of

$760,000.

b. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus

depreciation (but does not take §179 expense)?

Note: Round your intermediate calculations to the nearest whole dollar amount.

MACRS depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardNonearrow_forward[The following information applies to the questions displayed below.] DLW Corporation acquired and placed in service the following assets during the year: Asset Computer equipment Furniture Commercial building Assuming DLW does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is DLW's year 1 cost recovery for each asset? Asset Date Acquired 2/26 2/26 12/20 Computer equipment Furniture Commercial building Total Year 1 Cost Recovery $ Cost Basis $ 19,500 $ 18,000 $ 341,000 3,900 2,572 9,050 15,522arrow_forward

- Nonearrow_forwardFitness Department purchased a building on a tract of land and allocated the entire cost of the purchase to building. Normally the company depreciates buildings over 40 years using the straight-line method with zero residual value and does not depreciate land. What is the impact of the improper accounting treatment of the purchase on the company's net income for the life of the building? a.understated b.unaffected c.overstated d.indeterminable from the information providedarrow_forward(0) Problem 10-54 (LO 10-2, LO 10-3) (Algo) Skip to question Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore §179 expense and bonus depreciation for this problem): (Use MACRS Table 1, Table 2, and Table 5.) Asset Date Placed in Service Original Basis Machinery October 25 $ 102,000 Computer equipment February 3 42,000 Delivery truck* March 17 55,000 Furniture April 22 182,000 Total $ 381,000 *The delivery truck is not a luxury automobile. In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of $620,000. Problem 10-54 Part b (Algo) b. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus depreciation (but does not take 179 expense)?arrow_forward

- P9-1A Acquisition Cost of Long-Lived Assets The following items represent expenditures (or receipts) related to the construction of a new home office for Lowery Company. Cost of land site, which included an old apartment building appraised at $75,000 $173,000 Legal Fees, including fee for the title search 2, 100 Payment of apartment building mortgage and related interest due at time of sale 9,300 Payment for delinquent property taxes assumed by the purchaser 6,000 Cost of razing the apartment building 17,000 Proceeds from sale of salvaged materials (3,800) Grading to establish proper drainage flow on land site 2, 100 Architect’s fees on new building…arrow_forward! Required information [The following information applies to the questions displayed below.] Burbank Corporation (calendar year-end) acquired the following property this year: (Use MACRS Table 1, Table 2 and Exhibit 10-10.) Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Placed in Service November Basis 12 $ 7,800 June 6 14,000 July 15 October 28 January 31 32,000 19,000 70,000 $ 142,800 Total Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. (Round your answer to the nearest whole dollar amount.) b. Assuming Burbank would like to maximize its cost recovery deductions by claiming bonus and §179 expense, which assets should Burbank immediately expense? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education